STOCK MARKET NEWS: Dow, S&P, Nasdaq wrap winning week, Yellen debt warning, Mega Millions jackpot

JPMorgan CEO Jamie Dimon talks recession, Apple CEO Tim Cook's pay cut, Warner's HBO Max hiking prices. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

U.S. stock futures are in red territory following the holiday as commodities like gold and oil trade up and down.

The Dow Jones Industrial Average futures is off roughly 89 points, or 0.26%, while the S&P and Nasdaq futures are down approximately 0.16% and 0.19%, respectively.

Despite the dip, the Dow remains up around 3.02% year-to-date, the S&P is up around 3.69%, and the tech-heavy Nasdaq is now 4.28% over the same time.

In commodities, West Texas Intermediate crude futures spiked 0.73% to $80.44 a barrel, as gold lost 0.35% to $1,915.00 an ounce.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WWE | $88.45 | -0.89 | -0.99 |

World Wrestling Entertainment said on Thursday it has retained bankruptcy and restructuring powerhouse Kirkland & Ellis LLP as its legal adviser related to its review of strategic alternatives for the company.

It has also retained The Raine Group LLC as financial advisor and August LLC as strategic communications adviser.

The announcement comes days after the company elected Vince McMahon as the executive chair of the media and entertainment company's board and said co-chief executive officer and chairwoman Stephanie McMahon was stepping down.

Vince McMahon returned to WWE earlier this month and made some changes to the company's board. At the time, WWE announced that it was launching a review to explore "strategic alternatives" for the company.

He had retired in July last year, as the company's CEO and chairman, following an investigation into his alleged misconduct. Later, WWE said that it found some unrecorded expenses tied to Vince McMahon.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| LUV | $36.86 | -0.11 | -0.30 |

A group of 15 U.S. senators on Friday demanded Southwest Airlines LUV.N Chief Executive Bob Jordan answer questions about the low-cost carrier's holiday meltdown that led to nearly 16,000 flight cancellations.

"The airline must examine the causes of this disaster and ensure it never happens again," said the letter led by Democratic Senators Ed Markey and Richard Blumenthal asking for answers about the software it uses for crew scheduling and why did the company "fail to invest funds to modernize these systems to ensure that it could effectively coordinate crew and flight schedules after major storms and during major travel periods?"

U.S. stocks finished Friday with gains wrapping up winning week as investors digested a slight cooling of inflation and mixed earnings from the big banks. In commodities, oil 8.3% to $79.86 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| XLY | $139.70 | 1.30 | 0.94 |

| XLB | $83.79 | 0.51 | 0.61 |

| XLC | $52.35 | 0.17 | 0.33 |

So far this year, S&P consumer discretionary, communications and material sectors have advanced over 7% apiece.

Weekly Performance:

Dow Jones Industrial Average: +3.5%

S&P 500: +4.2%

Nasdaq Composite: +5.9%

| Symbol | Price | Change | %Change |

|---|---|---|---|

| F | $12.69 | -0.74 | -5.51 |

Ford unit Lincoln is certifying dealers to sell electric vehicles. 356 retailers have enrolled in the voluntary program, representing 60% of the luxury brand’s store count.

The next opportunity for dealers to opt-in is 2026.

U.S. Treasury Secretary Janet Yellen said on Friday that the United States will likely hit the $31.4 trillion statutory debt limit on Jan. 19, forcing the Treasury to launch extraordinary cash management measures that can likely prevent default until early June.

"Once the limit is reached, Treasury will need to start taking certain extraordinary measures to prevent the United States from defaulting on its obligations," Yellen said in a letter to congressional leaders in which she urged lawmakers to act quickly to raise the debt ceiling."

While Treasury is not currently able to provide an estimate of how long extraordinary measures will enable us to continue to pay the government’s obligations, it is unlikely that cash and extraordinary measures will be exhausted before early June," the letter added.

As of Wednesday, Treasury data showed that U.S. federal debt stood $78 billion below the limit, with a Treasury operating cash balance of $346.4 billion. The department on Thursday reported an $85 billion December deficit as revenues eased and outlays grew, particularly for debt interest costs.

Treasury Secretary Janet Yellen informed Congress and U.S. taxpayers that the debt ceiling will be hit next week.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| LUV | $36.81 | -0.16 | -0.43 |

Shareholders filed a lawsuit against Southwest Airlines Co on Thursday, accusing the carrier of fraudulently concealing problems that led last month to an operational meltdown and more than 15,000 flight cancelations.

According to the proposed class action filed in federal court in Houston, Southwest publicly downplayed or failed to disclose serious shortcomings in its flight scheduling software technology.

The lawsuit said Southwest also did not discuss how its "point-to-point" route structure, which differs from the "hub-and-spoke" structure at other large U.S. airlines, could leave it vulnerable to unexpected bad weather.

Shareholders led by Arthur Teroganesian said the inadequate disclosures made Southwest's statements about its operations in regulatory filings and in a media appearance by former Chief Executive Gary Kelly "materially false and misleading."

Teroganesian said that as the truth came out, Southwest's share price fell about 10% between Dec. 23, 2022, and Jan. 3, 2023, wiping out more than $2 billion of shareholder value.

Southwest did not immediately respond to requests for comment. Kelly, his successor Bob Jordan and Chief Financial Officer Tammy Romo are all named as defendants, in addition to the airline.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BBBY | $4.65 | -0.59 | -11.26 |

Bed Bath & Beyond Inc is in talks with private equity firm Sycamore Partners for the sale of its assets, including its buybuy Baby stores, as part of a possible bankruptcy process, the New York Times reported on Friday citing people familiar with the matter.

The company is also in talks with other suitors about possible deals, the report added.

Bed Bath & Beyond said it does not "comment on speculation of this nature" and reiterated a previous statement that it was exploring multiple paths. Sycamore Partners declined to comment.

The Union, New Jersey-based company had earlier considered selling its buybuy Baby stores after shareholder pressure, but held off on hopes it could fetch a higher price later, Reuters reported.

The company's buybuy Baby chain, which sells products for infants and toddlers, helped Bed Bath & Beyond obtain a loan worth $375 million last year.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DAL | $37.59 | -2.01 | -5.08 |

Delta Air Lines Inc on Friday forecast first-quarter profit below analysts' estimates on a rise in labor costs as U.S. carriers go all out to improve staffing levels amid robust travel demand.

Delta said on Friday it expects non-fuel unit costs to rise 3% to 4% in the first quarter from a year earlier. The company has also offered a 34% pay hike to its pilots in a new contract, Reuters reported last month, which is expected to become a new "benchmark" for the industry.

A worsening economic outlook has sparked concerns about consumer spending, but travel demand remains strong and exceeds the pace of flight capacity growth, keeping ticket prices high.

"As we move into 2023, the industry backdrop for air travel remains favorable and Delta is well positioned to deliver significant earnings and free cash flow growth," Chief Executive Ed Bastian said.

The company forecast first-quarter revenue would be 14%-17% higher than 2019 on capacity that is 1% lower. Delta expects earnings of 15 cents to 40 cents per share, below estimates of 55 cents, according to Refinitiv IBES data.

The airline reiterated the full-year profit forecast issued last month.For the fourth quarter, adjusted profit came in at $1.48 a share, above analysts' estimates of $1.33. The company reported $12.3 billion in adjusted revenue.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| JPM | $140.27 | 0.78 | 0.56 |

JPMorgan Chase & Co, the biggest lender in the United States, said on Friday it set aside $1.4 billion in anticipation of a mild recession, even as it beat forecasts for quarterly profit on the back of a strong performance at its trading unit.

Chief Executive Jamie Dimon said consumers were still spending excess cash and businesses remained healthy, but he listed a number of uncertainties facing the economy.

"We still do not know the ultimate effect of the headwinds coming from geopolitical tensions including the war in Ukraine, the vulnerable state of energy and food supplies, persistent inflation ... and the unprecedented quantitative tightening.

"The bank said it expects net interest income of $74 billion excluding markets in 2023, versus the average estimate of $75.15 billion, according to Refinitiv data.

JPMorgan's profit for the three months ended Dec. 31 was $11 billion, or $3.57 per share, compared with $10.4 billion, or $3.33 per share a year earlier.

Excluding items the company earned $3.56 per share, beating the average analyst estimate of $3.07.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WEN | $22.77 | 0.98 | 4.52 |

Trian Fund Management, run by activist investor Nelson Peltz, said on Friday it will not pursue a takeover of Wendy's Co, months after the company's largest shareholder said it was considering a potential bid for the burger chain.

Trian said in May last year it was exploring taking over Wendy's, either on its own or with others, almost two decades after Peltz invested in the company.

On Friday, Wendy's separately announced a new $500 million share buyback plan and doubled its quarterly dividend to 25 cents per share.

The hedge fund in a filing said the company's move to return additional capital to shareholders through share repurchases and increased cash dividends "was the appropriate path to enhance shareholder value at this time.

"The firm added it believes Wendy's is well positioned to deliver significant long-term value for shareholders.

Wendy's said in an emailed statement to Reuters that it looks forward to continuing its partnership with Trian and "are pleased with Trian's confidence in our growth strategy."

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WFC | $41.39 | -1.44 | -3.36 |

Wells Fargo & Co on Friday reported a 50% decline in profit for the fourth quarter, missing analysts' estimates, as the bank racked up more than $3 billion in costs related to a fake accounts scandal and boosted loan loss reserves for a potential economic slowdown.

The bank's shares were down nearly 4% in premarket trade.

The fourth-largest U.S. lender reported a profit of 67 cents per share for the quarter ended Dec. 31, compared with $1.38 per share a year earlier. On an adjusted basis, the bank earned 61 cents per share, compared with analysts' estimates of 66 cents per share, according to Refinitiv IBES data.

Provision for credit losses was $957 million in the quarter, compared with a $452 million release a year earlier.

Provision for credit losses in the quarter included a $397 million increase in the allowance for credit losses primarily reflecting loan growth, as well as a less favorable economic environment, the bank said.

Though Wells Fargo's operating losses were "one-offs" related to litigation and regulatory and customer remediation, its results were disappointing, said Thomas Hayes, chairman and managing member at Great Hill Capital."Of the major banks, Wells is the weakest of the reports today," he said. "They continue to underwhelm."

| Symbol | Price | Change | %Change |

|---|---|---|---|

| C | $49.16 | 0.07 | 0.14 |

Citigroup Inc reported a 21% fall in quarterly profit on Friday, missing forecasts, as the bank increased provisions to prepare for a worsening economy and investment banking revenue declined due to a sharp drop in dealmaking activity.

Fears of a potential recession prompted Citi to add $640 million to its reserves in the fourth quarter, compared with a release of $1.37 billion from its reserves in 2021 when pandemic-related loan losses failed to materialize.

On an adjusted basis, Citi earned $1.10 per share for the fourth quarter ended Dec. 31, falling below estimates of $1.14 a share, according to Refinitiv.

The U.S. Federal Reserve last year raised its interest rate by 425 basis points from the near-zero level to tame inflation, raising fears of an economic downturn, and thus, forcing many firms to forecast slower growth in revenue and profit.

The Fed's tightening helped Citi post a 61% surge in net interest income by charging higher interests on loans to customers.

Still, the U.S. central bank's aggressive stance, coupled with the war in Ukraine and growing economic uncertainties, roiled financial markets and slowed dealmaking activity last year. This saw Citi's investment banking revenue plunge 58%.

Meanwhile, elevated market volatility led traders reposition their portfolios, helping Citi's markets business and driving a 6% rise in the bank's revenue to $18 billion.

U.S. stocks fell across the board after a series of mixed results from the nation’s largest banks including JPMorgan, Bank of America and Wells Fargo, in addition Delta Airlines warned of rising costs pressuring those shares. In commodities, oil ticked up to the $79 level now on pace for weekly gains.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| JPM | $135.44 | -4.05 | -2.90 |

| WFC | $40.55 | -2.27 | -5.31 |

| DAL | $37.24 | -2.36 | -5.96 |

The Mega Millions jackpot is the second largest in history meaning the winner faces a huge tax bill. However, there are some states where the tax bite is not as bad.

BlackRock Inc. reported an 18% drop in fourth-quarter profit on Friday, hit by a global market rout that squeezed fee income.

The world's largest asset manager posted adjusted earnings of $1.36 billion, or $8.93 per share, in the three months to Dec. 31, down from $1.65 billion, or $10.68 per share, a year earlier.

Analysts on average had expected a profit of $8.11 per share, according to IBES data from Refinitiv.

Assets under management (AUM) stood at $8.59 trillion at the end of the quarter, down from a little more than $10 trillion a year earlier but up from $7.96 trillion in the third quarter.

Several big banks will kick off fourth-quarter earnings season Friday morning.

JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, and Bank of New York are all scheduled to post results ahead of the opening bell.

Overall, earnings for the financial sector are expected to decline 8.7% from a year ago, according to Refinitiv estimates.

Rising interest rates by the Federal Reserve will have both positive and negative effects.

It will help by boosting net interest margins and net interest income. However, the steep jump in borrowing costs could mean weaker demand for loans. There has also been a sharp decline in deal-making and underwriting fee.Investors will pay close attention to the banks’ outlooks in the face of global central bank tightening and economic uncertainty.

Other earnings reports to watch are from Blackrock and UnitedHealth Group.

Tesla price cuts that started a week ago in China, have now moved to the U.S. market.

The electric automaker has reportedly cut prices on some models by nearly 20%, according to the Wall Street Journal.

The move is seen as a way to grab new buyers at a time Wall Street is concerned appetite for the vehicles is weakening.

The cuts are likely to allow some buyers to qualify for a $7,500 U.S. government tax credit.

Watch for another inflation reading in the form of import and export prices for December.

Prices of imported goods likely fell 0.9% month-over-month, following a 0.2% slide in October. It would mark the sixth straight monthly drop in prices and coming on the heels of yesterday’s cooler December CPI data.

Export prices are expected to fall 0.5% in December, following a 0.3% decline the prior month.

Also watch as the University of Michigan releases its preliminary index of consumer sentiment for January.

It’s expected to inch higher to 60.5 after climbing more than expected to 59.7 in December on easing inflation expectations.

Oil prices gained Friday and were on track for gains of more than 6% for the week.

Prices were supported by signs of demand growth in China and expectations of less aggressive interest rate rises in the United States.

U.S. West Texas Intermediate (WTI) crude futures traded around $78.00 per barrel.

Brent crude futures traded around $83.00 a barrel.

WTI is up 6.2% this week and Brent has jumped 6.7% and recouping most of last week's losses.

Oil prices have also been buoyed by a slide in the dollar to a nearly nine-month low after data showed U.S. inflation fell for the first time in 2-1/2 years, reinforcing expectations the Federal Reserve would slow the pace of rate hikes.

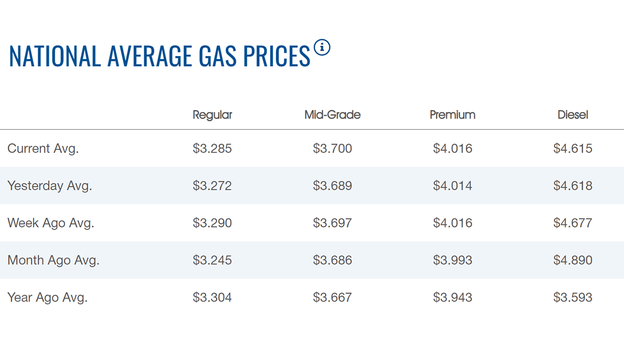

The nationwide price for a gallon of gasoline gained on Friday to $3.285, according to AAA.

The average price of a gallon of gasoline on Thursday was $3.272.

A year ago, the price for a gallon of regular gasoline was $3.304.

One week ago, a gallon of gasoline cost $3.290. A month ago, that same gallon of gasoline cost $3.245.

Gas hit an all-time high of $5.016 on June 14.

Diesel slipped lower, remaining below $5.00 per gallon to $4.615, but that is still a far from the $3.593 of a year ago.

Apple CEO Tim Cook may be 40% lower, but the target is still $49 million.

According to regulatory filings, his compensation will depend more on how well the iPhone maker's shares perform relative to market peers.

Cook's compensation for the fiscal year 2022 was $99.4 million, slightly higher than the previous year.

Bitcoin was trading around $18,000, after gaining for nine straight days.

For the week, Bitcoin has gained more than 12%.

For the month, the cryptocurrency is 13% higher, but down more than 56% in the past year.

Ethereum was trading around $1,400, after gaining 13% in the past week.

Dogecoin was trading at 8 cents, after gaining more than 12% in the past week.

Live Coverage begins here