LIVE STOCK MARKET UPDATES: Bank earnings in focus, McCarthy hits Wall Street, Angry Birds sold

Charles Schwab, M&T Bank and State Street lead more bank earnings, House Speaker Kevin McCarthy speaks on Wall Street, Sega Sammy buys Angry Birds maker Rovio for $776 million. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

JB Hunt Transport Services Inc. on Monday reported first-quarter net income of $197.8 million.

On a per-share basis, the Lowell, Arkansas-based company said it had net income of $1.89.The results did not meet Wall Street expectations. The average estimate of seven analysts surveyed by Zacks Investment Research was for earnings of $2.04 per share.

The trucking and logistics company posted revenue of $3.23 billion in the period, also falling short of Street forecasts. Five analysts surveyed by Zacks expected $3.43 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SP500 | $4,151.40 | 13.76 | 0.33 |

| I:COMP | $12,157.72 | 34.26 | 0.28 |

| I:DJI | $33,987.37 | 100.90 | 0.30 |

Major U.S. stock indexes ended with slim gains on Monday, helped by financial and industrial shares while investors braced for a heavy week of corporate results and comments from Federal Reserve officials that could give more insight into the path of interest rates.

The Dow Jones Industrial Average closed 100.84 points, or 0.3%, higher while the S&P 500 and Nasdaq Composite ended the trading session up 0.33% and 0.28%, respectively.

Meanwhile, the New York Federal Reserve said on Monday its barometer of manufacturing activity in New York State increased for the first time in five months in April, helping solidify the case for the U.S. central bank to raise rates at its meeting next month.

"Markets are in a bit of a wait-and-see mode," said Angelo Kourkafas, an investment strategist at Edward Jones. "We have a lot of corporate earnings ahead of us and the Fed rate decision in a couple of weeks."

Investors are awaiting more reports from major U.S. banks this week, including Goldman Sachs Group Inc., Bank of America Corp. and Morgan Stanley, after heavyweights including JPMorgan Chase & Co. reaped windfalls from higher interest payments last week.

Other companies due to report this week include Johnson & Johnson, Tesla Inc. and Netflix Inc.

Alphabet Inc shares fell nearly 4% on Monday after a report that South Korea's Samsung Electronics was considering replacing Google with Microsoft-owned Bing as the default search engine on its devices.

The report, published by the New York Times over the weekend, underscores the growing challenges Google's $162-billion-a-year search engine business face from Bing — a minor player that has risen in prominence recently after the integration of the artificial intelligence tech behind ChatGPT.

Google's reaction to the threat was "panic" as the company earns an estimated $3 billion in annual revenue from the Samsung contract, the report said, citing internal messages.

Another $20 billion is tied to a similar Apple contract that will be up for renewal this year, the report added.

Alphabet and Samsung did not immediately respond to Reuters' requests for comment.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| RBLX | $39.33 | -6.38 | -13.95 |

Roblox Corporation a global video game platform with millions of players, today released certain key metrics for the month of March 2023.

In March, daily active users were 66.2 million, up 26% year-over-year, while hours engaged were 4.8 billion, up 26% year-over-year.•

Estimated revenue was between $212 million and $223 million, up 15% - 21% year-over-year, while estimated bookings were between $247 million and $255 million, up 23% - 27% year-over-year.

Estimated average bookings per daily active user were between $3.73 and $3.85, which represents a year-over-year change of -2% - +1%.

Roblox has released monthly updates for it's first two years as a public company, but will now be releasing updates quarterly.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BTU | $26.27 | 1.04 | 4.12 |

Peabody announced today a new shareholder return framework which includes a share repurchase plan, a fixed quarterly cash dividend and a variable quarterly cash dividend component.

The Board also approved a new share repurchase program authorizing repurchases of up to $1.0 billion of common stock.

Peabody plans to return to shareholders at least 65 percent of annual Available Free Cash Flow (AFCF) retroactive to January 1, 2023. Expecting to launch the shareholder return program in the second quarter of 2023, following the Company's announcement of first quarter earnings.

The balance of AFCF is expected to be allocated to value enhancing growth projects, repurchase of potentially dilutive securities, additional shareholder returns and capital preservation.

House Speaker Kevin McCarthy pledged on Monday to pass legislation to raise the nation's debt ceiling — but on condition of capping future federal spending at 1% — as he lashed out at President Joe Biden for refusing to engage in budget-cutting negotiations to prevent a debt crisis.

In a high-profile speech at the New York Stock Exchange, McCarthy, the Republican leader who is marking his 100th day as speaker, said the nation’s debt load is a “ticking time bomb” and Biden is “missing in action” as the deadline nears to raise the debt limit.“

Since the president continues to hide, House Republicans will take action," McCarthy said.

His Wall Street address comes as the Washington is heading toward a potential fiscal crisis over the need to raise the nation's debt limit, now at $31 trillion, and avert a federal default. The Treasury Department has said it is taking “extraordinary measures” to continue paying its bills, but money will run short this summer.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SCHW | $50.77 | -0.72 | -1.40 |

Charles Schwab Corp beat first-quarter profit estimate s as rate hikes by the Federal Reserve boosted the financial services provider's interest income, even as it struggled with a decline in deposits from the U.S. banking crisis last month.

The firm's deposits fell to $325.7 million in the first quarter from $366.7 million in the prior quarter. They tumbled 30.1% from a year earlier.

Charles Schwab said it would pause its share buyback program in light of recent uncertainty in the U.S. banking sector and the resulting concerns around new regulations.

On an adjusted basis, profit rose to 93 cents per share for the three months ended March 31. Analysts on average expected 90 cents per share, according to Refinitiv IBES data.

Net interest revenue surged about 27% to $2.77 billion.Total net revenue rose 10% to $5.12 billion from $4.67 billion a year earlier.

Confidence among U.S. single-family homebuilders improved for a fourth straight month in April as a dearth of previously owned homes and falling mortgage rates boost demand for new houses, but a shortage of building materials remains a challenge.

The National Association of Home Builders/Wells Fargo Housing Market index edged up one point to 45 this month. A reading below 50 indicates that more builders view conditions as poor rather than good. Economists polled by Reuters had forecast the index unchanged at 44.

The NAHB survey found 30% of builders reported reducing prices this month, down from 31% in March. The share using incentives to boost sales climbed to 59% from 58% in March.

The survey's measure of current sales conditions rose two points to 51. Its gauge of sales expectations over the next six months increased three points to 50. It was the first time both of these components were at 50 or higher since last June.

The component measuring traffic of prospective buyers was unchanged at 31.

SpaceX called off its first launch attempt of its giant rocket on Monday.

Elon Musk and his company had planned to launch the nearly 400-foot Starship rocket from the southern tip of Texas, near the Mexican border. SpaceX postponed the launch because of a problem with the first-stage booster.

No people or satellites were aboard for this attempt. There won’t be another try until at least Wednesday.

The company plans to use Starship to send astronauts and cargo to the moon and, ultimately, Mars.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GTX | $8.27 | 0.37 | 4.68 |

Garrett Motion is increasing its first quarter and full-year outlook with the release of preliminary results.

The automotive technology company sees first quarter sales increasing 8% to $970 million, or up 13% in constant currency terms.

Net income is expected to fall to $81 million from $88 million, primarily due to unrealized marked-to-market gains on our interest rate swaps in the first quarter 2022.

2023 full year net sales are now seen at $3.79 billion to $3.98 billion versus $3.55 billion to $3.85 billion, or +5% to +10% (vs. +1% to +6%) in constant currency terms.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AAPL | $164.58 | -0.63 | -0.38 |

| GS | $337.79 | 0.87 | 0.26 |

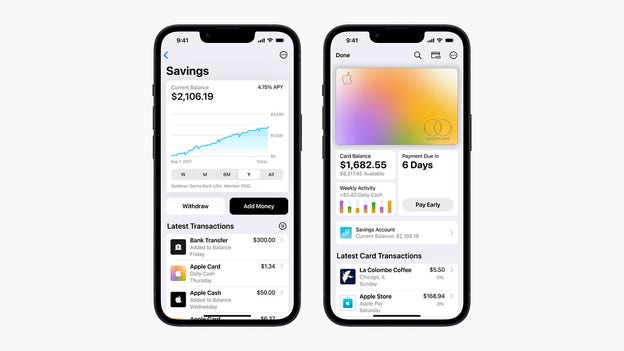

Apple is launching a savings account from Goldman Sachs, which offers a high-yield annual percentage yield of 4.15%, the iPhone and MacBook maker said.

The account features no fees, no minimum deposits, and no minimum balance requirements.

Users can be set up and managed directly from Apple Card in their wallet.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AFLYY | $1.67 | 0.00 | 0.00 |

| EADSY | $34.85 | 0.19 | 0.55 |

A French court on Monday acquitted Airbus and Air France of manslaughter charges over the 2009 crash of Flight 447 from Rio to Paris, which killed 228 people and led to lasting changes in aircraft safety measures.

Sobs broke out in the courtroom as the presiding judge read out the decision, a devastating defeat for victims’ families who fought for 13 years to see the case reach court.

The three-judge panel ruled that there wasn't enough evidence of a direct link between decisions by the companies and the crash. The official investigation found that multiple factors contributed to the disaster, including pilot error and the icing over of external sensors called pitot tubes.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| STT | $80.03 | 1.22 | 1.55 |

State Street Corp reported a first-quarter profit on Monday that missed analysts' estimates, hurt by a fall in fee income due to the recent U.S. banking crisis, sending the company's shares down 10% in premarket trading.

State Street, the world's largest custodian bank, saw its assets under custody or administration fall 10% to $37.6 trillion in the first quarter.

Cushioning the blow, the bank's net interest income rose 50% to $766 million helped by the U.S. Federal Reserve's aggressive interest rate hikes.

State Street set aside $44 million as provision for credit losses in the reported quarter as steep rate rises stoke fears of an economic slowdown.

The company reported a profit of $1.52 per share. Analysts had expected State Street to earn $1.64 per share, according to Refinitiv IBES data.

The company's total quarterly revenue rose 1% to $3.1 billion.

Stocks opened little changed as more banks released quarterly earnings reports. The

• Dow Jones Industrial Average rose 43.99 points, or 0.13%, at the open to 33,930.46.

• The S&P 500 opened lower by 0.47 points, or 0.01%, at 4,137.17.

• The Nasdaq Composite dropped 15.23 points, or 0.13%, to 12,108.23.

Charles Schwab beat profit estimates, State Street missed.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SCHW | $50.77 | -0.72 | -1.40 |

| STT | $80.03 | 1.22 | 1.55 |

| MTB | $116.59 | 0.04 | 0.03 |

COMEX gold for June delivery was flat and oil was lower, trading around $82 a barrel.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| MTB | $116.59 | 0.04 | 0.03 |

M&T Bank Corp beat Wall Street estimates for first-quarter profit on Monday, as the U.S. Federal Reserve's rapid rate hikes to tame high inflation boosted the lender's interest income.

U.S. banking heavyweights have also reaped windfalls from higher interest payments in the first quarter, brushing off a crisis prompted by the collapse of two regional lenders.Fed's aggressive monetary tightening that has benefited most consumer-facing lenders, has also roiled markets and the outlook for the economy.

Net interest income for the bank doubled to $1.83 billion in the first quarter ended March 31, compared with $907 million, a year earlier.

Total deposits for M&T Bank fell nearly 3% to $159.1 billion, compared with $163.5 billion at the end of the previous quarter.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| RXDX | $114.01 | 1.15 | 1.02 |

| MRK | $115.31 | -0.27 | -0.23 |

Merck & Co said on Sunday it will buy Prometheus Biosciences Inc for about $10.8 billion, picking up a promising experimental treatment for ulcerative colitis and Crohn's disease and building up its presence in immunology.

Merck will pay $200 per share for the California-based biotechnology company that specializes in treatments for autoimmune diseases, representing a 75.4% premium to Prometheus' last closing price.

"This is allowing us to move into immunology in a strong way and will allow us sustainable growth, we think, well into the 2030s given the long patent life," Merck Chief Executive Robert Davis said in an interview.

Davis said the Prometheus drug, PRA023, being developed to treat two inflammatory bowel diseases (IBD) - ulcerative colitis and Crohn's disease - and other autoimmune conditions, could be a multibillion-dollar seller for Merck. He said the recent release of encouraging mid-stage trial results drove Merck to pounce.

Japan's Sega Sammy Holdings Inc said on Monday it planned to acquire Finland's Rovio Entertainment for 706 million euros ($776 million) to bolster its mobile gaming business, sending Rovio shares soaring.

Sega Sammy will offer 9.25 euros for each share of the company behind the mobile game Angry Birds, a 19% premium over Friday's closing price, in its tender offer bid set to be launched around May 8.

The Sega Sammy announcement said Rovio's board of directors supported the tender offer, making the acquisition a friendly takeover.

Rovio received a 683 million euro takeover bid in January from Israeli peer Playtika Holding Corp 8II.F, but the talks were called off last month.

Live Coverage begins here