STOCK MARKET NEWS: Salesforce layoffs, Fed’s signals more rate hikes, Mega Millions jackpot grows

Stocks rebound on second trading day of the new year as oil falls on global growth concerns, Fed signals future pace of rate hikes in latest minutes, Salesforce layoffs announced. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GEHC | $59.65 | 3.65 | 6.52 |

GE HealthCare Technologies Inc's shares rose as much as 8.4% in their Nasdaq debut on Wednesday and its chief executive said the company was looking to do small acquisitions to boost its cardiology and oncology operations in the long term.

The company, which was spun off from conglomerate GE, had opened 3% lower in its first day of trading and closed up 8% at $60.49.

GE HealthCare has been a bright spot for GE recently and its new management plans to build on that momentum as an independent entity. GE will still own 19.9% of the unit.

GE said in 2021 it would split into three public companies to simplify its business, pare down debt and breathe life into battered shares.

GE HealthCare will have four medical device businesses under its wings — imaging and ultrasound devices, patient care solutions and pharmaceutical diagnostics — with imaging being the largest.

For the year up to the third quarter ended Sept. 30, that business generated more than half of its total revenue of $13.4 billion. GE Healthcare is scheduled to release its fourth-quarter results on Jan. 30.

Minutes from the Federal Reserve’s December meeting show none of the members of the Federal Open Market Committee anticipate “that it would be appropriate to begin reducing the federal funds rate target in 2023."

“With inflation staying persistently above the Committee's 2% goal and the labor market remaining very tight, all participants had raised their assessment of the appropriate path of the federal funds rate relative to their assessment at the time of the September meeting,” the minutes said.

The Fed raised its federal funds rate target by 50 basis points at last month’s meeting, a smaller increase than the prior 75 basis point hikes.

“Participants observed that a slowing in the pace of rate increases at this meeting would better allow the Committee to assess the economy's progress toward the Committee's goals of maximum employment and price stability, as monetary policy approached a stance that was sufficiently restrictive to achieve these goals.”

| Symbol | Price | Change | %Change |

|---|---|---|---|

| XLE | $84.14 | -0.26 | -0.31 |

| XLF | $34.78 | 0.46 | 1.34 |

| XLB | $78.71 | 1.11 | 1.43 |

U.S. stocks notched gains across the board as investors took the Federal Reserve’s minutes from the last meeting in stride. Policymakers indicated more rate hikes remain in the pipeline with inflation risks elevated. In commodities, oil fell over 5% to $72.84 per barrel.

Energy stocks rose the least among the S&P's largest sectors, while materials and financials topped the leader board.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GM | $34.71 | 0.89 | 2.63 |

| TM | $137.40 | -0.88 | -0.63 |

General Motors Co reclaimed the top spot in U.S. auto sales from rival Toyota Motor Corp in 2022 as it was able to better meet strong demand for cars and trucks despite industry-wide supply disruptions.

Shares of GM rose 2.7% in afternoon trade on Wednesday to $34.75, after the company posted a 2.5% rise in 2022 sales to 2,274,088 vehicles, higher than Toyota's 2,108,458 units, in a closely watched race.

Inventory shortages stemming from surging material costs and a persistent chip crunch had hobbled production at many automakers, keeping car and truck prices elevated. Asian brands were hit hardest.

The Japanese automaker cut its full-year production target in November. Sales of its SUVs, a key segment, fell 8.6% in 2022, data on Wednesday showed.

However, Toyota executives said there were some positive signs emerging, and the rate of inventory buildup was slow but steady."

Industry-wide, last year's U.S. auto sales are forecast to be about 13.9 million units, down 8% from 2021 and 20% from the peak in 2016, according to industry consultant Cox Automotive.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CCL | $8.70 | 0.73 | 9.16 |

Carnival Cruise Line is raising gratuity levels on its routes from the U.S. and Europe, Cruise Industry News reported, citing emails from the company to passengers.

The report said guests will pay an additional $1.50 in standard staterooms and suites, beginning April 1. The change raises the suggested payment to $16 per day per guest staying in standard cabins and $18 in suites.

Wi-Fi prices are also increasing. The Social plan goes to $12.75 daily from $10.20. Value plan customers will pay $17 instead of $14.45. Premium plan buyers will be charged $18.70, up from $17.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| COIN | $38.33 | 4.73 | 14.08 |

U.S.-based cryptocurrency exchange Coinbase Inc has reached a $100 million settlement with New York's Department of Financial Services (DFS), the exchange and the regulator said in statements on Wednesday.

The settlement, which includes a $50 million penalty, caps the regulator's investigation into the firm's compliance with requirements to prevent money laundering.

The department found Coinbase treated its onboarding requirements for customers as a "simple check-the-box" and had not done sufficient background checks, the regulator said.

“Coinbase failed to build and maintain a functional compliance program that could keep pace with its growth. That failure exposed the Coinbase platform to potential criminal activity," said New York DFS Superintendent Adrienne Harris.

The exchange has addressed the problems, said Paul Grewal, Coinbase's chief legal officer, in a statement.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| VMEO | $3.62 | 0.14 | 3.88 |

Vimeo is cutting its global full-time headcount by approximately 11%, the company said in a regulatory filing.

The headcount reduction is part of the company’s effort to focus on its top priorities, and to put itself in position to become sustainably profitable.

The video hosting, sharing, and services platform expects the layoffs to be substantially complete by the end of the first quarter of 2023. Potential position eliminations in each country are subject to local law and consultation requirements.

Vimeo reports third quarter revenue rose 8% to $108.1 million driven by a 1% increase in average subscribers and a 7% increase in average revenue per user.The net loss widened to $21.4 million from $11.7 million.

A New York man was sentenced today to 24 months in prison for conspiring to steal General Electric (GE) trade secrets, knowing or intending to benefit the People’s Republic of China (PRC).

Xiaoqing Zheng, 59, of Niskayuna, New York, was convicted of conspiracy to commit economic espionage, following a four-week jury trial that ended on March 31, 2022.

According to court documents, Zheng was employed at GE Power in Schenectady, New York, as an engineer specializing in turbine sealing technology. He worked at GE from 2008 until the summer of 2018.

The trial evidence demonstrated that Zheng and others in China conspired to steal GE’s trade secrets surrounding GE’s ground-based and aviation-based turbine technologies, knowing or intending to benefit the PRC and one or more foreign instrumentalities, including China-based companies and universities that research, develop, and manufacture parts for turbines.

“This is a case of textbook economic espionage. Zheng exploited his position of trust, betrayed his employer and conspired with the government of China to steal innovative American technology,” said Assistant Attorney General Matthew G. Olsen of the Justice Department’s National Security Division.

The number of jobs available in the U.S. grew in a sign the labor market remains stubbornly tight.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CRM | $139.48 | 4.70 | 3.49 |

Salesforce Inc plans to cut its workforce by 10% and close some offices, saying it needs to cut costs after rapid pandemic hiring left it with "too many people" amid an economic slowdown, sending its shares up 5%.

The cloud-based software company said on Wednesday it expects between $1.4 billion and $2.1 billion in charges due to the job cuts, of which about $800 million to $1 billion will be recorded in the fourth quarter.

Businesses that relied on cloud services during the pandemic are now trying to reduce expenses through job cuts or delaying new projects, hurting companies such as Salesforce and Microsoft Corp.

"The environment remains challenging and our customers are taking a more measured approach to their purchasing decisions," co-Chief Executive Officer Marc Benioff said in a letter to employees."

"As our revenue accelerated through the pandemic, we hired too many people leading into this economic downturn we're now facing, and I take responsibility for that," Benioff added.

Salesforce had 73,541 employees at the end of January last year, a 30% jump from 2021. The company's growth has slowed during the past four quarters, with Salesforce posting its weakest revenue increase in the third quarter.

Salesforce said affected employees in the United States will receive a minimum of about five months pay, health insurance and other benefits.

U.S. job openings slipped in November but remained high suggesting businesses remain determined to add workers, a blow to the Federal Reserve's efforts to cool hiring and wage gains.

There were 10.46 million job vacancies on the last day of November, down slightly from 10.51 million in October, the Labor Department said Wednesday. That's down from a peak of 11.9 million in March.

Yet the figures show there are nearly 1.8 jobs for every unemployed person, down from a peak of 2 but historically very high. Before the pandemic, there were usually more unemployed people than jobs.

In another key metric, the number of people quitting their job rose to 4.2 million, up from about 4 million in October. That is below record peaks of roughly 4.6 million quits late last year, but is still historically high. Workers typically quit a job for higher pay in new positions. When many Americans quit, it can force businesses to pay more to keep their workers.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| TSLA | $110.14 | 2.04 | 1.89 |

Tesla Inc's China chief Tom Zhu has been promoted to take direct oversight of the electric carmaker’s U.S. assembly plants as well as sales operations in North America and Europe, according to an internal posting of reporting lines reviewed by Reuters.

The Tesla posting showed that Zhu's title of vice president for Greater China had not changed and that he also retained his responsibilities as Tesla's most senior executive for sales in the rest of Asia as of Tuesday.

The move makes Zhu the highest-profile executive at Tesla after Chief Executive Elon Musk, with direct oversight for deliveries in all of its major markets and operations of its key production hubs.

The reporting lines for Zhu would keep Tesla's vehicle design and development — both areas where Musk has been heavily involved — separate while creating an apparent deputy to Musk on the more near-term challenges of managing global sales and output.

Tesla did not immediately respond to a Reuters request for comment.

Reuters reviewed the organizational chart that had been posted internally by Tesla and confirmed the change with two people who had seen it. They asked not to be named because they were not authorized to discuss the matter.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GERN | $3.73 | 1.33 | 55.42 |

Geron Corp said on Wednesday its experimental blood cancer drug helped more patients achieve independence from blood transfusions when compared with a placebo in a late-stage trial, sending its shares up 50%.

Geron's lead drug, imetelstat, was being studied in patients with a type of myelodysplastic syndromes (MDS), a difficult to treat family of blood cancers. Patients with the disease require frequent blood transfusions to manage their anemia.

The company plans to submit applications for approval in the United States in mid-2023 and in Europe in the second half of 2023, and expects to commercially launch the drug in 2024.

It anticipates a peak market potential of $1.2 billion in the United States and some key EU countries, Chief Executive Officer John Scarlett told Reuters.

Nearly 40% of the 118 patients who were on the drug showed independence from transfusion for eight weeks, compared with 15% of the 60 patients on placebo, the company said in a statement.

The results suggest that treatment with the drug "may be altering the course of the disease," Chief Medical Officer Faye Feller said in a statement.

U.S. stocks attempted an early recovery on the second trading day of 2023 as investors snapped up financial and material companies making the two the S&P leaders ahead of the minutes of the Federal Reserve’s last meeting. Energy stocks lagged as oil slipped to the $74 per barrel level.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| XLF | $34.69 | 0.36 | 1.06 |

| XLB | $78.18 | 0.58 | 0.75 |

| USO | $65.50 | -2.14 | -3.16 |

U.S. stock futures are up again ahead of the opening bell on Wednesday as gold and silver find gains and oil slips.

The Dow Jones Industrial Average futures is up roughly 63 points, or 0.19%, while the S&P and Nasdaq futures are approximately 0.26% and 0.46% higher, respectively.

Over the last month, the Dow remains off around 1.97%, the S&P is still off around 3.78% and the tech-heavy Nasdaq is still roughly 6.94% lower.

In commodities, West Texas Intermediate crude futures shed 2.55% to $74.38 a barrel, as gold jumped 0.71% to $1,859.20 an ounce.

The minutes from the last Federal Reserve meeting will be released Wednesday afternoon.

Investors are hoping they might show the U.S. central bank is moderating its plans for more interest rate hikes to cool inflation.

The Fed’s key lending rate stands at a range of 4.25% to 4.5%, up from close to zero following seven increases last year.

The U.S. central bank forecasts that it will reach a range of 5% to 5.25% by the end of 2023. It isn't calling for a rate cut before 2024.

The Associated Press contributed to this post.

The ISM’s manufacturing purchasing managers index for December will be released.

It’s expected to slip for the fourth month in a row to 48.5, the lowest since May 2020 and the second month in contraction territory.

Keep in mind a reading of 50 is the dividing line between an expanding or contracting sector.

The markets will pay close attention to the prices paid component. It’s expected to fall for the 9th month in a row to 42.6, the lowest since May 2020 and consistent with other data showing that inflation has peaked.

At the same time watch for the latest Job Openings and Labor Turnover Survey.

The Labor Department is expected to say that there were 10.0 million job openings available at the end of November. That’s down more than 300,000 from October’s level and would be the lowest June 2021.

Even at 10.0 million, the number of jobs that need to be filled is almost 70% greater than the number of people looking for work.

Apple shares closed Tuesday with a market capitalization of less than $2 trillion for the first time since March 8, 2021, according to Dow Jones Market Data.

Shares of Apple ended the day with a loss of 3.7% at $125.07 Tuesday, a new 52-week closing low, putting its market capitalization at $1.90 trillion.

The market cap has fallen $996.5 billion since its peak closing level of $2.986 trillion market cap a year ago.

Among Apple's challenges in the past year include a Covid-19 related lockdown and worker protests at a major iPhone manufacturing plant in China resulted in some product shipment delays, according to the Wall Street Journal.

Economic issues such as inflation and a decline in consumer spending also have weighed on the stock.

On Wednesday morning, Exane BNP Paribas analyst Jerome Ramel downgraded Apple stock to Neutral from Outperform, citing a lower level of shipments from China and reduced consumer spending, as well as the lack of new products ready to come to market.

There was no winner in Tuesday night's Mega Millions jackpot worth $785 million.

That means the Mega Millions drawing on Friday night will have a grand prize of $940 million, according to Megamillions.com.

The cash value comes to $483.5 million.

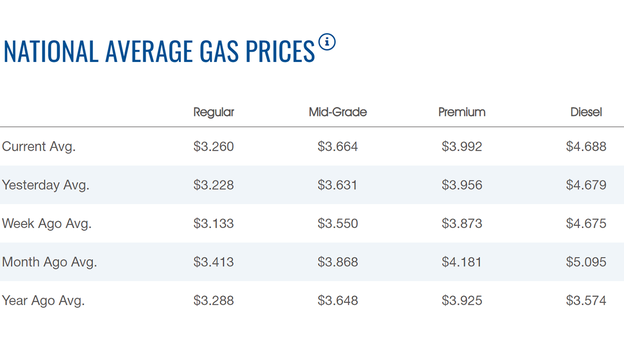

The price of gasoline continues to tick higher.

The nationwide price for a gallon of gasoline bumped up on Wednesday to $3.26, according to AAA.

The average price of a gallon of gasoline on Tuesday was $3.228.

A year ago, the price for a gallon of regular gasoline was $3.228.

One week ago, a gallon of gasoline cost $3.133. A month ago, that same gallon of gasoline cost $3.413.

Gas hit an all-time high of $5.016 on June 14.

Diesel has been rising, but remains below $5.00 per gallon to $4.688, but that is still a far cry from the $3.574 of a year ago.

Oil traded lower Wednesday adding to declines in the prior session.

U.S. crude traded around $76.00 per barrel.

Brent futures traded around $81.00 a barrel.

Both benchmarks plunged more than 4% on Tuesday, with Brent suffering its biggest one-day loss in more than three months.

The head of the International Monetary Fund warned that much of the global economy would see a tough year in 2023 as the main engines of global growth - the United States, Europe and China - were all experience weakening activity, according to Reuters.

U.S. crude oil stockpiles likely rose 2.2 million barrels, with distillate inventories expected down, a preliminary Reuters poll showed on Monday.

Industry group American Petroleum Institute is due to release data on U.S. crude inventories on Wednesday afternoon.

Bitcoin was trading at around $16,000, after snapping a two-day winning streak.

For the week, Bitcoin was trading lower by 0.14%.

The cryptocurrency is down 64% from where it was a year ago.

Ethereum was trading around $1,200, after gaining 0.3% in the past week.

Dogecoin was trading at 7 cents, after falling 4% in the past week.

Live Coverage begins here