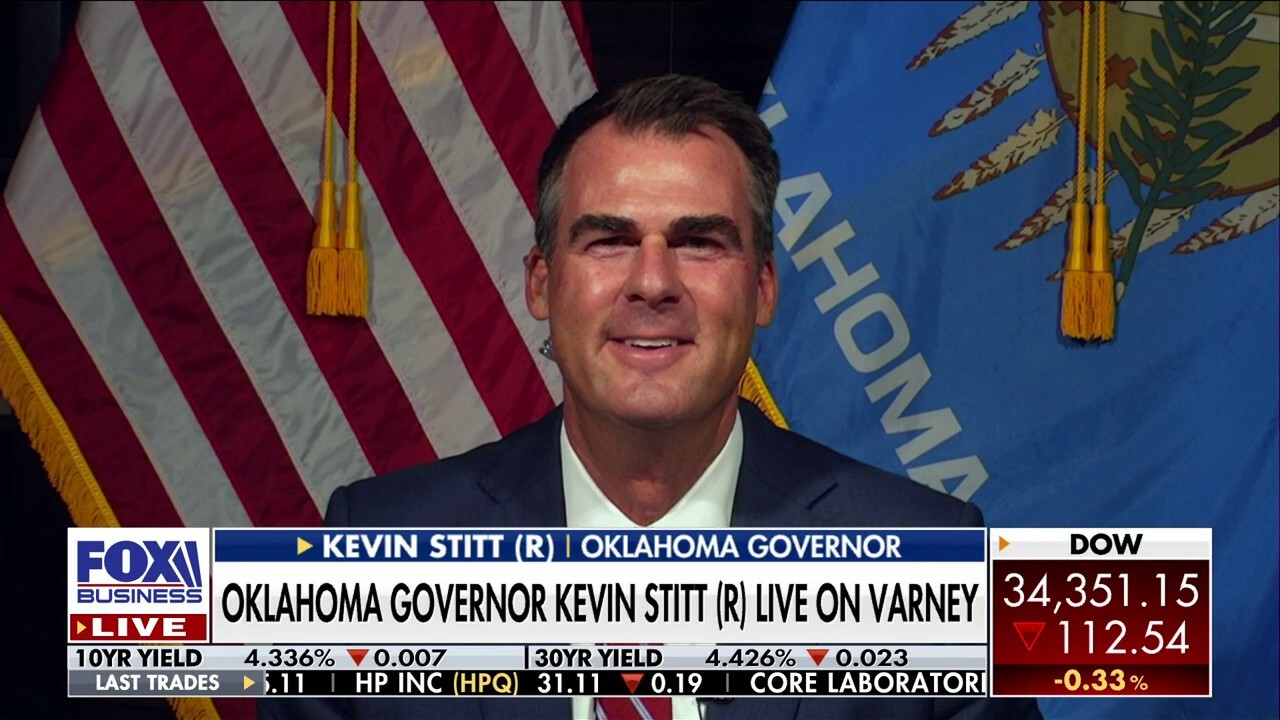

Oklahoma governor pushing to get state income tax 'on the path to zero'

Gov. Kevin Stitt looking to cut the Sooner State's income tax, grocery tax

Oklahoma governor aiming to cut taxes for residents

Oklahoma Gov. Kevin Stitt details which taxes he hopes to slash in order to compete with states like Florida and Texas.

Oklahoma Gov. Kevin Stitt is pushing to provide relief for residents by slashing some state taxes.

"We believe in smaller government, lower taxes. That's first and foremost, and we have built the largest savings account in our state's history. In Oklahoma, since I've been governor, we have a budget surplus. So now is the time to give that back to the people," Gov. Stitt said on "Varney & Co" Tuesday.

The Republican leader noted which state taxes he hopes to get cut back.

"We want to get rid of income tax, get that to zero. We want to be the most business-friendly state in the country."

STATE INCOME TAXES: EVERYTHING YOU NEED TO KNOW

Only eight states in the country do not have a personal income tax for taxpayers. These include Wyoming, Washington, Texas, South Dakota, Alaska, Nevada, Florida and Tennessee.

Stuart Varney: Democrats' love of taxes and 'culture of control' is costing blue states billions

'Varney & Co.' host Stuart Varney argues the exodus out of blue states like California and New York is picking up steam due to high taxes, regulations, and their political culture.

Other states such as New Hampshire only have interest and dividend teases, not direct income tax from an individual personal annual wage, and Pennsylvania has a flat tax rate of 3.07%, making it one of the lowest tax rates in the nation.

Currently, Oklahoma's state income tax rate is at 4.75%.

"This last session. I called for a 75-point reduction to get it down into the threes. You do that, when you have a budget surplus, so it just makes common sense. You either raise expenses or you cut revenue. And so I'm not going to put our core services at risk. But with surplus, we should give that back to the citizens of Oklahoma. That's what I'm advocating for."

IRS SAYS NEW PAPERLESS PROCESSING INITIATIVE WILL ALLOW FOR FASTER REFUNDS

Gov. Stitt is advocating for bringing the tax down to zero, like Florida or Texas.

"If you look at the states that are really growing, and Oklahoma's economy is booming right now, but it could be going even better if we would start lowering that. And I'm not saying you do it overnight, but as revenue increases, you take part of that revenue and you can grow modestly some things. CPI index, you can grow some expenses, but you have to lower a quarter of a point at a time. And over the next decade, you can put your state on the path to zero. And that's my effort. That's what I'm trying to get down through the legislature."

Oklahoma Gov. Kevin Stitt is pushing to get the Sooner States income and grocery tax cut. (Reuters/Shannon Stapleton/FOX Business / Fox News)

In addition to the income tax, Gov. Stitt also said he hopes to reduce the state grocery tax.

"We're one of only 12 states that taxes groceries, and I'm trying to eliminate that because of the inflation and the harm that it's costing everyday Americans, everyday Oklahomans. We're trying to give them some relief at the grocery store as well."

CLICK HERE TO READ MORE OF FOX BUSINESS

Accoding to the most recent inflation data, prices climbed 3.2% from last July, up from 3% in June but slightly below the 3.3% forecast from Refinitiv economists. It marked the first acceleration in the headline figure in more than a year, underscoring the challenge of taming high inflation.

The July consumer price index (CPI) report showed food prices, a visceral reminder of inflation for many Americans, also inched higher in July. Grocery costs rose 0.3% last month and are up 3.6% compared with the same time last year.

FOX Business' Megan Henney and Phillip Nieto contributed to this report.