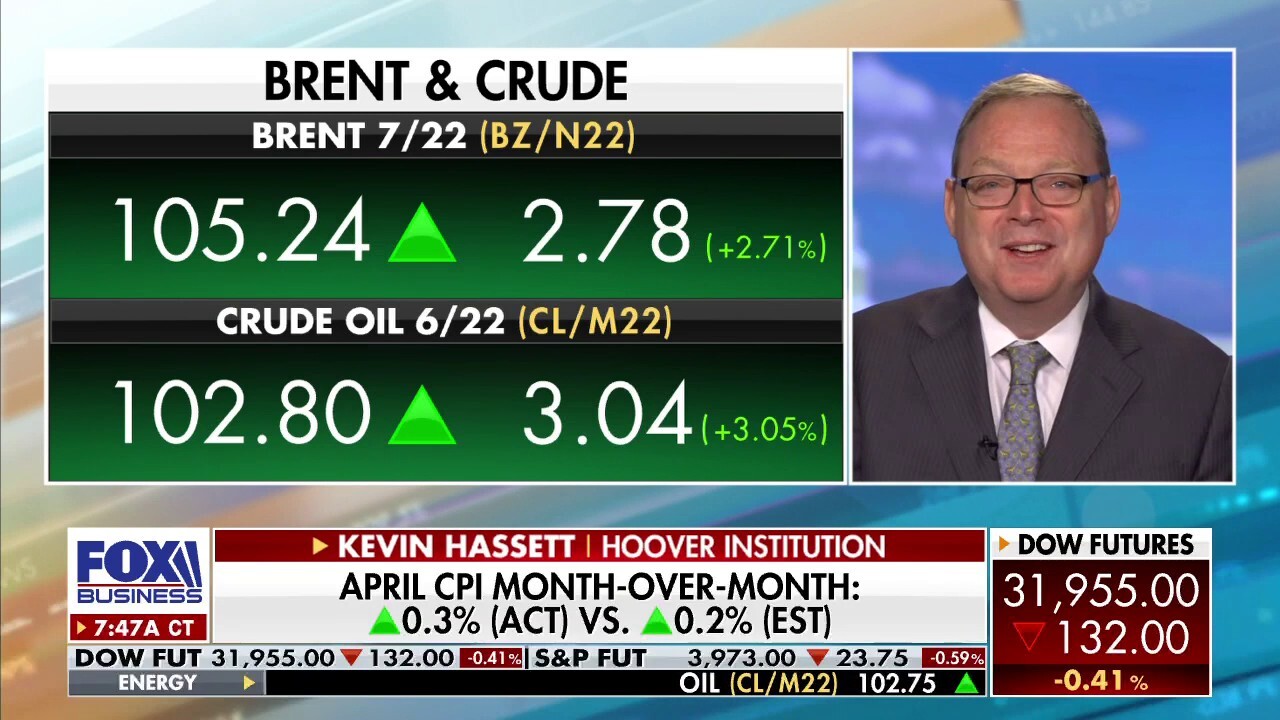

Inflation showing 'no signs' of slowing down: Former White House economist

Kevin Hassett argues the Fed’s policies to curb inflation are not 'having any effect at all right now'

No sign inflation is slowing down: Former White House economist

Former Chairman of the council of economic advisers Kevin Hassett argues data from April's consumer price index report shows the Federal Reserve's moves to try and curb soaring inflation are not working.

Former Chairman of the council of economic advisers Kevin Hassett argued on Wednesday, shortly after the release of April's inflation data, that the Federal Reserve’s policies to try to alleviate soaring prices are not "having any effect at all right now."

He stressed on "Mornings with Maria" that based on the data released on Wednesday, "there are really no signs that inflation is slowing down."

Inflation cooled on an annual basis for the first time in months in April, but rose more than expected as supply chain constraints, the Russian war in Ukraine and strong consumer demand continued to keep consumer prices running near a 40-year-high.

The Labor Department said Wednesday that the consumer price index, a broad measure of the price for everyday goods including gasoline, groceries and rents, rose 8.3% in April from a year ago, below the 8.5% year-over-year surge recorded in March. Prices jumped 0.3% in the one-month period from March.

INFLATION SOARS 8.3% IN APRIL, HOVERING NEAR 40-YEAR HIGH

Those figures were both higher than the 8.1% headline figure and 0.2% monthly gain forecast by Refinitiv economists.

So-called core prices, which exclude more volatile measurements of food and energy, climbed 6.2% in April from the previous year, also more than Refinitiv expected. Core prices also rose 0.6% on a monthly basis – double the 0.3% increase notched in March, suggesting that underlying inflationary pressures remain strong.

Inflation for April hotter than expected

FOX Business' Cheryl Casone reports on the highly anticipated consumer price index report moments after the Labor Department posted the data.

Hassett pointed to the data for core prices on Wednesday and said he believes that the 0.6% increase on a monthly basis is "the most important thing" in the report because it indicates that "an inflection point where inflation starts to go down is really not visible."

"You take .6, you multiply it by 12, account for a little compounding and you’re basically looking at about the same core inflation that we see looking back over the last year," he explained. "So for me, there are really no signs that inflation is slowing down in this [report.]"

Former Chairman of the council of economic advisers Kevin Hassett argues that the Fed’s policies to curb inflation are not "having any effect at all right now." (iStock/Getty )

The slight slowdown in inflation last month came as energy prices declined 2.7%, driven by a 6.1% drop in gasoline (which had climbed a stunning 18.3% the prior month as a result of the Russia-Ukraine war).

Hassett acknowledged on Wednesday that "energy prices are sort of fluctuating" and have been "going down a little bit," but warned that energy prices "will go back up next month."

"And so I think that both top-line and core are probably at about the same pace that we’ve been seeing and so there is no sign that the Fed’s policies are having any effect at all right now," he told host Maria Bartiromo.

BANK OF AMERICA ANALYSTS SLASH S&P 500 PROJECTIONS AS 'SPECTER OF RECESSION' LOOMS

The Federal Reserve faces the tricky task of cooling demand and prices without inadvertently dragging the economy into a recession. Policymakers raised the benchmark interest rate by 50 basis points last week for the first time in two decades and have signaled that more, similarly-sized rate hikes are on the table at coming meetings as they rush to catch up with inflation.

Former White House economist warns a 'rout in markets' is on the way

Former Chairman of the council of economic advisers Kevin Hassett argues Democrats are 'attacking supply when they should be feeding supply.'

Hassett pointed to historical patterns on Wednesday, noting that "if we fall into the normal pattern of history, the federal funds rate has to be above the inflation rate for inflation to start to go down."

He then stressed that if the Fed does not get fiscal policy help, then the central bank "is going to have to take pretty extreme actions."

"And so the market is moving a lot today, but I think the market has a lot more room to go," he warned, pointing to the Fed’s expected move to raise rates by 50 basis points "for a whole bunch of meetings in a row" in an attempt to curb inflation.

U.S. stocks bounced between losses and gains on Wednesday as investors processed the latest inflation data.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50135.87 | +20.20 | +0.04% |

| SP500 | S&P 500 | 6964.82 | +32.52 | +0.47% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23238.66991 | +207.46 | +0.90% |

Markets have been volatile recently. In fact, last week, the day after the Federal Reserve raised interest rates by a half a point for the first time in two decades, the Dow Jones Industrial Average fell over 1,000 points or 3%, while the NASDAQ Composite fell 4% and the S&P 400 over 3%.

Hassett warned on Wednesday that more market volatility should be expected.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

He argued that Democrats "are attacking supply when they should be feeding supply and if they fed supply, they would help the Fed out, and we wouldn’t have to go to these really, really major interest rate hikes to fix the problem."

"They’re not doing that," Hassett continued, stressing that that’s "putting all the pressure on the Fed and that’s going to end in, basically, a rout in markets that’s unlike anything we’ve seen yet this year."

CLICK HERE TO READ MORE ON FOX BUSINESS

FOX Business’ Megan Henney contributed to this report.