Dem candidates are pushing for EU-style economic changes: What does that mean for your taxes?

The U.S. could be moving toward European-style taxes -- what does that mean for your bottom line?

If Americans want a shift toward European-style programs like single-payer health care, they should be ready to pay taxes like Europeans, according to a new report released by The Heritage Foundation, a conservative think tank.

The report broke down the numbers in terms of middle-class workers in both systems. Single workers in European countries making $40,000 end up with $22,467 in personal income after taxes, according to the report.

ELIZABETH WARREN'S MEDICARE-FOR-ALL PROPOSAL WOULD COST JEFF BEZOS $7 BILLION

That's a nearly $6,000 difference from a comparable U.S. worker, who would be left with $28,352 in useable income after taxes.

"Paying for the currently projected government spending will require large tax increases on all Americans," Heritage tax policy analyst Adam Michel wrote in the report. "Paying for new entitlement programs, such as Medicare for All, free college, a national job guarantee, or paid family and medical leave, will require yet higher taxes. It is mathematically impossible to pay for large new spending programs with tax increases only on high-income Americans."

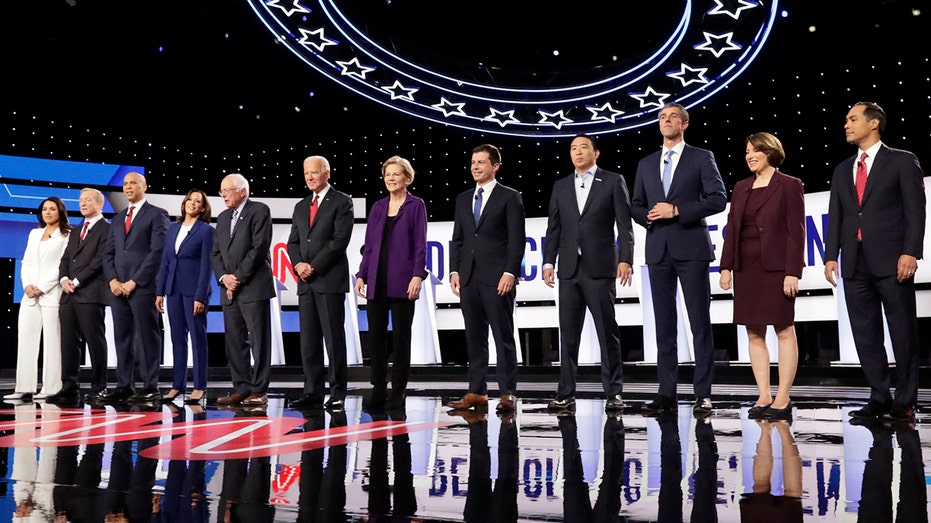

Democratic presidential candidates stand on stage for a photo before a Democratic presidential primary debate hosted by CNN and The New York Times at Otterbein University, Tuesday, Oct. 15, 2019, in Westerville, Ohio. (AP Photo/Tony Dejak)

Michel's report comes as 2020 Democratic candidates are divided about what new programs to offer the American people and how to pay for them.

Presidential hopeful Elizabeth Warren recently released her plan to pay for Medicare-for-all after facing criticism for refusing to promise that her proposal would not raise taxes on the average American.

Warren continuously insisted that overall costs would go down for Americans, which would offset higher taxes.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Her opponents, like former Vice President Joe Biden, have piled on the criticism.

"Warren said tonight that her single payer plan won't raise taxes on anyone but billionaires, but that's simply not true," Biden deputy campaign manager Kate Bedingfield said in a statement over the weekend. "Her plan would create a new tax on employers of almost $9 trillion that would come out of workers' pockets, a new financial transaction tax that would impact investments held by middle class Americans, and a new capital gains tax that would affect far more people than she stated tonight."