Election 2020 proves that every state needs to do what Colorado has been doing since 1992

Some states that have a strong reputation for low tax burdens, such as Texas, Florida, North Carolina, and Arizona are noticeably weak when it comes to taxpayer protections

In addition to voting for elected officials at the federal, state and local level, taxation was on the ballot on Election Day all across the country.

Close to 2,400 measures that have tax or fiscal ramifications were on American ballots in the form of property tax measures, bond propositions and more.

Close to $25 billion in annual tax hikes were voted on, a significant amount that would hit taxpayers' wallets in dozens of states.

Not only that, but more than $50 billion in bond measures were on the ballot, which can result in higher debt obligations for governments that could affect taxpayers for decades.

CALIFORNIA VOTERS REJECT REVAMP TO PROPERTY TAX SYSTEM

There's a way to make sure that these tax increases are headed off without craven politicians taking advantage of taxpayers: a Taxpayer Bill of Rights (TABOR).

Colorado adopted a Taxpayer Bill of Rights in 1992 in the form of Section 20 of the state constitution, and it's proven to be effective for taxpayer transparency and accountability.

Section 20 limits the amount taxes can be increased, specifies how the revenue will be spent, the total principal amount and annual repayment cost for bonded debt, and any revenue collected above the estimated amount in the ballot text must be refunded to taxpayers in the next fiscal year. These are clear and transparent rules that every state budget process should aspire to include.

If every state had the kind of taxpayer protections that Colorado’s TABOR provides, the threat that Americans face every year from tax increases would be greatly abated.

If every state had the kind of taxpayer protections that Colorado’s TABOR provides, the threat that Americans face every year from tax increases would be greatly abated.

HOW BIDEN'S TAX PLAN COULD IMPACT HIGH-TAX STATES

Each tax increase individually may not sound like a lot, but collectively, the total is massive.

Even more astonishing is the “unknown” factor of hundreds of other ballot measures. Since not every election office is required to provide an estimate for how much a tax might raise annually, in many instances they don’t give voters that information.

By calculations from the National Taxpayers Union, there are at least 1,248 measures that provide no information on how much revenue they will raise annually. That means when taxpayers go to fill in their ballots, they will be kept in the dark on the tax implications of their vote.

It is clear that taxpayers everywhere deserve the protection and accountability that comes with a taxpayer bill of rights.

A taxpayer bill of rights in every single state should be the goal for taxpayers. With the start of 2021 state legislative sessions just a few months away, state lawmakers across the country can and should make reasonable adjustments to election laws for 2021 ballot measures.

This is extremely problematic for voters and people who believe in government transparency. For example, I called and emailed the City of Austin, Texas numerous times in order to try to get details on Proposition A, an 18 percent citywide property tax hike to fund a $7.1 billion transportation plan. In a city of one million people, such a tax hike could raise taxes by hundreds of millions of dollars annually.

Despite the pestering, no city official had an estimate of how much revenue this tax would bring in if passed by voters.

It was a similar story in smaller counties as well.

Officials in Lower Frederick Township, Pennsylvania couldn’t give me information about the measure that would increase income taxes by an additional five-hundredths of one percent.

In Florida, numerous rural counties had no estimates about higher sales tax rates.

Fortunately, ballot measures often did contain revenue information or election officials had that information handy when asked. But taxpayers shouldn’t have to jump through hoops or contact numerous people in order to understand the tax measures that are on their ballot.

This is a problem that all state and local governments should remedy immediately so their constituents can make better-informed decisions in the future.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Certainly, few people would consider California a bastion of politicians dedicated to defending taxpayer interests. The state consistently raises taxes and has one of the highest state and local tax burdens in the country.

While its politicians may soak its taxpayers, California law does provide some important protections for taxpayers.

Special taxes must be approved by a two-thirds supermajority of voters, ballot measures have to have a revenue estimate, proposed bond measures must include potential impacts to property tax rates, and in most cases, sample ballots are easily accessible for voters to review before an election.

Other states, such as Colorado, Oregon, Wisconsin, and Michigan also have similar features.

On the flipside, some states that have a strong reputation for low tax burdens, such as Texas, Florida, North Carolina, and Arizona are noticeably weak when it comes to taxpayer protections.

Ensuring that states enact sound tax policy isn't solely limited to the rates or types of deductions and credits contained in their tax code, but also having protections for taxpayers and voters.

A taxpayer bill of rights in every single state should be the goal for taxpayers.

With the start of 2021 state legislative sessions just a few months away, state lawmakers across the country can and should make reasonable adjustments to election laws for 2021 ballot measures.

If not, localities will continue to pull the wool over the eyes of taxpayers.

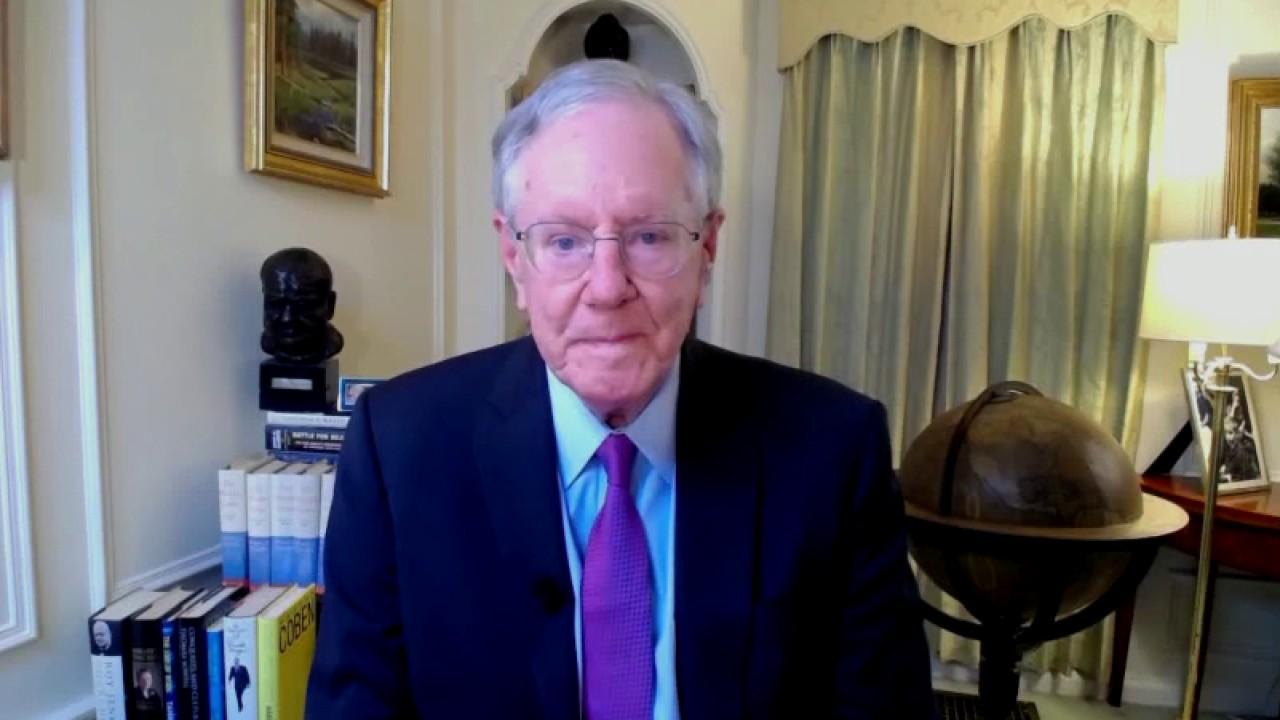

Thomas Aiello is a policy and government affairs manager with the National Taxpayers Union, a nonprofit dedicated to advocating for taxpayer interests at all levels of government.