STOCK MARKET NEWS: Stocks post positive week, Boeing on hiring spree, ETF celebrates 30 years

Stocks ended higher, with the Nasdaq extending gains for a fourth week, Intel falls on a profit warning, Ford announces recall. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BA | $211.27 | -1.46 | -0.69 |

Boeing expects to hire 10,000 workers in 2023 as it recovers from the pandemic and increases jetliner production, but will trim some support jobs, the U.S. planemaker said Friday.

The Arlington, Virginia-based company boosted overall employment by about 14,000 workers in 2022 to 156,000 as of Dec. 31, up from about 142,000 in 2021. Boeing employs about 136,000 workers in the United States.

Boeing acknowledged it will "lower staffing within some support functions" — a move meant to enable it to better align resources to support current products and technology development. It declined to comment on how many jobs it will cut in 2023.Most of the growth will occur in Boeing's business units, as well as engineering and manufacturing, to meet airlines' growing demand.

The company plans to increase deliveries of the 737 MAX from 374 aircraft in 2022 to between 400 to 450 planes this year, with deliveries of the 787 expected to hit between 70 and 80 aircraft.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| F | $13.27 | 0.35 | 2.71 |

Ford Motor Co said Friday it is recalling 462,000 vehicles worldwide because video output may fail, preventing the rearview camera image from displaying.

The U.S. automaker said the recall covers some 2020-2023 model year Explorer, Lincoln Aviator, and 2020-2022 Lincoln Corsair vehicles equipped with 360-degree cameras and includes 382,000 in the United States.

Ford said it has reports of 17 minor crashes relating to the recall issue and more than 2,100 warranty reports but no reports of injuries. The recall expands and replaces a 2021 recall of 228,000 vehicles. Dealers will update the image processing module software and vehicles previously updated under the old recall will need the new update.

Ford said in late 2021 and 2022 the National Highway Traffic Safety Administration (NHTSA) contacted the automaker about reports of a blue image in the rear camera display after the completion of the 2021 recall, which prompted the company to investigate.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GS | $354.85 | -0.12 | -0.03 |

| MS | $96.22 | -0.28 | -0.29 |

Goldman Sachs Group Inc. slashed compensation for its Chief Executive Officer David Solomon by 29% to $25 million for 2022, the bank said in a filing Friday.

Solomon's pay comprises a $2 million base salary, $6.9 million cash bonus and $16.1 million in restricted stock. He was paid $35 million for 2021.The bank's compensation committee cited the "challenging operating environment" as a factor in deciding Solomon's pay, according to the filing. It also noted his "strong individual performance and effective leadership.

"The cut was the largest so far among the CEOs of the biggest U.S. banks, whose firms suffered from a dealmaking drought after a blockbuster 2021.Morgan Stanley CEO James Gorman's compensation was reduced 10% to $31.5 million for 2022.

At JPMorgan Chase & Co, Jamie Dimon's pay held steady at $34.5 million for 2022.

Last year, influential proxy advisory firm Glass Lewis urged shareholders to vote against pay packages that included one-off stock grants for Solomon and John Waldron, the company's president. Their compensation was later approved by investors.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BAER | $12.69 | -6.10 | -32.48 |

Bridger Aerospace Group has closed a deal to combine with special purpose acquisition company Jack Creek Investment.

The combined company will operate as “Bridger Aerospace Group Holdings, Inc.” and its common stock and warrants are expected to begin trading on the Nasdaq Global Market under the ticker symbols “BAER” and “BAERW,” respectively, on Jan. 25.

Founded in 2014 and led by former Navy SEAL Tim Sheehy, Bridger provides its federal agency and state government client base with a comprehensive range of aerial firefighting solutions.

Bridger operates a large and sophisticated fleet of firefighting aircraft, which includes “Super Scoopers” (CL-415EAF), air attack and logistical support aircraft (Next Generation Daher Kodiaks, Pilatus PC-12s, DeHavilland Twin Otter and legacy Twin Commanders), and UAVs (Unmanned Aerial Vehicles).

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SI | $13.04 | -1.07 | -7.58 |

Silvergate Capital Corporation announced that the crypto-focused company has suspended the payment of divide nds on its 5.375% Fixed Rate Non-Cumulative Perpetual Preferred Stock, Series A, in order to preserve capital.

This decision reflects the company’s focus on maintaining a highly liquid balance sheet with a strong capital position as it navigates recent volatility in the digital asset industry.The provider of innovative financial infrastructure solutions continues to maintain a cash position in excess of its digital asset customer related deposits.

The board will re-evaluate the payment of quarterly dividends as market conditions evolve.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WMT | $143.14 | 0.93 | 0.65 |

| CVS | $87.58 | -0.09 | -0.10 |

| WBA | $37.42 | 0.92 | 2.51 |

Walmart Inc said on Friday it would adjust working hours for its U.S. pharmacy team and implement it nationwide in 4,600 locations, with drugstore operator CVS Health Corp doing the same for about two-thirds of its retail pharmacies, amid a tight labor market.

The United States has been experiencing a nationwide labor shortage since the COVID-19 pandemic which has forced retailers to offer attractive incentives and pay increases.

Walgreens Boots Alliance and CVS each raised their minimum wage to $15 per hour in 2021 while Walmart said last year it would increase the average pay of pharmacy workers to more than $20 per hour.

Earlier on Friday, the Wall Street Journal first reported CVS Health Corp and Walmart were cutting pharmacy hours.

Walmart's pharmacies will be open from 9 AM to 7 PM, Monday through Friday from March, while the weekend hours would not change, a spokesperson for the company said. Currently, they are open from 9 AM to 9 PM.

CVS said the new hours of operation, which begin in March, at impacted pharmacies will vary, adding it periodically reviews operating hours to make sure peak customer demand was being met.

The U.S. Securities and Exchange Commission is probing registered investment advisers over whether they are meeting rules around custody of client crypto assets, three sources with knowledge of the inquiry told Reuters.

The SEC has been questioning advisers' efforts to follow the agency's rules around custody of clients' digital assets for several months, but the probe has gathered pace in the wake of the blow-up of crypto exchange FTX, the sources said. They spoke on condition of anonymity as the inquiries are not public.

Advisers managing clients' digital assets typically use a third party to store them.

SEC enforcement staff are asking investment advisers for details around what the firms did to assess custody for platforms including FTX, one of the sources said. The broad enforcement sweep, which has not been previously reported, is a sign the top U.S. markets regulator's scrutiny of the crypto industry is expanding to more traditional Wall Street firms.

A spokesperson for the SEC declined to comment.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| INTC | $27.89 | -2.20 | -7.31 |

Intel shares are down more than 9% in premarket trading after the company said it expects to lose money in the current quarter, surprising investors with a bleaker-than-expected outlook for both the PC market and slowing growth in its key data center division.

Two of Intel's most important markets are showing signs of weakness after two years of strong growth as remote work boomed during the pandemic.

Now, the PC industry is struggling with a glut of chips after demand for consumer electronics fell off a cliff and business customers wary of a recession are slowing spending on data centers.

The company forecast first-quarter revenue in the range of about $10.5 billion to $11.5 billion.

Analysts on average were expecting Intel's total revenue of $13.93 billion, according to Refinitiv data.

The company expects an adjusted loss of 15 cents per share versus expectations of a 24 cents per share profit.

Revenue in the fourth quarter fell 32% to $14 billion. Analysts on average expected revenue of $14.46 billion.

Reuters contributed to this post.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CRM | $165.95 | 0.86 | 0.52 |

Salesforce Inc on Friday named three new board directors, including the chief of hedge fund ValueAct Capital, amid pressure from activist investors for better cost control and a management shakeup at the cloud-based software firm.

The company appointed chief executive of hedge fund ValueAct Capital Mason Morfit, Mastercard finance chief Sachin Mehra and former chief executive of Carnival Corp Arnold Donald to its board.

Reuters reported on Thursday that Elliott Management Corp, the activist investment firm that recently made a multimillion-dollar investment in Salesforce, plans to nominate several director candidates.

At Salesforce, there are at least four activist investors including Elliott, Starboard Value, Jeff Ubben's Inclusive Capital and ValueAct, the firm Ubben founded and which is now run by Mason Morfit, sources familiar with the matter had said.

Earlier this year, the company had announced plans to cut 10% of its jobs and close some offices after rapid pandemic hiring left it with a bloated workforce.

The company also said Sanford Robertson and Alan Hassenfeld, directors at Salesforce since 2003, will not stand for re-election.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HNNMY | $2.40 | -0.12 | -4.76 |

H&M said on Friday soaring costs had slashed its profits, the latest fast-fashion retailer to feel the pinch as consumers cut back, while LVMH and Salvatore Ferragamo revealed the damage to luxury sales caused by China's COVID-19 policies.

Shares in H&M, the world's No. 2 fashion retailer, fell as much as 6% in early trade after quarterly operating profit sank to 821 million Swedish crowns ($79.7 million) from 6.26 billion a year earlier. That was well below a mean forecast of 3.67 billion crowns in a Refinitiv poll of analysts.

The results highlighted the challenge for fashion retailers facing higher bills for textiles, energy and shipping at the same time as rising costs for food, energy and rents force consumers to be more picky about what they buy.

H&M last year launched a drive to cut costs by 2 billion crowns annually, with savings from layoffs and other measures expected to start showing from the second half of 2023.

But it has struggled to keep up with bigger rival Inditex, whose flagship brand Zara aggressively raised prices last year without turning off shoppers.

Zara has outperformed rivals after selling higher-priced garments and enticing shoppers who might have otherwise spent money at luxury stores.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| GT | $10.98 | -0.54 | -4.69 |

The Goodyear Tire & Rubber Company today announced cost savings actions in response to a challenging industry environment and cost pressure driven by inflation.

The company plans an approximately 5% reduction in salaried staff globally, or about 500 positions.

Global replacement tire industry demand remained weak in the fourth quarter, led by a 12% decline in EMEA. When coupled with the impacts of inflation — including significant increases in energy costs.

Goodyear expects its EMEA business unit to report a fourth quarter segment operating loss of approximately $80 million. EMEA had reported positive segment operating income since the second quarter of 2020.

Goodyear expects to record pre-tax charges associated with these actions of approximately $55 million, primarily relating to cash severance payments that are expected to be substantially paid during the first half of 2023. The rationalization and reorganization will result in a quarterly run-rate benefit of approximately $15 million beginning in the second quarter. Savings in the first quarter are expected to be $5 million.

These actions follow the Company’s earlier announced plans to close its Melksham, United Kingdom, manufacturing facility and exit its TrenTyre retail operations in South Africa to support EMEA’s overall competitiveness.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| ALV | $91.57 | 6.64 | 7.82 |

Sweden's Autoliv reported fourth-quarter core earnings above analyst forecasts on Friday having restored profitability by passing higher costs on to its customers, sending its shares up almost 8%.

Cost inflation related to high raw material prices have squeezed car suppliers for some time now, and chief executive Mikael Bratt said in a statement that the cost inflation seen by Autoliv in 2022 was the worst in three decades.

Despite this the Swedish company has been able to meet or exceed analysts estimates in the past quarters as it has continued to negotiate price hikes with its clients which includes OEM manufacturers.

The world's largest producer of airbags and seatbelts said its adjusted earnings before interest and taxes (EBIT) rose to $233 million from $177 million a year earlier, beating estimates by analysts who had expected $224.8 million.

Inflation has also hit Autoliv's employees, with Westin saying the company had to support some of its workforce in specific countries within Eastern and Western Europe as well as in North America.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| SPY | $404.29 | -0.46 | -0.11 |

The first ever US listed exchanged traded ETF, SPY, has been a game changer for investors and traders.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AXP | $155.88 | -0.89 | -0.57 |

On Friday, American Express reported net income reached $1.6 billion, or $2.07 per share, in the final quarter of 2022, while net income for the full year totaled $7.5 billion, or $9.85 per share.

Also in the fourth quarter, the global finance company showed consolidated expenses were $11.3 billion, a 15% improvement from $9.8 billion a year ago, and "primarily reflected higher customer engagement costs, driven by higher network volumes and increased usage of travel-related benefits, and was partially offset by lower marketing expenses in the current quarter."

Meanwhile, consolidated expenses for all of 2022 hit $41.1 billion, notching a 24% jump from the $33.1 billion from a year ago, and reflected "higher customer engagement costs driven by higher network volumes and increased usage of travel-related benefits throughout the year," according to the company release.

U.S. stocks slipped in early trading as the tech-heavy Nasdaq Composite paced the selling led by Intel which posted a sharp decline in revenue as PC sales slump. Other chipmakers fell in sympathy. Still, stocks are on pace to wrap a winning week.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| INTC | $30.09 | 0.39 | 1.31 |

On the last five days, the Dow is up around 1.60%, the S&P remains up around 1.86%, and the tech-heavy Nasdaq is now roughly 3.07% higher during the same time.

In commodities, West Texas Intermediate crude futures spiked 1.31% to $82.07 a barrel, as gold clings to a 0.02% pop to $1,933.30 an ounce.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CVX | $187.79 | 8.71 | 4.86 |

Chevron posted earnings of $6.4 billion, or $3.33 per share for the fourth quarter of 2022. Over the same time last year, the oil giant recorded just $5.1 billion, or $2.63 per share.

Meanwhile, the average sales price per barrel of crude oil and natural gas liquids reached $66 in the final quarter of 2022, up from $63 a year earlier.

On the year, annual cash flow from operations hit a record $49.6 billion as free cash flow reached $37.6 billion.

Earnings reached $35.5 billion, or $18.28 per share, compared with $15.6 billion, or $8.14 per share in 2021, while adjusted earnings totaled $36.5 billion, or $18.83 per share in 2022.

Over the same period in 2021, adjusted earnings reached just $15.6 billion, or $8.13 per share.

After a choppy few months, Elon Musk is having a good week thanks to what's going on with Tesla where he is the largest single shareholder.

The Federal Reserve's favorite inflation tracker is showing modest signs of a cool down.

Shares of BuzzFeed are jumping more than 21% in premarket trading on reports of a deal with Meta Platforms Inc and plans to use artificial intelligence to personalize and enhance the digital media firm's online quizzes and content.

Shares had more than doubled in value earlier in the day as a Wall Street Journal report said it would use ChatGPT creator OpenAI for its content.

Buzzfeed, in an emailed response to Reuters, said "we are not using ChatGPT - we are using OpenAI's publicly available API (application programming interface)."

Earlier in the day, the stock had jumped 50% on a separate report by the Journal that said Meta was paying BuzzFeed millions of dollars to bring more creators to Facebook and Instagram.

The deal, reached last year, was valued at close to $10 million and BuzzFeed will help generate content for Meta's platforms and train creators to grow their presence online, the report had said.

Reuters contributed to this post.

The big focus will be personal income and spending for December.

Economists surveyed by Refinitiv anticipate spending to slip 0.1% month-over-month after a 0.1% gain in November. Personal income, meantime, is expected to rise 0.2%, half the 0.4% pop in November.

The PCE Price Index rose 0.1% in November and was up 5.5% annually.

The Fed bases its 2% inflation target on the annual change in the PCE Price Index. The Core PCE Price Index, which factors out volatile food and energy costs, is expected to rise 0.3%.

The year-over-year change in the Core PCE Price Index, the Fed’s preferred measure of inflation, is anticipated to slow to 4.4%, the lowest since October 2021 and down from 4.7% in November.

The University of Michigan’s will release its final index of consumer sentiment for January.

It’s expected to remain unchanged from the stronger-than-expected preliminary reading of 64.6 two weeks ago.

That was the highest in nine months on rising incomes and easing inflation.

The National Association of Realtors is out with its index of pending home sales for December. Economists surveyed by Refinitiv are looking for a drop of 0.9%, the thirteenth decline in the last 14 months as buyers struggle with surging borrowing costs and high prices.

Integrated oil and gas giant Chevron and consumer finance powerhouse American Express, both Dow members, will report quarterly results ahead of Friday’s opening bell.

Also watch for results from hospital operator HCA Healthcare, telecom and media firm Charter Communications, and consumer products giant Colgate-Palmolive.

Just over one-quarter of the companies in the S&P 500 have reported results.

A new 'guide' says springing for the VIP treatment is the only way to enjoy Disney World.

But data shows those who would most like to visit the amusement park are people less likely to be able to afford it. Yet many make the trek regardless, pointing to the power the Disney brand holds on the average American.

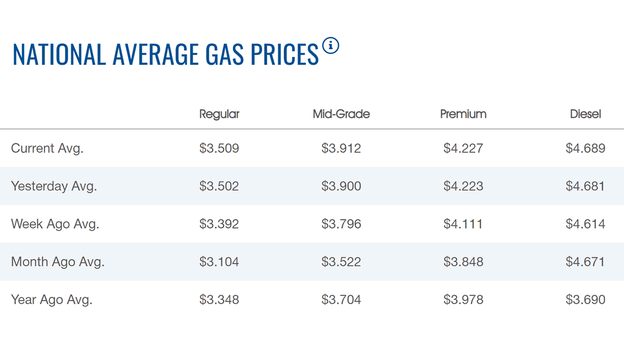

The nationwide price for a gallon of gasoline gained on Friday to $3.509, according to AAA.

The average price of a gallon of gasoline on Thursday was $3.502.

A year ago, the price for a gallon of regular gasoline was $3.348.

One week ago, a gallon of gasoline cost $3.392. A month ago, that same gallon of gasoline cost $3.104.

Gas hit an all-time high of $5.016 on June 14.

Diesel gained, but remained below $5.00 per gallon to $4.689, but that is still far from the $3.69 of a year ago.

Visa shares were 1% higher in premarket trading after first-quarter profit beat Wall Street targets on Thursday as its payments volume held steady with Americans still spending on international travel despite an economic slowdown.

The world's largest payments processor said total cross-border volumes - a key measure that tracks spending on cards beyond the country of issue - jumped 22% on a constant dollar basis in the quarter. Total payment volumes added 7%.

That was, however, far lower than last year's 40% surge in cross-border volumes and a 20% jump in payments volumes.

Visa's revenue rose at the slowest rate in seven quarters, gaining 12% to $7.9 billion.

Earlier in the day, rival Mastercard Inc forecast current-quarter revenue growth below expectations as pent-up demand for travel was seen slowing going forward.

Reuters contributed to this post.

Oil prices edged up on Friday after stronger-than-expected U.S. economic growth report.

Prices also getting a boost on hopes for a rapid recovery in Chinese demand as COVID-19 cases and deaths plunged from last month's peak levels.

U.S. crude traded around $81.00 per barrel.

Brent futures traded around $87.00 a barrel.

Both benchmarks had gained more than 1% on Thursday.

OPEC+ delegates will meet next week to review crude production levels.

Hasbro shares are more than 4% lower in premarket trading after the company said it would eliminate about 1,000 positions from its global workforce this year, or about 15% of full-time employees, as the toymaker looks to cut costs in a tough macroeconomic backdrop.

The company estimated fourth-quarter revenue of about $1.68 billion, down 17% from a year earlier. Analysts on average expect revenue of $1.92 billion, according to Refinitiv IBES data.

It forecast quarterly adjusted earnings per share of $1.29 to $1.31, much lower than estimates of $1.48.

Hasbro said President and Chief Operating Officer Eric Nyman is also exiting the company as part of organizational changes.

Reuters contributed to this post.

Bitcoin was trading around $23,000, after trading down in three of the last five days.

For the week, Bitcoin has gained more than 9%.

For the month, the cryptocurrency was up 39%, but down more than 36% over the last 52 weeks.

Ethereum was trading around $1,500, after gaining more than 3% in the past week.

Dogecoin was trading at 8 cents, after gaining more than 5% in the past week.

Live Coverage begins here