Nike’s supply-chain snags bring pain to sneakerhead shops

Delayed deliveries of key sneakers hit boutiques that sell coveted designs

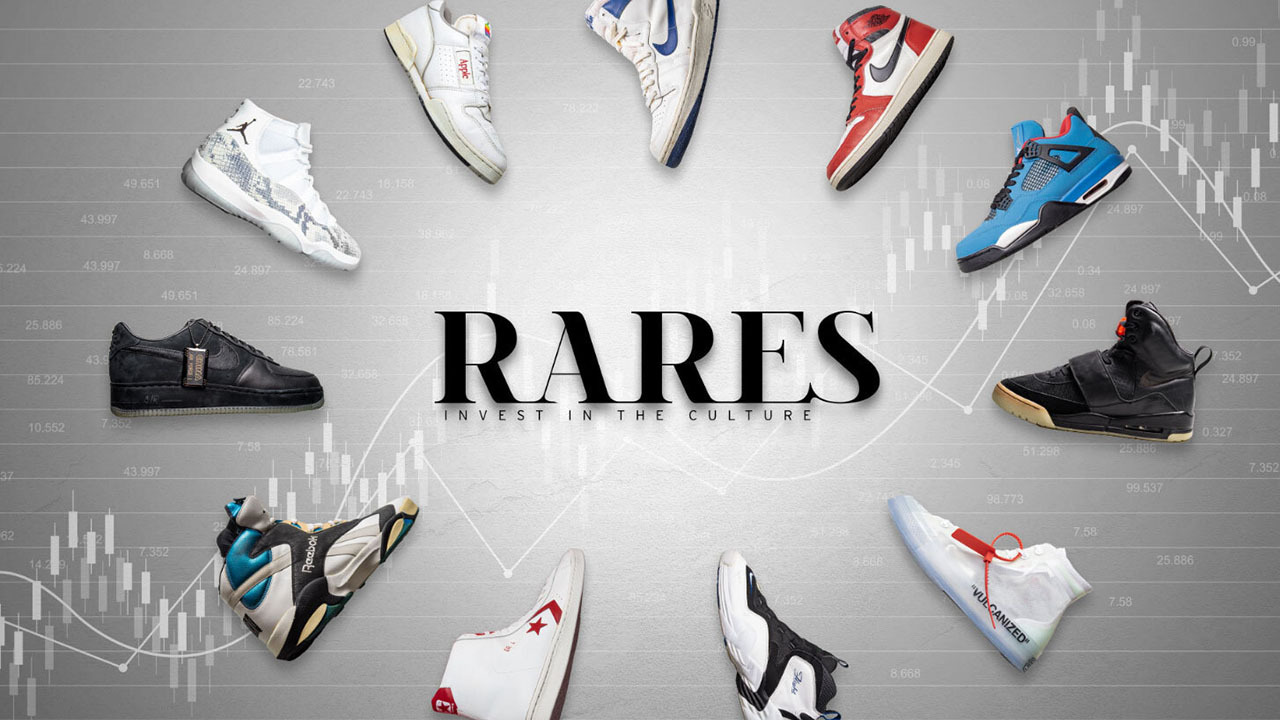

Former NFL player creates site to invest in sneakers

Rares founder Gerome Sapp on the rise of sneaker culture.

Even the cool sneaker shops are getting dragged by supply-chain problems.

Several independent retailers told The Wall Street Journal that Nike Inc. and other global sneaker companies have delayed deliveries of key shoe designs as the industry continues to grapple with production and shipping complications through the COVID-19 pandemic.

Sneakersnstuff AB, a small chain of streetwear and sneaker stores with locations in Europe and the U.S., has faced delays on its Nike orders sometimes lasting several months, according to co-founder Erik Fagerlind. "We still have to pay rent, we still have to pay the staff," he said, when a coveted shoe like a Nike x Sacai is delayed.

NIKE JOINS AMAZON ON LIST OF POTENTIAL PELOTON SUITORS: REPORT

In a call with analysts in November, Nike said that factory closures in Vietnam as a result of the coronavirus and lengthy transit times had constricted the company’s production capacity. On the call, Nike Chief Financial Officer Matthew Friend said the company was confident the supply chain would normalize heading into the middle of this year.

Supply-chain snarls are being felt across the footwear industry. In a call with analysts on Friday, Under Armour Inc. Chief Financial Officer Dave Bergman said the company was still experiencing supply constraints as a result of longer than usual transit times and higher freight costs. Mr. Bergman said these delays caused Under Armour to cancel some deliveries as a way to give priority to its direct-to-consumer business and top wholesale accounts.

The Nike "Swoosh" logo at one of the entrances to Nike World Headquarters in Beaverton, Ore.

In recent years, Nike has cut around half of its wholesale accounts in North America as it has put more emphasis on selling products through its own apps, websites and stores. Such direct sales now account for roughly 40% of its $44.5 billion in annual revenue.

While Nike has kept relationships with mainstream retailers like Nordstrom Inc. and Dick’s Sporting Goods Inc., the company uses small-scale boutiques for introducing specialized, highly desirable designs like Dunks and Jordans that customers line up to purchase.

Sneaker collectors anticipate these releases for months, monitoring leaks of images and drop dates on Instagram and blogs dedicated to tracking Nike’s next move. In the digital age, many stores employ online raffles to launch a shoe, giving customers an often-slim chance at buying a hot sneaker, where the supply is minuscule compared with the demand. Still, these premium stores also fall victim to the global supply-chain problems hitting the retail industry.

Mr. Fagerlind said Nike informs Sneakersnstuff of delays but the snags have helped to slow the business. Last year, Sneakersnstuff expected to increase sales by around 17% over the year before, but Mr. Fagerlind said sales grew closer to between 5% and 10%.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NKE | NIKE INC. | 63.92 | +1.22 | +1.95% |

| UAA | UNDER ARMOUR INC. | 7.56 | +1.28 | +20.38% |

| JWN | NO DATA AVAILABLE | - | - | - |

| DKS | DICK'S SPORTING GOODS | 208.29 | +2.76 | +1.34% |

| VFC | VF CORP. | 20.34 | +0.24 | +1.19% |

| ADDYY | ADIDAS AG | 91.445 | +0.86 | +0.95% |

Mr. Fagerlind is understanding of Nike’s current production predicament, which he felt has the company giving priority to its own stores over independent retailers. "Given their current strategy, I’d be surprised if they didn’t give priority to themselves," he said.

Nike didn’t respond to requests for comment.

Notre, a fashion and footwear retailer in Chicago, has experienced delivery delays averaging one to two months on "quickstrike," or particularly desired, limited-run Nike models, according to co-founder Michael Jaworowski.

Mr. Jaworowski said Nike and the other sneaker companies Notre deals with have communicated with him openly about delays. "They’re doing the best that they can," he said.

Unexpected lags in delivery make it difficult for the store to forecast its monthly revenue and make future purchasing decisions, he said. When a sure-to-sell-out sneaker gets pushed back, Notre "might not be hitting certain financial goals that we were expecting to hit," said Mr. Jaworowski.

Phil Knight, chairman and co-founder of Nike Inc., arrives for a session at the Allen and Co. Media and Technology Conference in Sun Valley, Idaho, July 11, 2019. ( Patrick T. Fallon/Bloomberg / Getty Images)

Receiving products out of season is also an issue. "You don’t want to be taking boots in February," said Matt Powell, a senior adviser at NPD Group, a retail-research firm. Mr. Powell added that the demand for a Jordan or a Dunk sneaker is likely to remain high regardless of the season.

"Even in normal times they don’t have much power," Mr. Powell said of the boutiques. "The brands are so huge and the boutiques are so small that there’s very little recourse for them."

Particularly troubling for these shops are delays of coveted collaborations they have with the sneaker giants, which are produced in limited numbers and burnish a store’s reputation.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Union, a boutique in Los Angeles, originally expected its new collaborative Nike Dunk design to launch in November, but the shoe was delayed in production according to the store’s owner, Chris Gibbs. The shoe, which had been teased on sneaker blogs for months, eventually released on Feb. 11.

Notre had a collaboration with Vans — owned by VF Corp. — which was pushed back by a few months, while another with Nike’s Converse brand was moved from the first quarter of this year to the fourth quarter.

In a statement, Vans Global Brand President Doug Palladini said, "While no brand is immune to headwinds created by the pandemic, we have worked hard to ensure our customers receive their orders and have continued to leverage our strong relationships with our retail partners to fulfill product orders to the best of our abilities."

CLICK HERE TO READ MORE ON FOX BUSINESS

Last year, Bodega, a streetwear boutique with locations in Boston and Los Angeles, had the release of around one-third of its collaborative sneakers pushed back as a result of supply-chain issues, according to the store’s founding partner, Oliver Mak.

"You could beg, you could plead" to get a release moved up, but in the end the store is at the mercy of Nike’s or Reebok’s production schedule, said Mr. Mak. "You have to be a little bit Zen" to be in the sneaker business these days, he said.