Biden's tax hike proposal: All of your questions, answered

Here’s a closer look at what we know — and don't know — about the proposed tax increases

Footing the bill for Biden's massive $6 trillion economic vision

Rep. Kevin Brady, R-Texas, weighs in on president's tax policies on 'The Evening Edit'

Wealthy Americans are bracing for higher taxes.

President Biden released an ambitious spending proposal on Wednesday that would make significant investments in child care and paid family leave – a $1.8 trillion measure that would be paid for almost entirely by significant tax hikes on the top sliver of U.S. households.

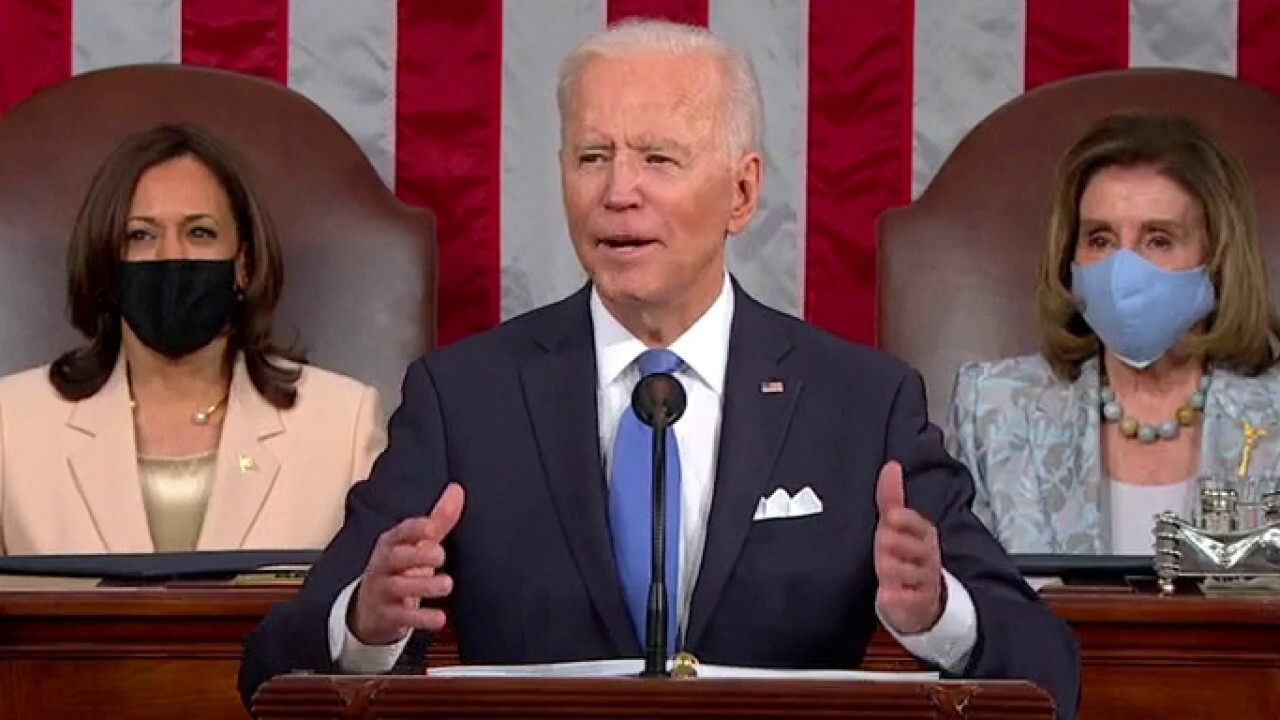

"My fellow Americans, trickle-down economics has never worked," Biden said this week during his first primetime address before a joint session of Congress. "It’s time to grow the economy from the bottom up and middle out."

WHAT BIDEN'S CAPITAL GAINS TAX PROPOSAL COULD MEAN FOR YOUR WALLET

The 10-year initiative, known as the American Families Plan, is the second part of Biden's multi-part "Build Back Better" agenda, which calls for some $4 trillion in new spending. The first part, dubbed the American Jobs Plan, includes billions in new funding for roads and bridges, as well as green energy, water systems and elder care. That proposal would be paid for by a slew of new taxes on corporations.

Here’s a closer look at what we know — and don't know — about the proposed tax increases.

What is Biden proposing?

The American Jobs Plan, the $2.3 trillion spending plan that Biden introduced at the beginning of April, would raise the corporate tax rate to 28% from 21%, reversing a key part of Republicans' 2017 tax law. The measure would also impose a higher global minimum on companies' foreign earnings.

The American Families Plan, which the White House unveiled this week, includes the tax hikes on wealthy Americans.

That proposal would restore the top personal income tax rate to 39.6% – where it sat before the 2017 Tax Cuts and Jobs Act – for the highest 1% of earners.

"No one making $400,000 per year or less will see their taxes go up," the White House said.

Biden would also increase the capital gains rate to 39.6% from 20% for households earning $1 million or more, bringing that rate in line with the top marginal income tax rate. The administration estimates it will affect roughly 0.3% of taxpayers, or about 500,000 households.

Coupled with an existing Medicare surcharge, federal tax rates for the wealthy could climb as high as 43.4% – bringing the levy on returns on financial assets higher than rates on ordinary income.

WHAT'S IN BIDEN'S $2.25T TAX AND INFRASTRUCTURE PLAN?

The president also wants to eliminate the so-called stepped-up basis. Under current law, when heirs inherit an asset that has appreciated in value, they get a "step-up" in basis, meaning they receive the holding at its current market value. Beneficiaries can sell those assets and pay capital gains based only on the time they receive the asset and the time they sold it, allowing them to minimize the tax bite.

The first $1 million of gains would be exempt from the end of the stepped-up basis, and there would be no tax if the gains are used for charitable donations.

Biden is calling on Congress to beef up funding for the IRS, giving the agency more manpower to audit wealthy Americans. The White House estimates that enhancing enforcement will generate $700 billion in tax revenue by closing the gap between typical American workers and very high-earners who employ sophisticated methods to minimize their tax liability.

Who would pay the higher taxes?

The White House said the higher tax rates would apply "only to those within the top 1%."

The top individual income tax rate – 39.6% – will be paid by families with joint taxable income of about $509,300 and individuals earning more than $452,700, the administration official told FOX Business. Under those proposed brackets, a hypothetical couple that earns $600,000 combined each year would be required to pay the higher taxes, even if the spouses individually made less than $400,000. This would apply if the couple filed jointly.

The current top marginal rate of 37% is currently paid by singles earning $523,601 or more and couples making $628,301 or more.

The income threshold level for the higher capital gains tax is still unclear, although Biden said anyone who earns more than $1 million will pay the new levy. It's unknown if that applies to individual filers or joint filers.

BIDEN'S PLANNED CAPITALS GAINS TAX HIKE COULD SLASH US REVENUE BY $33B

The top 1% of U.S households would owe an average of $260,000 more per year in taxes under the proposal, according to an analysis by the Urban Institute's Tax Policy Center.

Will the income threshold change for married couples filing jointly vs. individual filers?

The Biden administration has provided inconsistent answers on whether the proposed income threshold levels will apply to married couples who file jointly and individual filers.

"People file as married couples, they file as individuals, and his promise to the American people is that people who are in the 99% of people who are making less than that are not going to have their taxes go up," White House press secretary Jen Psaki said on CNN on Thursday. Asked whether the threshold for families will also be $400,000, she said: "That’s right, and individuals."

When would the new taxes take effect?

The proposal does not specify a date, although a senior White House official told FOX Business the higher individual income brackets would kick in for the 2022 tax year.

It's unclear whether the capital gains tax hike would begin in 2022, or whether the administration would make the increase retroactive in order to avoid triggering a market sell-off.

"The proposed changes to capital gains will be designed in coordination with Congress, and with an effective date that avoids gaming," the official said.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

How much will the new taxes generate in revenue?

The American Families Plan would generate $1.5 trillion over the next decade by taxing the highest earners, according to a fact sheet released by the White House.

How would the new revenue be spent?

Money from the taxes on high-income earners would go to:

- Child tax credit: Extending through 2025 an expanded version of the child tax credit, which provides up to $3,000 for every child ages 6 to 17 and $3,600 for every child under age 6

- Child care: Limiting child-care expenses for low- and middle-income families with children under the age of 5 at no more than 7% of their income

- Paid family leave: Establishing a paid and medical leave program that would guarantee 12 weeks of paid leave and would replace two-thirds of workers' average wages, up to $4,000 a month

- Universal pre-school: Create universal pre-school for all 3- and 4-year-olds

- College tuition: Make community college free for two years

- Health tax credits: Expand tax credits for households that buy health insurance on their own. It would also permanently extend a major expansion of the Affordable Care Act, which fully subsidized ObamaCare subsidies for people earning up to 150% of the federal poverty level

- Earned income tax credit: Make permanent the expansion of the earned income tax credit for childless workers

FOX Business' Blake Burman contributed to this report