Warren’s ‘wealth tax’ to face host of challenges

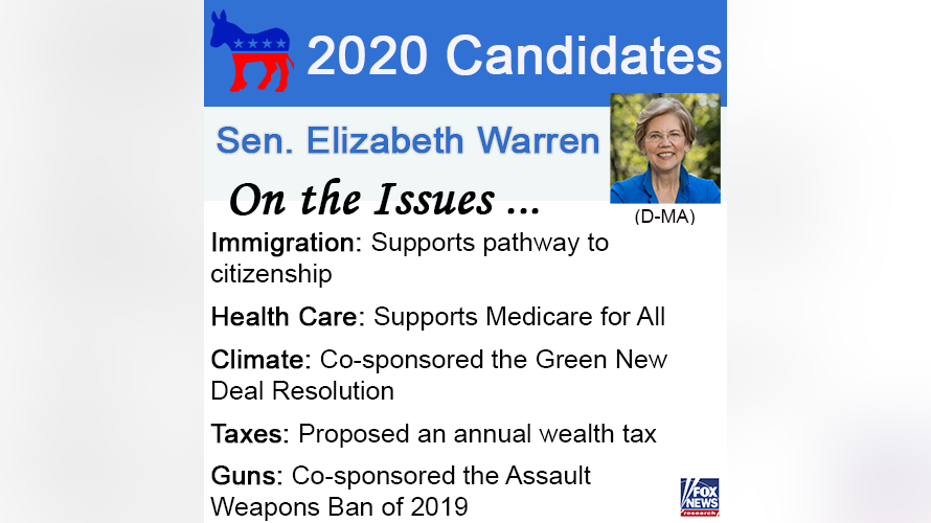

Sen. Elizabeth Warren’s plan to impose a new tax on the nation’s richest citizens has broad public support, but implementing such a measure would come with a host of difficulties that could blunt the expected benefits and send wealthy individuals scrambling to rearrange their assets.

And in some cases even taking extreme steps to avoid the tax all together.

According to a recent Fox News poll, 70 percent of voters support the proposal by Warren – a Massachusetts Democrat who is seeking the party’s nomination in the 2020 presidential election – to impose a 2 percent tax on those who have over $50 million in assets in a given year.

But determining who falls within that threshold is a monumental undertaking, involving changes to already complex tax policy that could further encourage the rich to seek new strategies to avoid the higher burden and ensnare the Internal Revenue Service in even more legal challenges. It’s one reason why eight of the 12 countries abandoned their own wealth tax, according to the nonprofit Tax Foundation’s Nicole Kaeding.

Wealth taxes “are difficult taxes to administer and that’s because the uber wealthy tend to have assets that are very difficult to value,” she told FOX Business. “It would add a lot of compliance costs to the IRS, they would have to beef up their enforcement and auditing.”

Among the strategies that the ultra-rich may employ is shifting wealth into closely held stocks, artwork and other collectible items that can be difficult to value, pooling assets among trusted associates and divesting money into third-party insurance policies, tactics the IRS is already intimately familiar with.

The agency currently evaluates an individual’s assets when calculating the estate tax. But the process is difficult and can lead to legal disputes between the family of the deceased and the IRS that take years to resolve.

Many assets, like real estate or businesses, fluctuate year by year, sometimes even daily in the case of stock ownership. And imposing a set threshold – in this case, $50 million – would almost certainly encourage the wealthy to, among the other tactics, try to redistribute assets to siblings, children or spouses in an attempt to avoid the tax.

“The real enforcement challenges occur during taxpayers lives when they find ways to shift assets out of their estate…and reduce the amount of the estate tax,” Joshua Blank, a law professor at the University of California, said. “Today, the best way for the wealthy to avoid tax on their assets is to hold onto them until they die. The Warren proposal would tax the wealthy during life."

To help remedy this, Warren is proposing “a significant increase in the IRS enforcement budget.” The plan also calls for a minimum audit rate for the wealthy – a measure that would hike the agency’s litigation costs, according to Moritz College of Law’s Stephanie Hoffer.

“It’s clear that they anticipate people trying to minimize the liability, perhaps in creative ways,” she told FOX Business.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:DJI | DOW JONES AVERAGES | 50135.87 | +20.20 | +0.04% |

| I:COMP | NASDAQ COMPOSITE INDEX | 23238.66991 | +207.46 | +0.90% |

| SP500 | S&P 500 | 6964.82 | +32.52 | +0.47% |

Another significant question is how the proposal would address pass-through businesses, or those companies that are structured in a way that profits flow through to the owner who is then taxed at an individual rate. Executives of such entities could theoretically be worth millions – given their overall wealth is tied to the valuation of the firm -- but only command a sliver of that as take-home income.

Warren’s proposal would allow individuals with “extremely high net worth but liquidity constraints” to defer tax payments for up to five years with interest.

Despite the challenges, however, experts say the plan is feasible.

“From the broad contours of this, we can safely say that there’d be valuation issues, there’d be tax avoidance and evasion issues. But that’s not to say that this is impossible,” said Leandra Lederman, a tax professor at Indiana University.

Given the potential challenges around implementation, there are also questions around exactly how much revenue such a plan would generate.

Warren says it could net the federal government an added $2.7 trillion over a decade, money that would be used to fund initiatives like universal child care. That includes the expectation that at least 15 percent of filers would successfully engage in tax avoidance measures, but some experts say it could be even higher.

“That’s currently the amount the federal government loses under the income tax, which is a much easier tax to administer,” the Tax Foundation's Kaeding said.

CLICK HERE TO GET THE FOX BUSINESS APP

Revenue from tax reform is also hotly debated and is often influenced by one’s ideological view. Republicans, for example, pitched their own $1.5 trillion tax law as paying for itself, a claim that has been debunked in various studies.