Trump pushes tax break for sporting events among ‘Phase 4’ incentives

The White House has discussed a few potential tax deductions

As discussions about a possible “Phase 4” stimulus bill heat up on Capitol Hill, sporting events are among the items that the Trump administration has discussed allowing attendees to deduct from their annual tax liabilities.

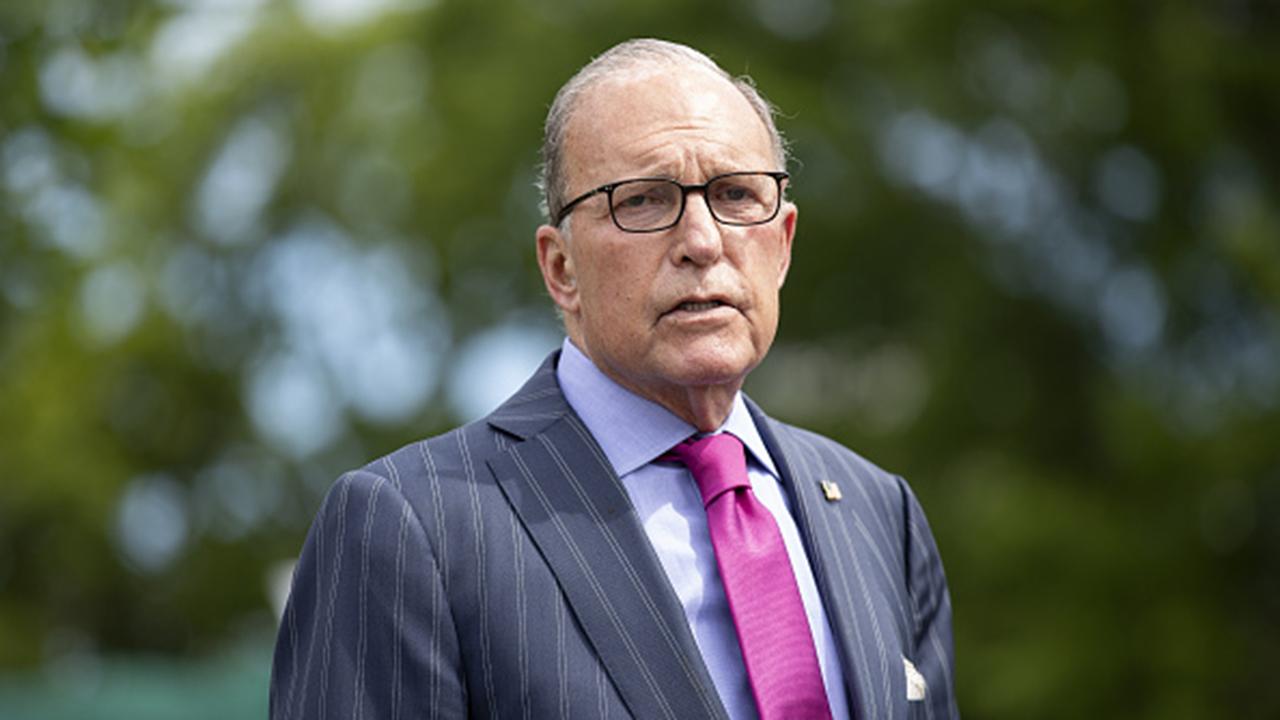

National Economic Director Larry Kudlow said during a recent interview with FOX Business that athletic games and matches are on Trump’s tax break wish-list of items aimed at spurring economic growth.

“He’s talked about deductions for restaurants, entertainment, sporting events and sightseeing and tourism,” Kudlow said, when discussing proposals for another stimulus package.

PHASE FOUR STIMULUS PACKAGE COULD INCLUDE A TAX CREDIT FOR DOMESTIC TRAVEL

Major sporting leagues, like the NHL, NBA and MLB, are trying to restart their seasons after the pandemic required games to be paused. The NFL is hoping to carry on with its season as planned this fall.

It is unclear whether – and in what capacity – fans would be allowed to attend these live sporting. Franchises generate a significant amount of revenue each season from ticket sales.

'PHASE 4' CORONAVIRUS STIMULUS BILL: THE PROPOSALS UNDER SERIOUS CONSIDERATION

While it is currently unknown what shape a sporting event deduction would take, the tax break could be included as part of Trump’s bid to reinstate the full deduction for business meals and entertainment, according to The Washington Post.

Under the Tax Cuts and Jobs Act, Congress repealed the entertainment deduction. That caused confusion as to whether business meals were still deductible.

The IRS issued guidance on business meals in 2018 indicating 50 percent of the expenses remained deductible as long as the meals were not “lavish” or “extravagant" and other criteria were met.

Because any expenses related to activities generally considered entertainment, amusement or recreation were still not deductible, the scope of the business meal provision was limited. When a business meal was considered entertainment, for example, remained unclear.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Other tax credits the president has voiced support for include domestic travel.

During a press briefing at the White House in May, Trump mentioned creating an “Explore America” tax credit that Americans would be able to use for domestic travel and expenses, like meals at restaurants.

Senior White House adviser Kevin Hassett has said the administration has been laser-focused on policies that will help the travel industry rebound.

CLICK HERE TO READ MORE ON FOX BUSINESS