IRS can’t spend its $80B without permission from Congress under GOP bill

A new GOP bill would require the IRS to 'answer to the American people'

The IRS has been politicized, goes after anyone it can: Don Bolduc

New Hampshire Senate Republican candidate Don Bolduc breaks down how the IRS has strayed from its role on 'Kudlow.'

Two Republican senators are working on legislation that would let Congress vote down plans by the IRS to spend the $80 billion on additional staff over the next decade that the GOP fears will be used to subject millions of Americans to audits.

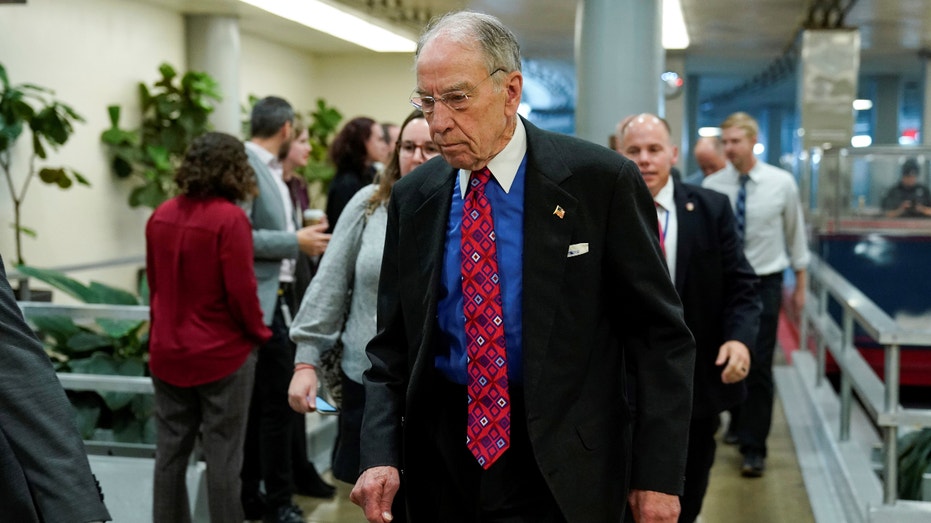

Sen. Chuck Grassley, R-Iowa, says the bill he’s working on with Sen. Jon Thune, R-S.D., is needed because the Democrat-led Congress gave the IRS billions in funding to build up its staff with "no oversight" strings attached. The money was approved as part of the Inflation Reduction Act (IRA) Congress approved this year without a single Republican vote.

"Our bill will ensure that the IRS is answerable to the American people in how it uses this money and will force it to forfeit funds every day it’s not in compliance," Grassley said.

"If our bill becomes law, the Biden administration’s IRS would have to answer to the American people, not Washington bureaucrats," Thune added.

IRS TO ADD 4,000 CUSTOMER SERVICE REPS TO PREP FOR 2023 TAX SEASON

Republicans intend to impose strict new oversight rules over how the IRS can spend $80 billion in new funding. (Brendan Smialowski/AFP via Getty Images | Drew Angerer/Getty Images / Getty Images)

Under their pending bill, the IRS would have to report to Congress each year on how it intends to use the money, and that plan would be subject to a resolution of disapproval in Congress. It would also require the IRS and Department of Treasury to provide quarterly updates on its plan in a bid to make it easier to spot the misuse of funds or possible violations of taxpayer rights.

"Failure to submit timely and thorough plans or reports would result in financial penalties, including IRA funds being rescinded on a daily basis until the IRS complies with the reporting requirements," according to a summary of the bill.

IRS RELEASES INFLATION ADJUSTMENTS FOR 2023 – HERE'S HOW IT COULD IMPACT YOUR TAX BILL

Both senators sit on the Senate Finance Committee, which has jurisdiction over tax matters, and Grassley also sits on the House-Senate Joint Committee on Taxation. Thune is the top Republican on the subcommittee on Taxation and IRS Oversight, and Grassley is a member of that subcommittee.

The senators said they would introduce the bill when Congress returns to work this month after the midterm elections.

Sen. John Thune is working with other Republicans to rein in a new source of funding for the IRS. (AP Photo/Jacquelyn Martin / AP Newsroom)

Republicans have accused Democrats of helping the IRS hire an army of IRS agents and say up to 87,000 of them could be hired with the funding Congress provided. That number is based on a 2021 Treasury Department estimate of how many new staff members it could hire with $80 billion.

Not all of them will be agents or auditors. Over the summer, the IRS started the hiring process by beginning the search for people to answer taxpayers’ phone calls. In late October, the IRS added 4,000 customer service representatives to help prepare for the 2023 tax season.

IRS RAISES 401(K) CONTRIBUTION LIMIT BY RECORD AMOUNT AS INFLATION RAGES

But Republicans have said they would impose rigorous oversight of the IRS and its new source of funding if they win control of Congress in the midterm elections. The three Republicans hoping to lead the House Ways and Means Committee, which has jurisdiction over tax policy — Vern Buchanan of Florida, Jason Smith of Missouri and Adrian Smith of Nebraska — say they will immediately exercise their new oversight authority over the agency.

Sen. Chuck Grassley wants Congress to have a say over how the IRS spends its new funding. (REUTERS/Joshua Roberts / Reuters)

House Minority Leader Kevin McCarthy, R-Calif., has said he would fight to slash funding for the IRS.

CLICK HERE TO GET THE FOX BUSINESS APP

Additionally, Ways and Means Republicans have warned the IRS they will be pushing for specific answers into how 30 million paper documents were destroyed by the IRS in 2021. Those "information returns" were submitted to report certain transactions to the IRS but were destroyed because of "software limitations" that prevented the IRS from storing these files.

Republicans have asked for this information for more than a year, but the IRS has only handed over a heavily redacted decision memo that has not clarified what happened.