IRS hit with inquiry from GOP lawmakers for destroying 30 million tax documents

Reps. James Comer and Nancy Mace are seeking answers from IRS Commissioner Charles Rettig

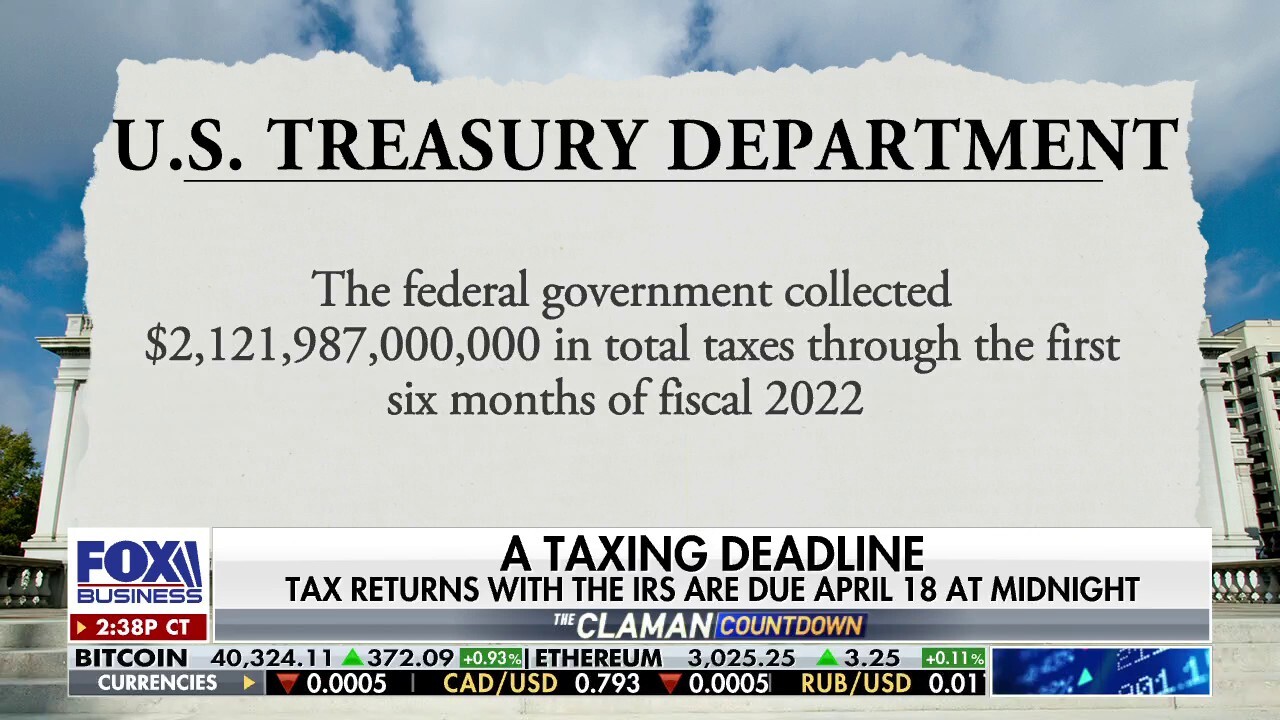

Federal tax collections set record through first half of 2022

Liberty Tax CEO Brent Turner discusses the government's record-breaking numbers on 'The Claman Countdown.'

EXCLUSIVE: Republican lawmakers are calling on the Internal Revenue Service (IRS) to provide explanation for why the agency destroyed 30 million paper-filed tax documents last year, raising concerns over the decision and demanding answers about the reasoning behind it.

In a letter sent Tuesday and exclusively shared with FOX Business, House Committee on Oversight and Reform Ranking Member James Comer, R-Ky., and Civil Rights and Civil Liberties Subcommittee Ranking Member Nancy Mace, R-S.C., questioned IRS Commissioner Charles Rettig, saying they were "troubled" over the findings of a recent audit of his agency by the Treasury Inspector General for Tax Administration (TIGTA) and that they are reviewing "allegations of potential misconduct" connected to it.

Internal Revenue Service (IRS) Commissioner Charles Rettig testifies before the House Ways and Means Oversight Subcommittee on March 17, 2022 (Photo by Kevin Dietsch/Getty Images / Getty Images)

The TIGTA report was released last month, and revealed that it was triggered "because the IRS’s continued inability to process backlogs of paper-filed tax returns contributed to management’s decision to destroy an estimated 30 million paper-filed information return documents in March 2021."

IRS WARNS OF ONGOING COVID-19 FRAUD, URGES AMERICANS TO BE WARY OF FAKE EMAILS AND PHONE CALLS

The information return documents included Forms W-2, 1099 and 1098, which are used by the IRS to verify taxpayers’ information such as income.

A man enters the Internal Revenue Service (IRS) building in Washington, D.C., U.S., on Friday, May 7, 2010. (Andrew Harrer/Bloomberg / Getty Images)

The IRS insisted at the time that "there were no negative taxpayer consequences as a result" of the document destruction because they were submitted to the agency by third-parties, and that taxpayers "have not been and will not be subject to penalties resulting from this action."

IRS CHIEF PUSHED CONGRESS FOR LAW CHANGE ON LAND-RIGHTS TAX DEALS

But Comer and Mace point to the TIGTA report's declaration that by destroying the documents, "the IRS will likely be missing many of the documents it requires to adequately screen for accuracy of returns, and may also end up lacking sufficient materials for tax audits."

Rep. James Comer, R-Ky. (Tom Williams/CQ Roll Call / Getty Images)

"Committee Republicans are concerned that the destruction of these documents might slowdown already inefficient processing procedures and hurt American taxpayers left unaware hat the IRS destroyed documents already entrusted into its care," they wrote, adding that "it appears that the IRS may now demand that taxpayers provide duplicate copies of information previously destroyed by the IRS."

The GOP lawmakers went on to say they "are skeptical that the IRS will follow through with TIGTA recommendations to alleviate these problems," given TIGTA's report noting that "IRS management did not take sufficient actions to address recommendations included in [TIGTA’s] prior review."

Rep. Nancy Mace, R-S.C. discusses the state of the economy on April 22, 2022 during "Cavuto: Coast to Coast." (Fox News)

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Comer and Mace requested that Rettig provide all documents and communications about the IRS’ destruction of documents, the legal authority the agency relied upon to destroy these documents, and the IRS’ plan to integrate the recommendations from the audit.

When contacted by FOX Business for reaction to the letter, an IRS spokesperson said the agency does not comment on congressional correspondence.

FOX Business' Fred Lucas contributed to this report.