Rent prices surge across the country, report finds: How to know if you should buy a home

Here's what to consider if you're deciding whether to rent or buy a home

Renters face a lot of challenges, from expensive security deposits to skyrocketing rent costs. But is buying a home worth it in the long term? Keep reading to determine whether you should rent or buy. (iStock)

The American housing market has been running hot since before the coronavirus pandemic, with home values skyrocketing as supply struggles to keep up with demand. But while buying a home may pose a challenge in today's hot housing market, renting isn't exactly a cost-effective alternative.

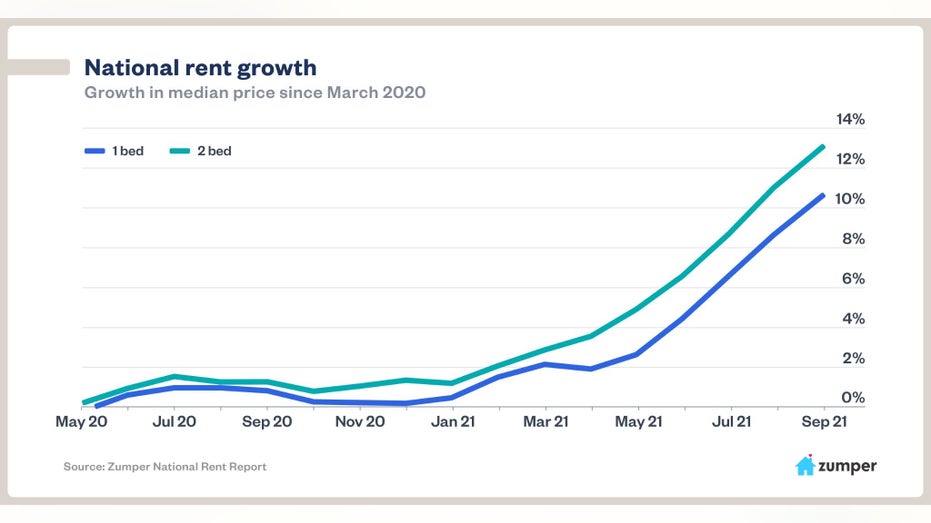

Between March 2020 and September 2021, rent prices have soared 10.7% for one-bedroom apartments and 13.1% for two-bedroom apartments, according to data from apartment rental website Zumper. The median one-bedroom rent is staggeringly high in some of the country's most populous cities:

- New York: $2,950

- San Francisco: $2,800

- Boston: $2,410

- Washington: $2,210

- San Jose, Calif: $2,200

- Los Angeles: $2,100

- San Diego: $2,100

- Oakland, Calif: $2,000

- Miami: $1,970

- Scottsdale, Ariz.: $1,850

Data shows that rental prices were stagnant in 2020, but the cost of rent at the national level is growing at an alarming rate in 2021.

With steep rent increases, some tenants may be considering buying a home instead of renting. Being a homeowner does come with its benefits: You lock in your monthly payment for a longer period of time, so you don't have to worry about your landlord jacking up your rent unexpectedly. Plus, much of your monthly housing payment will go back into the equity of your home, adding to your net worth.

But buying a home isn't the right move for all consumers, and it comes with its disadvantages. Keep reading to learn if you should rent or buy, and visit Credible to compare mortgage rates if you decide homeownership is the right path for you.

EVICTION MORATORIUM UPDATE: WARREN, PROGRESSIVES INTRODUCE BILL AIMED AT EXTENDING BAN

How to know if it's better to rent or buy a house

Well-intentioned friends or family may tell you that renting is "throwing away money," but that's not always the case. Depending on your financial situation and lifestyle, buying a house may not be an option.

With the right priorities and expectations, though, homeownership can be a reliable way to create long-lasting wealth while simply paying your living expenses and building equity.

Here are a few questions you should ask yourself when deciding whether to buy or rent.

HOMEOWNERS CAN GAIN NEARLY $200K WORTH OF VALUE BY RENOVATING, STUDY FINDS

What is the housing market like in your area?

The housing market in a large city will differ from one in a residential suburb or rural community. For example, it might not be practical to buy an apartment in a city where you can barely afford to pay rent. Or, it may not be feasible to buy a house in a booming market where inventory is limited.

It's all about how you wish to prioritize your lifestyle, too. Would you rather own a house an hour outside of the city or rent in the heart of the city? If you decide to buy in a large city, consider property taxes, HOA fees and historic housing prices.

AMERICA'S HOTTEST NEIGHBORHOODS ARE IN THE SUBURBS, REPORT FINDS

How much do you have saved up for a down payment?

Saving up for a mortgage down payment is one of the biggest challenges that first-time homebuyers face.

Prospective homeowners may be able to secure a home loan with much less than 20% down. A Federal Housing Administration (FHA) loan lets borrowers pay as little as 3.5% down, and some conventional mortgages require as little as 3% down for first-time homebuyers. But making a small down payment can cost you much more money in the long run.

Most mortgage lenders require you to pay private mortgage insurance (PMI) if your down payment is less than 20% of the purchase price. PMI can cost hundreds of dollars per month, and it doesn't get invested back into the value of your home.

Assuming a house costs $380,000 — that's the median listing price in August 2021, according to Realtor.com — you'd have to put $76,000 toward a down payment in order to avoid PMI. While many buyers would like to avoid paying PMI, your monthly mortgage payment plus PMI may still be competitive with average rent costs in your area.

If you're considering buying a home but want to learn more about mortgage down payments, get in touch with a knowledgeable loan officer at Credible who can guide you through the process.

35% OF MILLENNIALS SAY STUDENT LOAN DEBT IS PREVENTING THEM FROM BUYING A HOME

Do you have enough savings to cover repairs and other unexpected expenses?

Even if you've spent years saving up to buy a home, you shouldn't throw your entire savings into your down payment. Homeownership comes with many unexpected expenses and repairs, so it's imperative to have a robust emergency fund at the ready when you move into your new home.

This is one of the areas where renting can be more cost-effective. Your monthly rent covers the cost of necessary repairs and appliance upgrades that can cost thousands of dollars. But if you're a homeowner and your HVAC system calls it quits, you'll be on the hook for repair costs.

If the upfront cost of buying a home would drain your bank account, it may be necessary to continue saving up before becoming a homeowner.

AVERAGE MORTGAGE CLOSING COSTS TOP $6,000, STUDY FINDS: HERE'S HOW TO PAY

Estimate your monthly mortgage payments

Another way to decide if buying a home is right for you is to see how much a mortgage payment would compare to rent. You'll want to consider a few factors:

- How much do you plan on putting into a down payment?

- Will you be charged PMI? How much will that cost?

- What are property taxes like in your area?

- How long do you want your mortgage term to be?

- What kind of mortgage rates do you qualify for?

You can use Credible's mortgage calculator to estimate your monthly payments. Then, compare your different mortgage payment options with your current rent rate and the average rent in your area.

To get the most accurate monthly payment possible, get prequalified on Credible to see your estimated mortgage interest rate without impacting your credit score.

HOW HURRICANE SEASON CAN IMPACT YOUR HOMEOWNERS INSURANCE, ACCORDING TO AN EXPERT

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.