Credit card consolidation may save you thousands as personal loan rates are at record lows

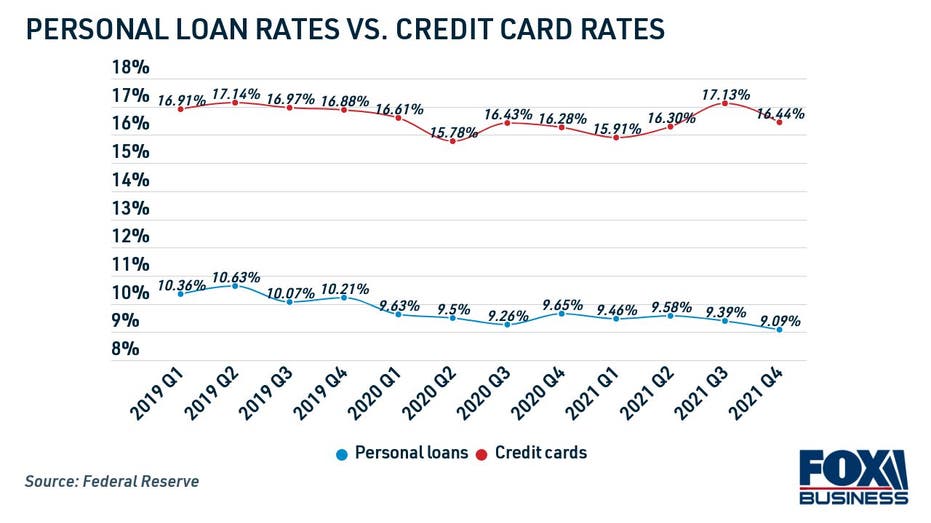

The average rate on a two-year personal loan is 9.09%, according to the Fed

Borrowers with a good credit score may be able to save thousands by consolidating credit card debt into a new loan. (iStock)

Making the minimum payments on high-interest credit card debt is an expensive way to pay off your balances. Credit card interest accrues daily, which adds to the total cost of debt repayment over time.

One common way to consolidate credit card debt is with a personal loan. This is a type of lump-sum, unsecured loan that you repay in fixed monthly installments at a lower interest rate. And since personal loan rates are lower than they've ever been, paying off credit card debt can save you more money than ever before.

In the fourth quarter of 2021, the average rate on a two-year personal loan set a new record low of 9.09%, according to the Federal Reserve. During the same period, the average credit card rate for accounts assessed interest was much higher, at 16.44%.

Keep reading to learn more about credit card consolidation, and visit Credible to compare personal loan rates for free without impacting your credit score.

MILLIONS OF AMERICANS FEAR MISSING DEBT PAYMENTS, NY FED REPORTS

Despite surging credit card debt, consolidation is cheaper than ever

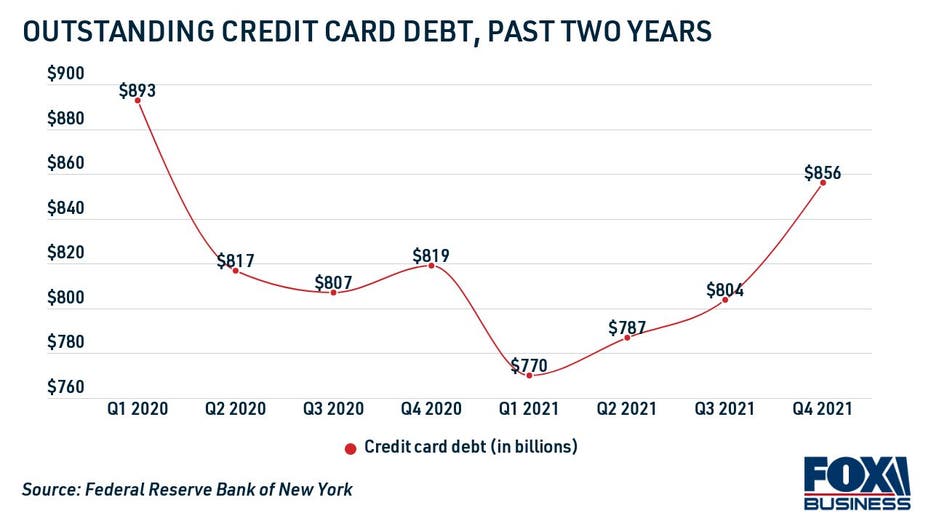

Americans are becoming increasingly reliant on credit cards as debt balances are skyrocketing, according to the Federal Reserve Bank of New York. The outstanding credit card debt grew 6.5% in the fourth quarter of 2021 as consumers added a record $52 billion to their balances.

At a time when credit card balances are soaring, it's more beneficial than ever to consolidate debt into a personal loan at a lower interest rate.

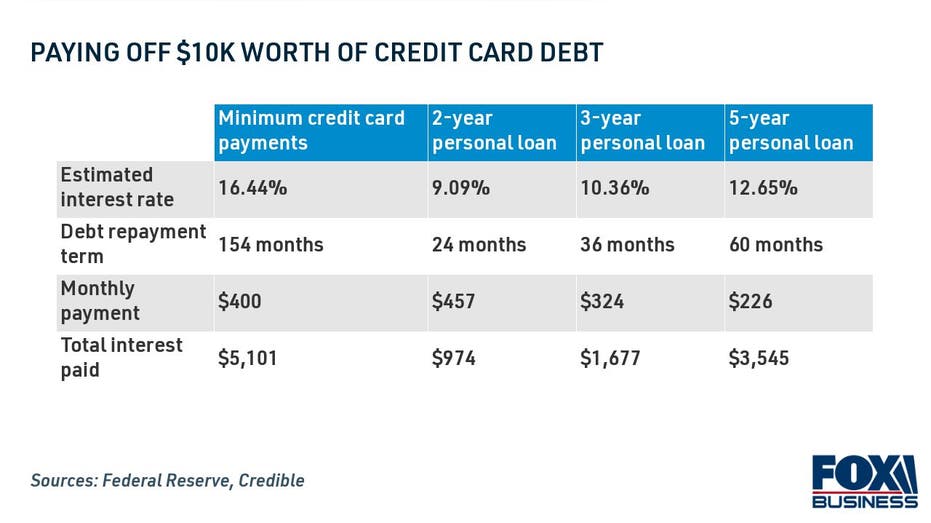

A recent analysis estimates that paying off $10,000 worth of credit card debt with a two-year personal loan at a 9.09% rate can save borrowers more than $4,000 in interest charges compared with just making the minimum credit card payments. By refinancing using this credit card repayment strategy, borrowers can pay off their balances 10 years faster by adding just $57 to their monthly payments.

It may also be possible save money over time and lower your monthly payments by consolidating to a longer-term personal loan. Keep in mind that longer personal loan terms typically result in higher rates, but you may still be able to get a lower, fixed interest rate than what you're currently paying on your credit cards.

The average fixed rate on a five-year personal loan was 12.65% for well-qualified applicants who borrowed a personal loan on Credible during the week of Jan. 31. Paying off $10,000 worth of credit card debt under those personal loan terms can potentially lower your monthly payments by $174 while still saving you more than $1,500 over the repayment period.

You can estimate your personal loan repayment terms for free on Credible, and see how much you can save by using a credit card consolidation loan calculator.

HOW TO GET A BALANCE TRANSFER CREDIT CARD

How to consolidate credit card debt with a personal loan in 5 steps

Using a personal loan for credit card debt consolidation may help you save money while paying off your debt in predictable monthly payments. Here's what the personal loan application process looks like:

- Add up all your credit card balances. This will help you determine the personal loan amount you need to borrow to repay your credit card debt. You can consolidate the balances of one or more credit cards into a single personal loan payment.

- Check your credit score. Since personal loans are unsecured and don't require collateral, lenders use your credit history to determine your risk and eligibility. Applicants with very good to excellent credit, defined as by the FICO model as a credit score of 740 or higher, will see the lowest personal loan rates.

- Shop for personal loan rates. Most lenders will let you see your loan terms, including estimated interest rates, with a soft credit check through a process called prequalification. You can compare personal loan rates across multiple lenders at once by using Credible.

- Choose the best personal loan. When comparing offers, you'll want to consider the interest rate, origination fee, loan amount and loan length. Once you've chosen a lender, you'll need to submit a formal application, which will require a hard credit inquiry.

- Use the loan to pay off your credit cards. If you're approved, you'll receive personal loan funding as soon as the next business day. It can typically be deposited right into your bank account. You can then use your personal loan balance to pay off your credit cards.

HOW TO CHECK YOUR CREDIT REPORT FOR FREE WITHOUT PENALTY

Although your credit card balances can be wiped to zero, it's important to avoid racking up more debt while you repay your personal loan. You should always prioritize paying your credit card debt in full each month to avoid paying interest.

You can learn more about debt consolidation loans from online lenders by visiting Credible. Plus, browse current personal loan interest rates in the table below to decide if this debt repayment method is right for your financial situation.

BALANCE TRANSFER CARDS WITH 0% APR INTRODUCTORY PERIODS ARE DISAPPEARING FAST

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.