91% of low-income families rely on child tax credit to cover basic expenses, study finds

The CTC expires at the end of the year, so consider your options for cash loans if you need money now

Millions of families have been receiving monthly CTC payments since the American Rescue Plan Act was passed earlier this year, and many have been relying on this money to pay for basic necessities, a new study found. (iStock)

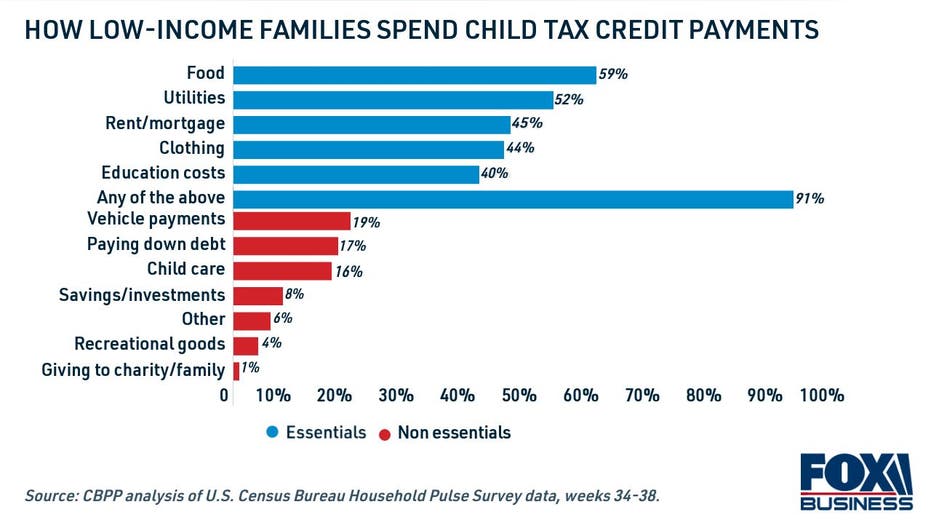

About 9 in 10 American families with incomes below $35,000 are using the monthly child tax credit payments (CTC) to cover basic household expenses like food, clothing, shelter, utilities and education, according to new research from the Center on Budget and Policy Priorities (CBPP).

Low-income families began receiving the CTC payments for the first time this year when President Joe Biden signed the American Rescue Plan into law. The White House estimates that a permanent and expanded CTC program could potentially cut child poverty in half.

Progressive Democrats have pushed to include a CTC expansion in Biden's trillion-dollar spending bill, but they're facing pushback from moderate lawmakers whose votes are necessary to pass the legislation. For example, Sen. Joe Manchin (D-W.Va.) wants to lower the income threshold for married couples, heads of household and single filers.

The future of CTC hangs in the balance while legislators work on whittling down the reconciliation bill. As it stands now, the monthly payments will stop at the end of 2021 unless an agreement is made.

Keep reading to learn more about monthly child tax credit payments, and consider your options for borrowing money if you rely on these credits. You can browse a range of financial products on Credible.

MILLIONS OF AMERICANS CUT OFF FROM UNEMPLOYMENT BENEFITS STILL WON'T RETURN TO WORK BY YEAR'S END

Who qualifies for the child tax credit?

The child tax credit program typically reduces the amount of federal income taxes you owe for each qualifying child in your household. But in 2021, the Internal Revenue Service (IRS) paid half the credit amount in advance monthly payments. As a result, millions of American families received regular monthly checks to help pay for basic expenses.

A qualifying child must be a dependent under the age of 17. This includes kids, adopted children, foster children, brothers, sisters, stepbrothers and stepsisters or a descendant of any of them — such as grandchildren, nieces or nephews.

The expanded child tax credit also increased the payment amount from $2,000 last year to $3,600 for children ages 5 and under and $3,000 for children ages 6 through 17 for the 2021 tax year. The total credit amount you receive may be lower depending on the number of children you have and your adjusted gross income (AGI).

If you filed taxes for the 2020 tax year, you should have been receiving direct deposit payments since July 2021. You can check the status of your advance payments by using the child tax credit update portal. This is where you can find the non-filer sign-up tool if you didn't file a tax return for 2020.

SHOULD YOU USE CORONAVIRUS STIMULUS CHECKS TO PAY OFF DEBT?

3 ways to borrow money if you need cash

As it stands right now, the expanded child credit applies to tax year 2021 only, which means the last payment would go out in December. If you've been relying on monthly CTC payments to pay for basic household expenses, it might be necessary to look at your borrowing options before the end of the year. Here are a few types of loans to consider:

Read more about each type of cash loan in the sections below.

MILLIONS WON'T GET FULL ECONOMIC IMPACT PAYMENT CHECKS

1. Personal loans

Personal loans are lump-sum loans that you repay in fixed monthly payments over a set period of months or years. They're typically unsecured, meaning you don't have to put up an asset you own as collateral. But because they're unsecured, lenders determine eligibility and set interest rates based on your credit history.

Well-qualified borrowers may qualify for a low rate on a personal loan, at least when compared with credit card interest rates. The average rate on a two-year personal loan was 9.39% in Aug 2021, according to the Federal Reserve, compared to 17.13% for credit card accounts assessed interest.

If you decide to borrow a personal loan, it's important to shop around to ensure you're getting the lowest possible interest rate for your situation. You can compare personal loan offers from multiple lenders at once on Credible. Checking your estimated rate is free, and it won't hurt your credit.

HOW YOUR TAX REFUND CAN IMPROVE YOUR CREDIT

2. 401(k) loans

You may be able to borrow from your own retirement savings in the form of a 401(k) loan. Since you're borrowing from yourself, you don't have to submit to a hard credit check — making this a good borrowing option for consumers with bad credit.

Interest rates are low, typically the prime rate plus 1%, and you're paying interest back into your own account. However, you're losing out on growing your retirement nest egg while you're repaying the loan. Plus, not all retirement plan providers offer this type of loan.

If you can't repay the loan, you may have to pay early withdrawal penalties and taxes on the amount you borrowed. Still, this can be a good option if you feel confident in your ability to repay the loan.

BIDEN CRITICIZES REPUBLICANS FOR 'DANGEROUS' DEBT CEILING INACTION, WARNS OF INTEREST RATE HIKES

3. Cash-out refinancing

With home values at an all-time high, you could be sitting on a pile of cash that's tied up in your mortgage. But with cash-out mortgage refinancing, you may be able to access the cash value of your home at a low interest rate.

Cash-out mortgage refi is when you take out a new mortgage that's larger than your home loan, pocketing the difference in cash that you can use as you see fit. Essentially, it's a way to tap into your home equity without taking out a second mortgage. Here's what you should know:

- Mortgage rates are still low. This means you may be able to lock in a lower rate on your new home loan.

- Your monthly payments may increase. When you take out a larger loan, you're likely to pay more each month and more money in interest over time.

- You'll pay closing costs. These are typically 2-5% of the total loan amount. Plus, your home will have to appraise for the new mortgage amount you want.

Learn more about cash-out mortgage refinancing and begin the process on Credible. You can compare mortgage refi rates that are tailored to you, all without impacting your credit score.

DEM SENATORS URGE BIDEN TO EXPAND MEDICARE IN AMERICAN FAMILIES PLAN

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.