How Warren Buffett's 'mistake,' Berkshire Hathaway, became the foundation of his career

Buffett bought Berkshire Hathaway stock in 1962, but later called it 'a monumentally stupid decision'

Get all the latest news on coronavirus and more delivered daily to your inbox. Sign up here.

In the 1960s, Warren Buffett made what he would later call "a monumentally stupid decision."

However, it was also the foundation of the rest of his career.

Buffett, now 89, known as the "Oracle of Omaha," is the CEO of Berkshire Hathaway. He is considered one of the most successful investors of all time and is estimated to be worth $72 billion, according to Forbes.

But in 1962, Berkshire Hathaway was a failing textile company with cheap stock and Buffett was running a small investing entity called Buffett Partnership Ltd.

In 2010, Buffett told CNBC that Berkshire Hathaway was "the dumbest stock I ever bought."

BUFFETT'S BERKSHIRE HATHAWAY REPORTS NEARLY $50B LOSS AS INVESTMENTS DROP

"It was a huge company originally, and they kept closing one mill after another," Buffett told the business channel. "And every time they would close a mill, they would — take the proceeds and they would buy in their stock. And I figured they were gonna close, they only had a few mills left, but that they would close another one. I'd buy the stock. I'd tender it to them and make a small profit."

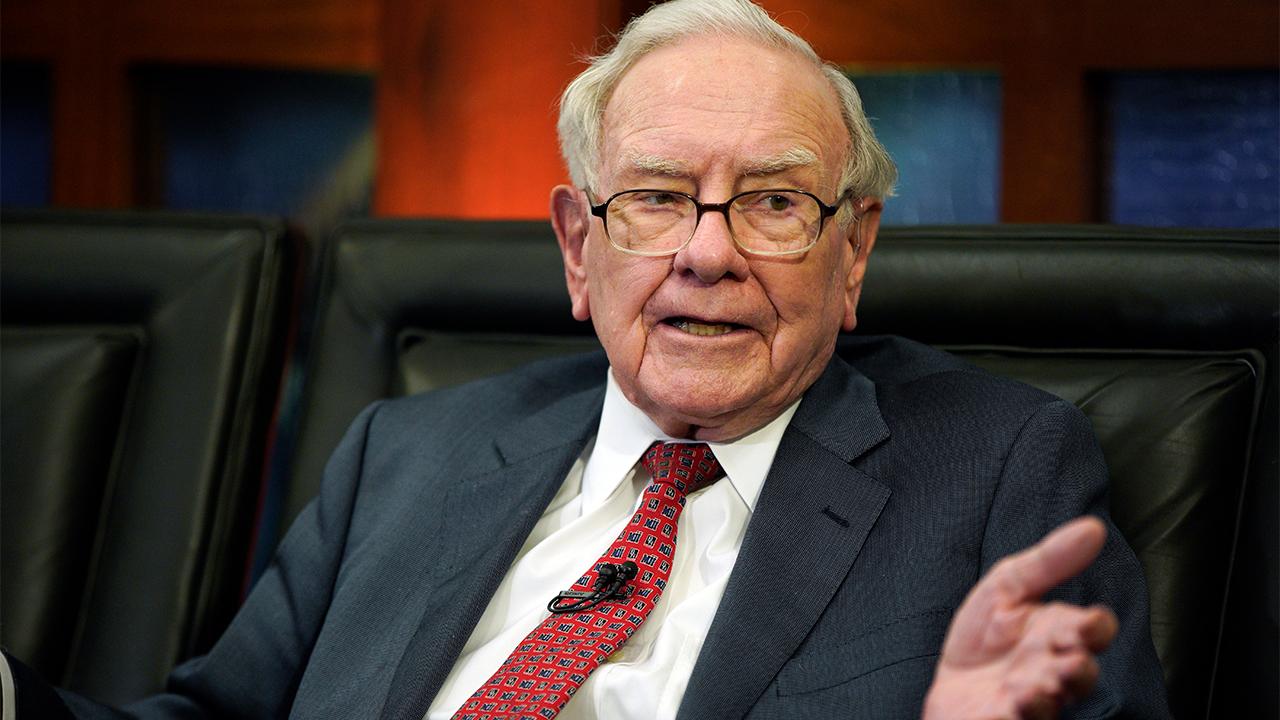

Berkshire Hathaway Chairman and CEO Warren Buffett is pictured in 2017. (AP Photo/Nati Harnik)

By 1964, Buffett had about 7 percent of the company's shares. He went to Seabury Stanton, who ran Berkshire Hathaway at the time, and told him that he would sell his stock back for $11.50.

But when Buffett received a letter from Stanton on May 6, 1964, the company was asking for $11.375 per share instead.

HOW JP MORGAN'S JAMIE DIMON WENT FROM BEING FIRED TO BECOMING A TOP LEADER IN BANKING

"Irritated by Stanton's chiseling, I ignored his offer and began to aggressively buy more Berkshire shares," Buffett wrote in a 2014 letter to Berkshire Hathaway shareholders.

He wrote that it was "a monumentally stupid decision."

By early May 1965, Buffett Partnership took over the company, according to the letter.

"Though Seabury's and my childish behavior -- after all, what was an eighth of a point to either of us? -- he lost his job, and I found myself with more than 25 percent of BPL's capital invested in a terrible business about which I knew very little," Buffett wrote.

BERKSHIRE HATHAWAY ANNUAL MEETING 2020: 5 THINGS TO KNOW

In 1967, Berkshire Hathaway bought an insurance company but continued to work in textiles as well, despite the fact that it "was earning nothing, year after year after year after year," he told CNBC.

In fact, Buffett kept the textile assets running for the next twenty years, despite the losses, all the while continuing to acquire companies in other industries under the Berkshire Hathaway umbrella.

Buffet is pictured in 2017. (Photo by Paul Morigi/WireImage)

However, he told CNBC that the first insurance company Berkshire acquired should actually have been bought "for a new entity."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"[If] instead of putting that money into the textile business originally, we just started out with the insurance company, Berkshire would be worth twice as much as it is now," he told the channel.

Ultimately, Buffett said the lesson he learned in the process was: "If you get in a lousy business, get out of it."

"I've always said that if you want to be known as a good manager, buy a good business," he added. "That's the way to do it. And everyone will think you're smart."

CLICK HERE TO READ MORE ON FOX BUSINESS

Despite the early losses, Buffett has brought Berkshire Hathaway a long way.

Today, the conglomerate owns more than 90 companies including GEICO, Dairy Queen, Fruit of the Loom and Duracell and has major investments in companies including Apple, American Express, Coca-Cola and Bank of America.

Berkshire Hathaway is also sitting on a pile of more than $137 billion in cash because Buffett has struggled to find major acquisitions for the company recently.

The Winning Formula tells the stories of business leaders who have overcome challenges — every Sunday on FOX Business.

The Associated Press contributed to this report.