US July retail sales rose 1.2%

Absence of additional coronavirus relief expected to also undermine consumer spending

U.S. households boosted retail spending 1.2% in July, the third straight monthly increase despite a rise in coronavirus infections, the Commerce Department reported Friday.

Retail sales—covering spending at service stations, restaurants, stores, and online—grew briskly in May and June.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Meanwhile, fresher data suggest retail spending softened this month. One factor: the July 31 expiration of an enhanced unemployment benefit. That benefit—authorized in the Cares Act passed by Congress in March—had boosted jobless Americans’ weekly income by $600 a week. Amid congressional deadlock over a new stimulus plan, President Trump has acted to replace the payments with a $300-a-week benefit, but it isn’t expected to reach workers for weeks.

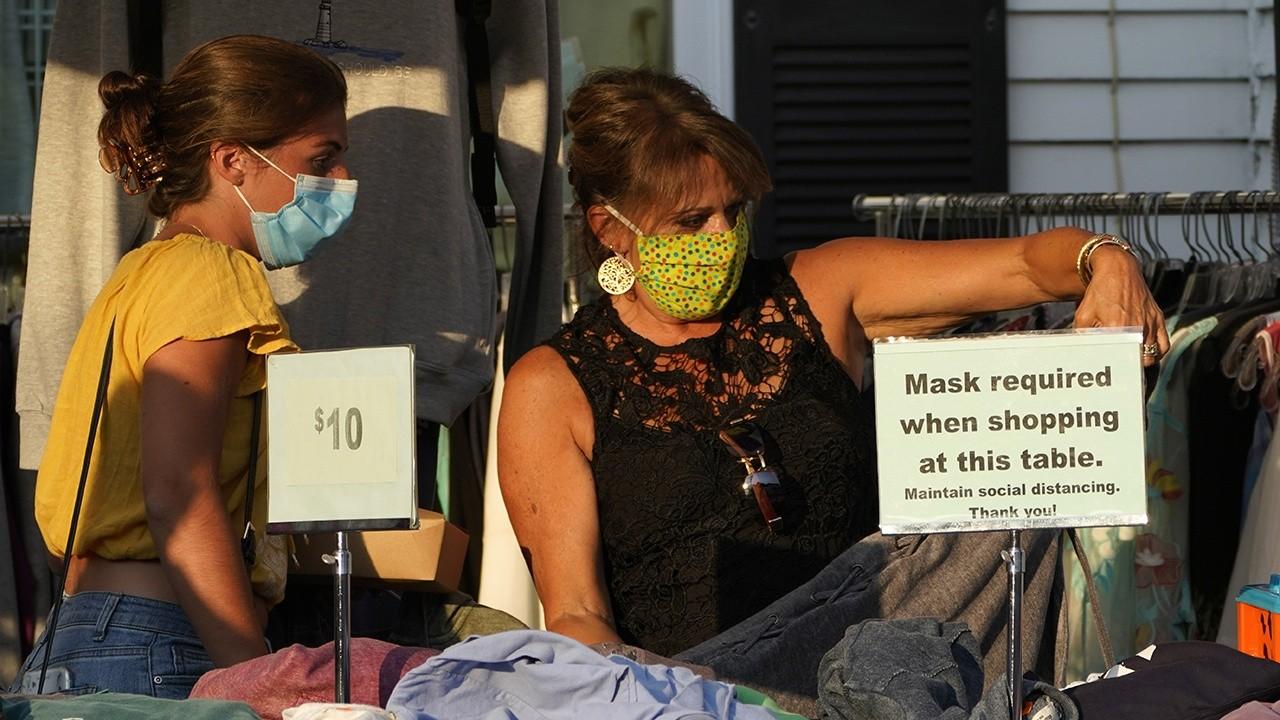

On top of that, a rise in coronavirus infections in several big states earlier this summer prompted a new round of restrictions on businesses and spooked many consumers back into their homes. The prospect of schools moving teaching online this fall may also undermine back-to-school spending.

RETAILERS LIKE NORDSTROM HIRING INFLUENCERS TO BOOST IN-STORE FOOT TRAFFIC, PROMOTE SAFE SHOPPING

The upshot: Consumer spending and the economy in general are on a bit of a roller coaster as they recover from a historically severe contraction. The economy has added millions of jobs in the past three months, including 1.8 million in July. Initial jobless claims, a proxy for layoffs, fell below 1 million last week for the first time since March. But the economy still has nearly 13 million fewer jobs than in February, and the unemployment rate remains high, at 10.2% in July.

In the world’s largest economy, consumers are paramount—their spending reflects more than two-thirds of economic demand. Retail spending, which excludes costs like utilities and rent, represents a big chunk of all consumer spending.

Expectations of a third-quarter rebound in U.S. gross domestic product hinge largely on Americans’ willingness and ability to shop.

DISCOUNT DEPARTMENT STORE STEIN MART FILES FOR BANKRUPTCY, MAY CLOSE ALL 281 STORES

“Many households are now being more cautious now that enhanced unemployment benefits have dried up,” said Neil Saunders, a retail analyst for the research firm GlobalData.

Only 36% of consumers tracked by GlobalData spent more or the same amount on retail purchases during the first week of August as they did the same week a year ago. That is down from 57% who did so during the last week of June.

Foot traffic to retail stores declined six weeks ago, coinciding with the receipt of the last batch of stimulus checks, a separate part of the pandemic relief unrelated to the added unemployment benefits, according to Aneta Markowska, the chief financial economist at Jefferies Group LLC, which parses data from location-tracking company SafeGraph Inc. Since then, foot traffic has remained fairly steady, despite the end of the additional unemployment benefits.

EGG PRODUCER GOUGED PRICES WHEN PANDEMIC HIT, LAWSUIT SAYS

Shawn Hall spent her $1,200 stimulus check as soon as she received it in April on bills and rent. Since the pandemic started, the 48-year-old Charlotte, N.C., resident has been earning less as a self-employed education consultant, and she is hoping Congress passes another round of stimulus spending to help her make ends meet. Meanwhile, she has cut back on dining out and Starbucks lattes, opting to make coffee at home.

The $600 weekly unemployment benefit expired July 31. That had funneled $250 billion to families this spring, according to a Wall Street Journal analysis. Last week, President Trump announced a series of executive actions that, among other things, would continue to provide an enhanced jobless benefit to Americans.

Even with that action, Ms. Markowska expects spending to decline in August since it could take weeks to get the checks out. “Even though the payments will be retroactive, it will be too late to salvage August,” she said.

Consumer spending has held up. One big factor is that aggregate household income has actually grown since the pandemic began in March, boosted by federal stimulus checks of up to $1,200 for individuals and the enhanced unemployment benefit.

CLICK HERE TO READ MORE ON FOX BUSINESS

Many households have used that money to pay bills and build up savings, with the personal savings rate soaring. As the pandemic-related shutdowns have extended for months, consumers have started to spend some of their money, particularly on big-ticket items and projects like refurbishing their homes.

Business has been steady for Joff Masukawa, a self-employed life-sciences consultant in his 50s from Washington, D.C. He bought a 1950s ranch-style house in Flat Rock, N.C., in May so that his mother could move out of a senior-living community. He is renovating the house and in July bought a refrigerator, stove, dishwasher and microwave.

Mr. Masukawa said he is still spending a bit less than he was before the pandemic. “What I’m not buying are clothes,” he said. “I’m not buying anything going out to eat. I’m not going to bars. The only entertainment we spend money on is really cable-internet service and then the various streaming things.”

He also suspended his gym membership and, for exercise, recently bought the Mirror, a product that displays an exercise routine.

Write to Josh Mitchell at joshua.mitchell@wsj.com and Suzanne Kapner at Suzanne.Kapner@wsj.com