Senate Republican to propose 'inflation relief' in new bill targeting tax credits

Grassley bill would adjust phase-out thresholds for key tax benefits

Economist warns 'widespread' inflation growing throughout all parts of economy

Former Treasury Department economist David Beckworth analyzes the pace of inflation and the risk of global recession on 'Varney & Co.'

EXCLUSIVE: A top Senate Republican plans to introduce legislation Thursday that is designed to provide targeted relief to lower- and middle-income Americans who are struggling financially due to rising consumer prices by indexing certain tax benefits to inflation.

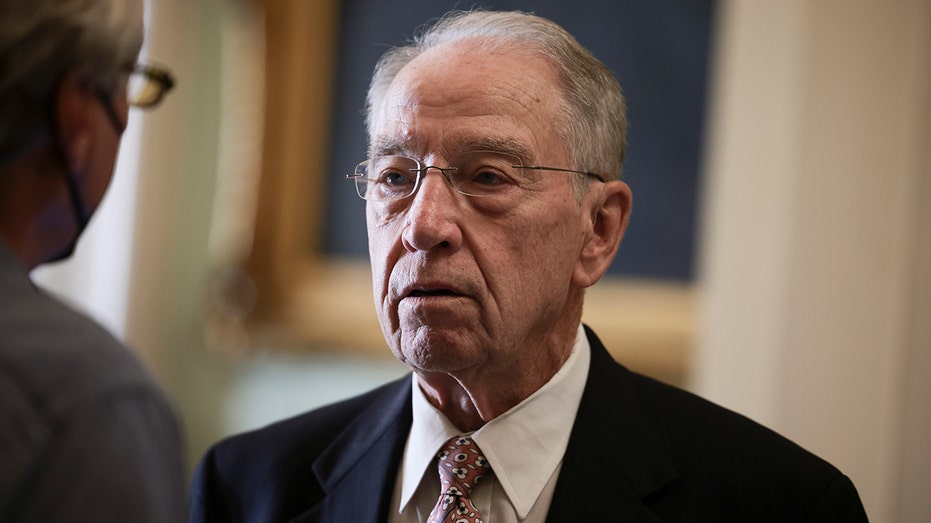

Sen. Chuck Grassley, R-Iowa, is set to unveil the "Family and Community Inflation Relief Act," which would adjust the phase-out thresholds or deductible amounts for several tax credits and other benefits for families and students.

The proposal – a copy of which was first shared with FOX Business – comes just one week after new June inflation data from the Labor Department showed consumer prices soared 9.1% from the previous year, the fastest year-over-year jump since 1981.

Although the IRS adjusts the federal income taxes for inflation, that is not the case for many of the government's low-income assistance programs – including the child tax credit, an income-based program that provides up to $2,000 per child for millions of families with children under the age of 17. Under current law, the payments go to individuals earning less than $75,000 and married couples earning less than $150,000.

WHY IS INFLATION STILL SO HIGH, AND WHEN WILL IT START TO COOL?

Sen. Chuck Grassley (R-IA) speaks with reporters before a vote at the U.S. Capitol Building before a Senate Luncheons on October 19, 2021 in Washington, D.C. (Anna Moneymaker/Getty Images / Getty Images)

Grassley's bill would adjust those income cut-off levels, as well as the annual payment of $2,000, by indexing them for inflation to ensure the credit is not eroded by the hottest inflation in four decades. The proposal also includes the non-child dependent credit, which provides up to $500 for other dependents, such as elderly parents.

"Indexing useful tax credits to inflation – like the child tax credit and the lifetime learning credit – will help parents and students keep up with rising costs," Grassley said. "While President Biden has failed to produce any meaningful solutions to the economic crisis he created, I’ll continue working on common sense policies that will help Americans weather this soaring inflation."

These are the other tax programs covered by the bill:

- Child and dependent care credit: Grassley wants to index for inflation the maximum child-care expenses used to calculate the credit amount as well as the income phase-out thresholds. The credit provides families with two children up to $2,100.

- American Opportunity tax credit: The legislation would index for inflation the eligible tuition expenses used for determining the credit amount. It also indexes the income phase-out thresholds to inflation. College students can qualify for up to $2,500 in tax credits.

- Lifetime learning credit: The $2,000 credit would essentially be indexed to inflation because the proposal would increase the eligible tuition expenses used for determining qualifications. The phase-out thresholds would also go up under the measure.

- Student loan interest deduction: The bill indexes for inflation the maximum amount of student loan interest that may be deducted in one year, which is currently $2,500. The phase-out thresholds would also be adjusted accordingly.

- Charitable mileage deduction: The Iowa Republican hopes to give the IRS the authority to adjust the mileage deduction rate for volunteers and charitable organizations based on economic conditions. The tax-collecting agency currently has the power to do so for medical, moving and business expenses, depending on the current economic climate.

Grassley has proposed paying for the changes proposed in his bill by extending the $10,000 cap on the state and local tax deduction that was imposed by Republicans in the 2017 tax overhaul. The current SALT deduction limit is poised to expire in 2025.

U.S. President Joe Biden speaks about inflation and the economy in the South Court Auditorium on the White House campus May 10, 2022 in Washington, DC. (Getty Images / Getty Images)

Scorching-hot inflation has created severe financial pressures for most U.S. households, which are forced to pay more for everyday necessities like food, gasoline and rent. The burden is disproportionately borne by low-income Americans, whose already-stretched paychecks are heavily impacted by price fluctuations.

Rising prices and the rapid dissolution of Americans' buying power have become a major political liability for Biden ahead of the November midterm elections, in which Democrats are expected to lose their razor-thin majorities. Surveys show that Americans see inflation as the biggest problem facing the country – and that many households blame Biden for the price spike.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The president has blamed higher prices on greedy corporations, supply chain bottlenecks and other pandemic-induced disruptions in the economy, as well as the Russian war in Ukraine. Most economists now agree that unprecedented levels of government stimulus and a stronger-than-expected recovery from the pandemic have also played at least some role in exacerbating the price spike.