Inflation causing hardship for nearly half of US households, survey shows

Soaring consumer prices disproportionately hurting low-income households

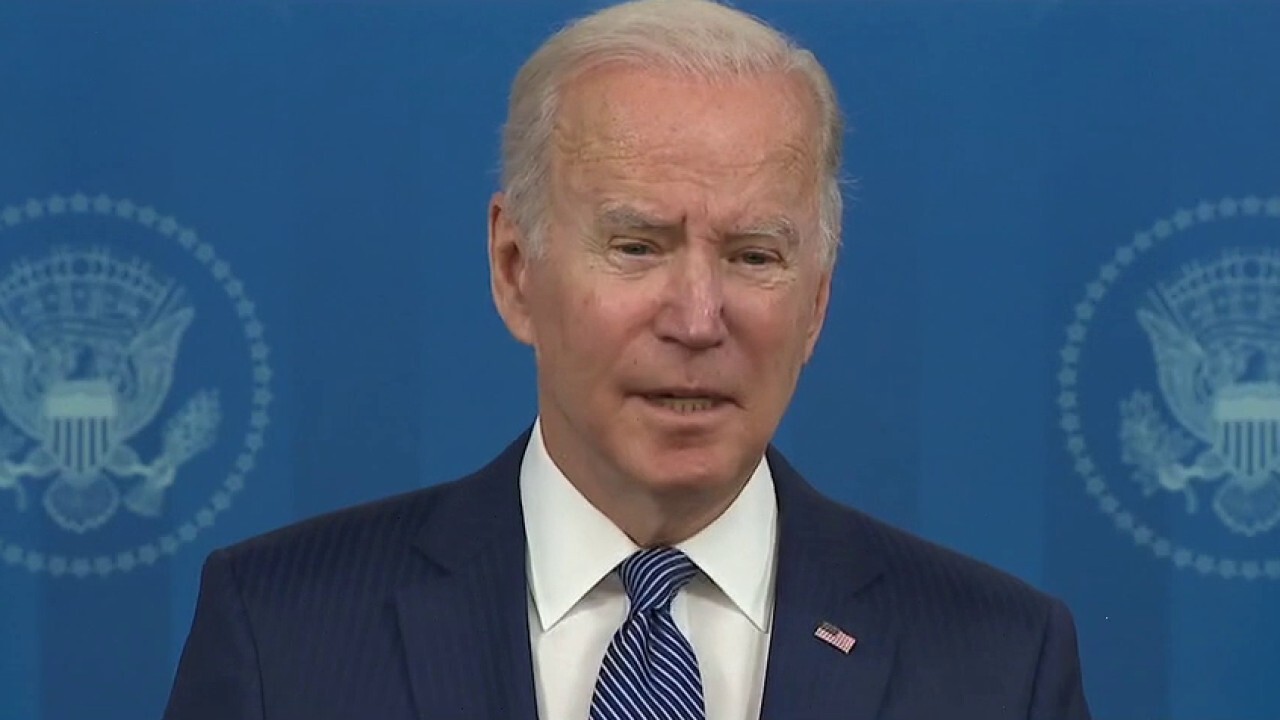

Biden pushes success of economic plans as inflation plagues country

New York Republican Lee Zeldin weighs in on the president's economic agenda and Democrats' spending plans on 'The Evening Edit'

Soaring inflation is inflicting financial pain on nearly half of U.S. households as prices for everyday necessities like food and gasoline continue to surge, according to a Gallup survey published on Thursday.

About 45% of households are being hurt by the recent price spike, according to the survey of nearly 1,600 people conducted between Nov. 3 and Nov. 16. Roughly 10% said the increase had affected their standard of living, while another 35% described the hardship as "moderate."

CBO: BIDEN SPENDING BILL ADDS $367B TO DEFICIT, NOT COUNTING IRS TAX ENFORCEMENT

The effect is more pronounced among lower-income families: 71% of those making less than $40,000 a year say they experienced hardship, compared with 29% of those earning more than $100,000 a year. What's more, 28% of Americans who are considered lower-income said the hardship they are experiencing is severe and hindering their ability to maintain their current standard of living.

A man fuels a car at a gas station in New York, on Oct. 13, 2021. (Xinhua via Getty Images / Getty Images)

Inflation has accelerated in recent months, rising 6.2% in October compared with a year earlier. So-called core prices, which exclude the more volatile measurements of energy and food, rose 4.6% over the past year. Both are the largest increases since 1990.

It's unclear when consumers can expect to see inflation begin to slow, with prices for an array of goods continuously climbing higher: Gasoline skyrocketed by nearly 50% in the year to October, meat was up 14.5% and rent increased by 3.5%.

Rising inflation is eating away at strong gains and wages and salaries that American workers have seen in recent months (average hourly wages in the U.S. actually fell 1.2% last month compared with October 2020 when accounting for inflation).

Federal Reserve Chairman Jerome Powell has repeatedly maintained that inflation is "transitory" and blamed disrupted supply chains, pent-up consumer demand and stimulus cash for the run of higher prices. But he's backed away from that assertion in recent days, telling lawmakers during Capitol Hill testimony that it's "probably a good time to retire" the word "transitory."

WASHINGTON, DC - NOVEMBER 29: U.S. President Joe Biden delivers remarks at the start of a hybrid virtual roundtable with CEOs and leaders of retail, consumer products firms, and grocery store chains in the Eisenhower Executive Office Building on Nove (Photo by Anna Moneymaker/Getty Images / Getty Images)

"The word ‘transitory’ has different meanings to different people," he said on Tuesday. "We tend to use it to mean that it won’t leave a permanent mark in the form of higher inflation."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

In hopes of addressing the supply-chain bottlenecks that economists say are to blame for higher-than-expected inflation, the Biden administration has announced plans to clear up backlogs at some of the nation's biggest ports, including establishing around-the-clock operations at the Port of Los Angeles and the Port of Long Beach.

The president has also spoken with the CEOs of Walmart, Target, UPS and FedEx about how to relieve supply-chain challenges as ships wait to dock at some of the biggest ports.

But Republicans have blamed Biden team policies for the spike in consumer prices, pointing to a massive $1.9 trillion stimulus package that Democrats passed in March along with another $2 trillion spending plan the party is hoping to pass by the end of the year.