Central banks can’t tackle inflation without more sensible fiscal policy, new study argues

A new study presented at the Jackson Hole Economic Symposium argues that governments most enact sensible fiscal policies to help central banks tackle inflation

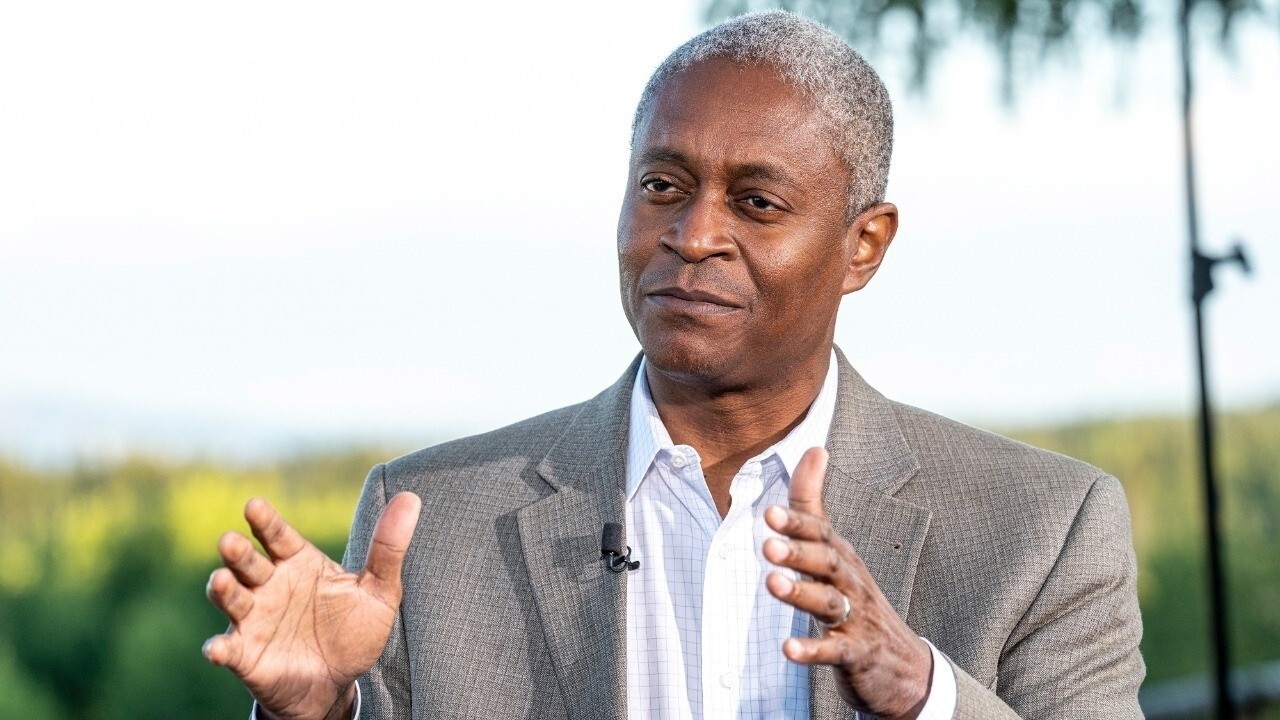

Atlanta Fed president outlines when inflation could start to cool

FOX Business sits down with Atlanta Fed President Raphael Bostic.

A new study argues that central banks will fail to temper inflation and possibly push price growth even higher unless governments implement more sensible budget policies.

The study was presented to policymakers gathered Saturday at the Kansas City Federal Reserve’s Jackson Hole Economic Symposium.

Jerome Powell, chairman of the U.S. Federal Reserve, leaves the reception dinner at the Jackson Hole economic symposium in Moran, Wyoming, US, on Thursday, Aug. 25, 2022. (David Paul Morris/Bloomberg via Getty Images / Getty Images)

Francesco Bianchi of Johns Hopkins University and Leonardo Melosi of the Chicago Fed argued that if monetary tightening was not supported by appropriate fiscal adjustments, then "the deterioration of fiscal imbalances (will lead) to even higher inflationary pressure."

"As a result, a vicious circle of rising nominal interest rates, rising inflation, economic stagnation, and increasing debt would arise," the paper argued. "In this pathological situation, monetary tightening would actually spur higher inflation and would spark a pernicious fiscal stagflation."

WORLD BANK PRESIDENT ON FED'S INFLATION FIGHT: CENTRAL BANKS HAVE MORE TOOLS THAN RATE HIKES

The study concluded that U.S. fiscal policy was one of the factors behind the recent surge in U.S. inflation and that even if central banks had raised interest rates earlier, it likely wouldn’t have made much of a difference.

"More hawkish (Fed) policy would have lowered inflation by only one percentage point at the cost of reducing output by around 3.4 percentage points," the authors said. "This is quite a large sacrifice ratio."

The central bank, as it is doing now, raises its benchmark short-term rate when it wants to lower inflation, and reduces it when it wants to accelerate hiring. Such moves, in turn, affect borrowing costs throughout the economy — for mortgages, auto loans and business loans, among others.

CLICK HERE TO GET THE FOX BUSINESS APP

On Friday, in his speech to the Jackson Hole symposium, Chair Jerome Powell stressed that the Fed plans further rate hikes and expects to keep its benchmark rate high until the worst inflation bout in four decades eases considerably — even if doing so causes job losses and financial pain for households and businesses.

The Associated Press contributed to this report.