EXCLUSIVE: After Stephen Moore's failed Fed bid, he's creating a crypto central bank

Economist Stephen Moore, who recently lost out on a bid to join the board of the Federal Reserve, is now looking to start his own mini-Fed through the creation of a cryptocurrency product that is billing itself as “the world’s decentralized central bank,” FOX Business Network has learned.

Moore has joined a group of entrepreneurs who are starting what they describe as a new type of central bank they believe will stabilize cryptocurrencies like bitcoin and its myriad of imitators, according to an investor pitch deck obtained by FOX Business and interviews with people associated with the effort.

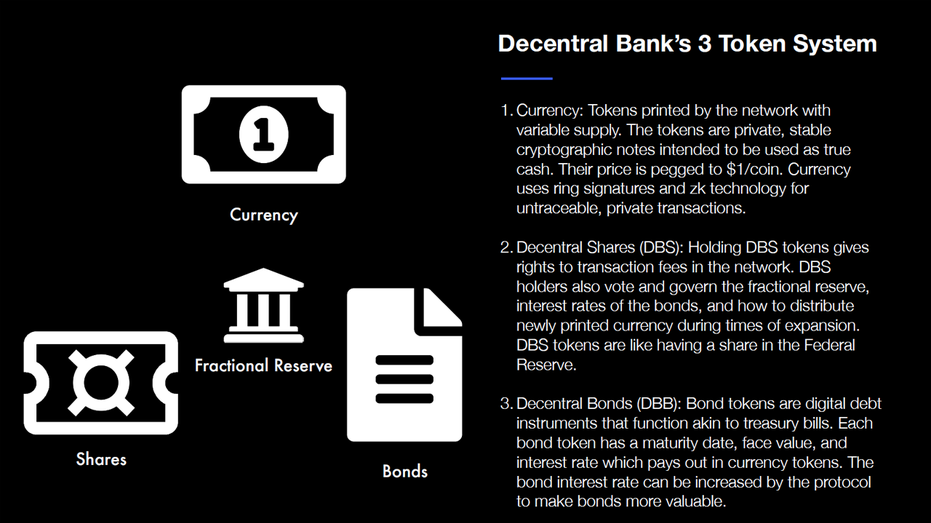

“Decentral,” as it is known, will attempt to perform Fed like duties in terms of regulating the supply of crypto in the same way as the Fed controls the supply of money for the U.S. economy, they contend. It will exchange its own new token for other cryptos; the supply of the new cryptocurrency will be tied to the value of the dollar or some other “stable” valuation method and will be strictly controlled by an algorithm, company officials tell FOX Business.

Moore’s role is somewhat unclear. For now he is the group’s chief economic officer and will report to tech entrepreneur Sam Kazemian, Decentral’s chief executive officer. In a brief interview, Moore described the Decentral crypto as something similar to what social media powerhouse Facebook is planning with its new Libra token—namely a payment method that is also pegged to a stable currency and could offer uniformity and reliability in the crypto world that is currently fractured among various different currencies.

“I’m really excited about doing this,” Moore said. “I hope it makes me rich.”

Given that crypto is viewed by many at the Federal Reserve as an attempt to usurp the Fed’s hold on monetary policy and Moore’s near appointment to it board, his decision to join Decentral has surprised some people who received pitches to invest in the product. The Fed’s power stems from its ability to control the money supply, so many traditional economists see crypto as an attempt to undermine the central bank’s authority.

Moore said he will officially join Decentral on July 1 and his move comes amid a broader and even more contentious debate over whether cryptocurrencies are a fad or will someday transition into a credible form of money. Economists like Nouriel Roubini have called crypto “the mother and father of all bubbles” in a recent debate with crypto supporter Mike Novogratz, who called the creation of Bitcoin “a small miracle.”

Novogratz is an investor in Decentral’s parent company, company executives told FOX Business. Novogratz didn’t return a request for comment.

Bitcoin, the most popular and first crypto, has fluctuated wildly in price since its inception in 2009. In the past two years, for instance, its price has risen as high of $19,783 and has dropped below $3,000, based on investor’s shifting sentiments. More recently bitcoin has been increasing in value, trading at around $11,000.

Moore, for his part, doesn’t see his involvement with Decentral as a conflict with his work as an economist or even his bid to join the Fed board. He also said that he believes there is a role for cyptocurrencies in the economy in which they don’t conflict with Fed policy. “These guys are super smart,” he said of his partners, adding: “This is an alternative way of making payments.”

Others are more skeptical of Decentral’s grand plans and cryptos in general. One money manager with knowledge of the product said company officials approached him on an investment but they didn’t seem to have a firm grasp on exactly how Decentral will be able to convince the crypto world of its mission: That business needs a central clearinghouse and uniformity to survive as a viable payment option for consumers.

Crypto entrepreneurs are incredibly anti-establishment; the whole business of cryptocurrency was created as an alternative to the Fed’s role in regulating the U.S. economy, particularly after the 2008 financial crisis when the Fed greatly expanded the money supply and, some would say, risked debasing the dollar.

Even the supply of Bitcoin doesn’t lend itself to the type of commodization Decentral is seeking. It’s supply is based on so-called "mining," where programmers use computers to solve complex math problems and as a reward receive additional bitcoins that are circulated through a blockchain payment system.

Independent analyst Chris Whalen said he isn’t surprised that Moore would join a crypto-currency outfit because as a writer and commentator on economic issues, “Moore has never liked central banks… He wouldn’t have been a traditional governor, so I think by joining a cryptocurrency outfit, he’s being more true to himself than serving on the Fed Board.”

Still, Whalen—a skeptic of cryptocurrencies—is disappointed by the move. “I’m saddened Steve Moore would waste his time on such a thing,” Whalen said. “We keep seeing all the currencies springing up but none of them have any real credibility. Moore is trying to cash in on the gold run like everyone else.”

Kazemian, Decentral’s CEO, believes cryptocurrencies are here to stay. He told FOX Business that Decentral isn’t trying to compete with the Fed. In fact, he said, he plans to introduce the concept to Fed officials at some point. “Decentral will solve the biggest problem facing regulators when it comes to the crypto space: The current instability of pricing."

Decentral, he added, “will allow more and better price discovery without wild swings in value that have been the case."

“Our goal is to be collaborative, not combative,” Kazemian said. “The next big wave in the crypto space is a digital currency that is designed to be useful to consumers and keep stable prices instead of acting as volatile, speculative investments. Stable coins are the next big innovation in the crypto industry.”

In fact, both Kazemian and Moore praised Facebook’s efforts in creating Libra, which is also pegged to the dollar. “We’re doing what Facebook is doing by making a great payment method,” Moore said.

In addition to Kazemian and Moore, the other partners of Decentral include chief technology officer Kedar Iyer, Director of software Travis Moore, and chief operating officer Henry Liu—all of whom have backgrounds in crypto and technology startups. The remaining three partners have political backgrounds. Moore, of course, worked as an editorial writer and policy wonk at the conservative Heritage Foundation, as well as advising President Trump on his tax cut plan (his title is now Distinguished Visiting Fellow).

Ralph Benko, the general counsel of Decentral, was deputy general counsel in the Reagan White House, while the chief marketing officer, Michael Gruen, was an adviser to the 2016 Trump campaign. Gruen’s other job experience: Working as an NBA agent and founding an influencer marketing agency.

Moore’s involvement in Decentral began at the recent SALT conference, a hedge fund and investing confab in early May run by Anthony Scaramucci of SkyBridge Capital. Moore was a speaker at the conference just around the time he pulled his name from consideration as Trump’s choice to join the Fed board. Moore made the announcement amid controversy over his past writings, and disclosure that he owed hundreds of thousands to the IRS and had at one point owed his ex-wife around $300,000 for alimony and child support.

CLICK HERE TO GET THE FOX BUSINESS APP

When Moore withdrew his name from consideration, he stated: “The unrelenting attacks on my character have been untenable for me and my family.”

But the conference, which was heavy on all things crypto, allowed Moore to meet Kazemian and other Decentral officials, and the partnership was formed. “We were amazed with Steve’s knowledge of the Fed and offered him a chance to come on board,” Gruen said.