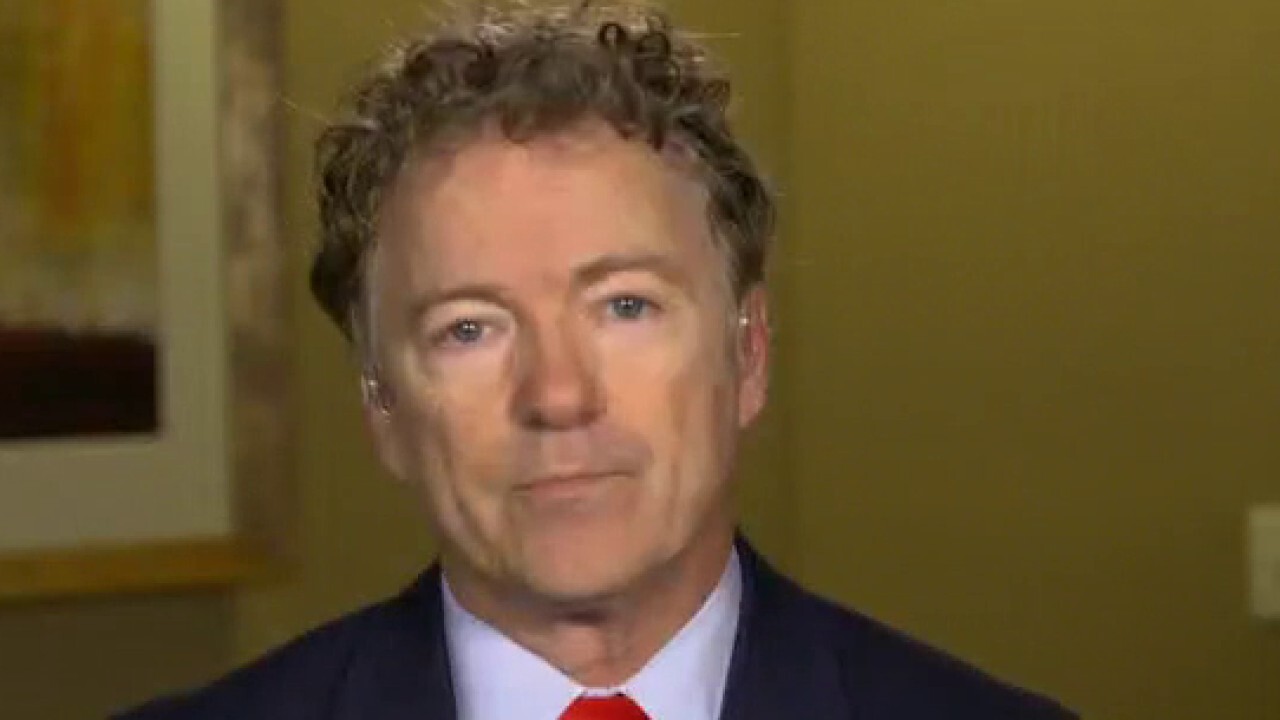

Sen. Paul: Raising capital gains tax will lead to 'significant market reaction'

Kentucky senator says doubling the capital gains tax is 'more worrisome' than raising the corporate tax

Sen. Paul: Doubling capital gains tax 'more worrisome' than raising corporate tax

Sen. Rand Paul, R-Ky., warns that increasing the capital gains tax will lead to a 'significant market reaction.'

Sen. Rand Paul, R-Ky., warned on Sunday that increasing the capital gains tax will lead to a "significant market reaction."

The Kentucky senator made the comments during an exclusive interview with "Sunday Morning Futures" three days after U.S. equity markets turned sharply lower following a report that the Biden administration is mulling increasing the capital gains tax.

Biden, according to Bloomberg, is exploring raising the top capital gains tax rate for individuals earning over $1 million to between 39.6% and 43.4%. The increase would help fund Biden's American Families Plan, the details of which are still being ironed out.

"The markets are jittery, and they’re jittery about doubling the capital gains tax and then some, they’re jittery about raising the corporate income tax," Paul told host Maria Bartiromo.

"I think even more worrisome than raising the corporate tax is actually doubling the capital gains tax," he added. "If you make capital gains tax upwards of 40 percent, there's a real risk that you are going to see a significant market reaction to this."

He also noted that "one of the best things we did in the Republican years under Trump was lower the corporate income tax and it brought hundreds and hundreds of millions of dollars back to the U.S."

GOP BILL SEES 50% OF AMERICAN JOBS PLAN SPENDING GO TOWARD TRADITIONAL INFRASTRUCTURE

The Kentucky senator pointed to an example.

"In my town [of] Bowling Green, Kentucky, the Corvette plant added 400 jobs because General Motors had hundreds of millions of dollars returned to them by having lower corporate income tax," he said, before noting that when corporate income taxes are raised, "the opposite happens."

Sen. Paul assesses president's first 100 days in office: 'It's Biden's way or the highway'

Sen. Rand Paul, R-Ky., argues Biden has not held up to his word to unify the country, calling the president out for refusing to work in a bipartisan manner.

"We'll have more jobs go overseas [and] more corporations going overseas," Paul warned.

President Biden is expected to lay out another spending plan this week, which may include the sizable hike in the capital gains tax rate for the wealthy.

Currently, short-term capital gains are taxed at the same rates as income, but long-term gains are taxed at lower rates.

White House press secretary Jen Psaki declined to give any details about the tax provisions of the forthcoming plans when asked by reporters on Thursday. She did reiterate, however, that the president will not raise rates on anyone earning less than $400,000.

The White House declined FOX Business' request for additional details. The Treasury Department also declined to comment.

Earlier this month, the Treasury Department released details of Biden's tax plan, which aims to raise $2.5 trillion over 15 years to finance his sweeping spending initiative, dubbed the American Jobs Plan. That includes raising the corporate tax rate to 28% from 21%, imposing a new minimum tax on global profits and cracking down on companies that try to move profits offshore.

CLICK HERE TO READ MORE ON FOX BUSINESS

The proposed tax hikes that would fund the sweeping measure could kill close to 1 million jobs within two years if approved, according to a study released earlier this month by the National Association of Manufacturers.

Paul also warned on Sunday that "we're printing up so much money that there's going to be real inflation and I think there's going to be a day in which people wake up and say, 'Oh, my goodness, what have we done to our country.'"

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"Sometimes this happens gradually, but sometimes the market can react in remarkable ways such that we could have never predicted," he continued. "That's the kind of thing I'm worried about with all this money being printed up."

Fox Business’ Megan Henney contributed to this report.