SEC to float mandatory disclosure of climate-change risks, emissions

Proposal would require public companies to provide estimates of direct and indirect greenhouse-gas emissions

House Dems urge Biden to declare a 'climate emergency': Report

Rep. Bill Johnson, R-Ohio, talks the possibility of Biden declaring a national emergency for climate change and the consequences of rushing to green energy resources on 'Mornings with Maria.'

U.S. regulators are set to propose stringent requirements for publicly traded companies to report information on greenhouse-gas emissions and risks related to climate change, in one of the Biden administration’s most significant environmental actions to date.

The headquarters of the US Securities and Exchange Commission (SEC) is seen in Washington, DC, January 28, 2021. (Photo by SAUL LOEB / AFP) (Photo by SAUL LOEB/AFP via Getty Images) ((Photo by SAUL LOEB/AFP via Getty Images) / Getty Images)

The Securities and Exchange Commission will begin considering the proposed rules in a meeting at 11 a.m. ET Monday. If a majority of the agency’s four commissioners—three Democrats and one Republican—votes in favor, it will open the proposal to public comment for at least two months before working to finalize a rule.

The proposal would force publicly traded companies to report greenhouse-gas emissions from their own operations as well as from the energy they consume, and to obtain independent certification of their estimates. In some cases, firms also would be required to report greenhouse-gas output of both their supply chains and consumers, known as Scope 3 emissions. Companies would have to include the information in SEC filings such as annual reports.

HOUSE DEMS WANT BIDEN TO DECLARE NATIONAL ‘CLIMATE EMERGENCY’ AND BAN OIL DRILLING ON FEDERAL LANDS

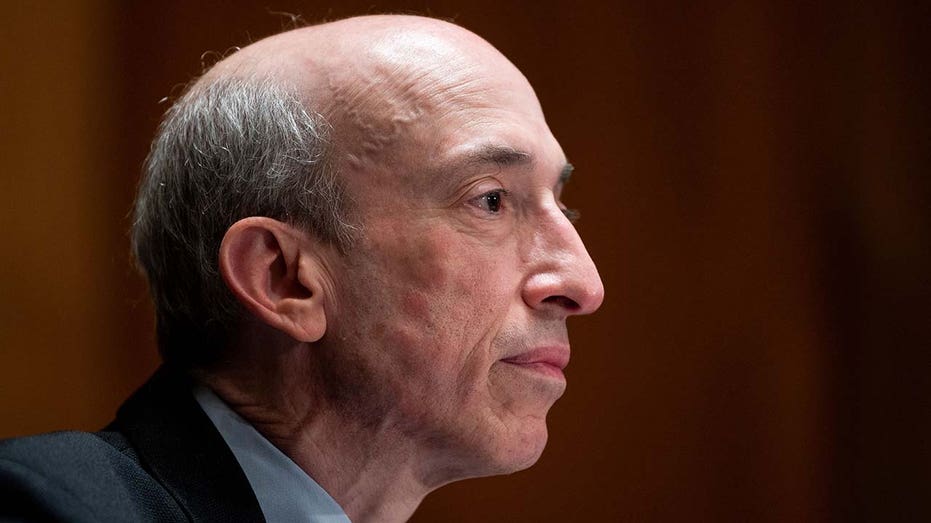

Republicans and some industry groups have been gearing up for months to fight the new requirements, which are a hallmark of Democratic SEC Chairman Gary Gensler’s ambitious policy agenda. They say the proposed rules would increase compliance costs and go far beyond a strict interpretation of the SEC’s mandate to protect investors by requiring disclosure of information relevant to companies’ financial performance.

Gary Gensler,Chair of the Securities and Exchange Commission(SEC), testifies during the Senate Banking, Housing, and Urban Affairs Committee hearing on "Oversight of the US Securities and Exchange Commission" on September 14, 2021 in Washington,DC. ( ((Photo by BILL CLARK/POOL/AFP via Getty Images) / Getty Images)

Mr. Gensler says investors and asset managers representing tens of trillions of dollars have called for companies’ climate-related disclosures to be more standardized. While hundreds of firms already have begun reporting data about their carbon emissions and other climate-related metrics, SEC officials say current disclosures are inconsistent and hard for investors to compare.

"Companies and investors alike would benefit from the clear rules of the road proposed in this release," Mr. Gensler said in a statement.

The proposal comes as President Biden’s efforts to address global warming through legislation have stalled in Congress, putting pressure on regulatory agencies to deliver on a core Democratic priority. That has drawn criticism from Republicans, who accused Mr. Gensler of overreach.

"Today’s action hijacks the democratic process and disrespects the limited scope of authority that Congress gave to the SEC," Sen. Pat Toomey (R., Pa.) said in an emailed statement. "This is a thinly veiled effort to have unelected financial regulators set climate and energy policy for America."

Sen. Pat Toomey, R-Pa., questions Treasury Secretary Steven Mnuchin during a Congressional Oversight Commission hearing on Capitol Hill in Washington, Thursday Dec. 10, 2020. (Sarah Silbiger/The Washington Post via AP, Pool) ((Sarah Silbiger/The Washington Post via AP, Pool) / AP Newsroom)

SEC commissioners, staff and advisers have spent months negotiating the contours of the proposal. Their challenge is to reconcile two conflicting goals: To make public as much information about climate change and associated risks as they can feasibly demand from companies, and to craft rules that withstand legal scrutiny in federal courts that have grown increasingly conservative. The Biden administration has deemed climate change a major risk to the financial system.

A sticking point in the deliberations were the circumstances in which the SEC would mandate disclosure of Scope 3 emissions, which is typically much larger than a company’s direct greenhouse-gas output. But companies struggle to accurately estimate the emissions from their suppliers, who may not offer their own calculations of greenhouse-gas output, or from customers who use their products and services.

The rules proposed Monday would allow firms a degree of flexibility. Disclosure of Scope 3 emissions would be mandatory only if output of those greenhouse gasses is material, or significant to investors, or if companies outline specific targets for them.

SEC PROPOSES RULES FOR MORE DISCLOSURE FROM SHORT SELLERS

For instance, if a firm announces plans to reach "net-zero" emissions by a certain date, it would have to specify whether that goal includes all scopes of greenhouse-gas output. If so, disclosure of its Scope 3 emissions would have to be included in its SEC filings starting in 2025 for large firms. Companies wouldn’t, however, be required to obtain independent assurance that their Scope 3 estimates are accurate and wouldn’t be held liable for the estimates if they were provided in good faith.

An SEC official said most companies in the S&P 500 would likely have to report Scope 3 emissions.

Many regulators say the threats to companies from global warming fall into two buckets: First are the so-called physical risks posed to a company’s facilities and operations by the increased frequency of extreme weather events—droughts, floods, wildfires and hurricanes—in regions where such occurrences used to be rare. Second are "transition risks" resulting from efforts to both wean the economy off fossil fuels and prepare for the effects of climate change.

The SEC’s proposal would require publicly traded companies to include in their financial statements estimates of the impact of both sets of risks. Firms also would have to provide broader explanations about their long-term vulnerabilities to climate change and their processes for addressing those concerns.

CLICK HERE TO READ MORE ON FOX BUSINESS

While the requirements outlined Monday would dramatically increase disclosure from companies under the SEC’s oversight, the U.S. is viewed as having fallen behind some other jurisdictions on climate reporting in recent years.

"Europe and quite a lot of the rest of the world have been focused on disclosure of climate-related risks for a while," said Mary Schapiro, who served as SEC chair during the Obama administration and has since worked with global standard setters to establish guidelines for climate reporting. "Now with the SEC creating mandatory disclosure rules, it really brings the U.S. up to the level where the rest of the world has been."