Fed's Fisher to FBN: Central Bank Went Too Far in Stimulus Efforts

The question on every trader’s mind is when will the Fed raise rates. Those guessing games have caused wild gyrations in the market, particularly as the employment situation has been improving and savers are clearly suffering with interest rates below the rate of inflation.

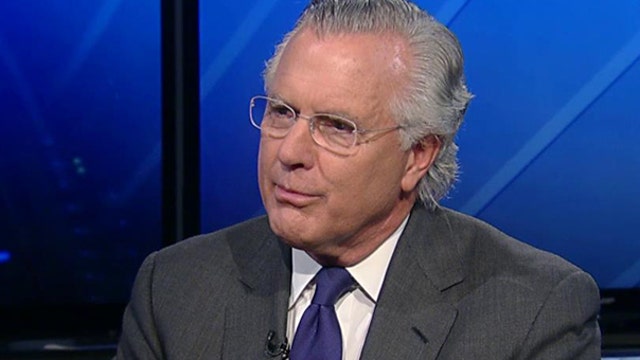

We got a better idea of when a rate hike might happen in an interview Monday with Dallas Federal Reserve Bank President Richard Fisher, who will be stepping down on March 19, after ten years on the job. Fisher spoke exclusively to FOX Business’s David Asman on "After the Bell," saying the central bank had gone "too far" in its stimulus efforts.

Never one to mince words, Fisher was straight forward in criticizing the Fed for taking too long to exit the extraordinary period of zero interest rates and multi trillion dollar portfolios, and he predicted that the Fed will raise rates this year.

He wouldn’t get more specific than that, but his prediction flies in the face of suggestions by prominent economists and investors like Larry Summers and Warren Buffett, who have said it would be a mistake for the U.S. to raise rates while the dollar was so strong; a rate hike would boost the dollar even higher.

While Fisher recognized that a strong dollar was hurting exports, he suggested that getting interest rates back to normal was of critical importance right now in our economic recovery.

Fisher also took a shot at Sen. Rand Paul, (R-KY), and others who want to put the Fed through a more extensive audit than is now required. Fisher said the Fed is already “audited up the wazoo,” and further involvement of Congress in the workings of the Fed would be dangerous for the independent functioning of the Fed.

While Fisher’s views are shared by all of the other Fed presidents and Board members, the Fed may be forced to concede to Paul’s wishes. The last “Audit the Fed” vote in the House won by a 333-92 bipartisan majority. Sen. Harry Reid, (D-NV), blocked a vote on the measure in the Senate. But the new, Republican-led Senate will probably let the vote through, and it’s likely to pass with a veto-proof majority.

Fisher’s replacement has not yet been announced by the Dallas Fed Board.