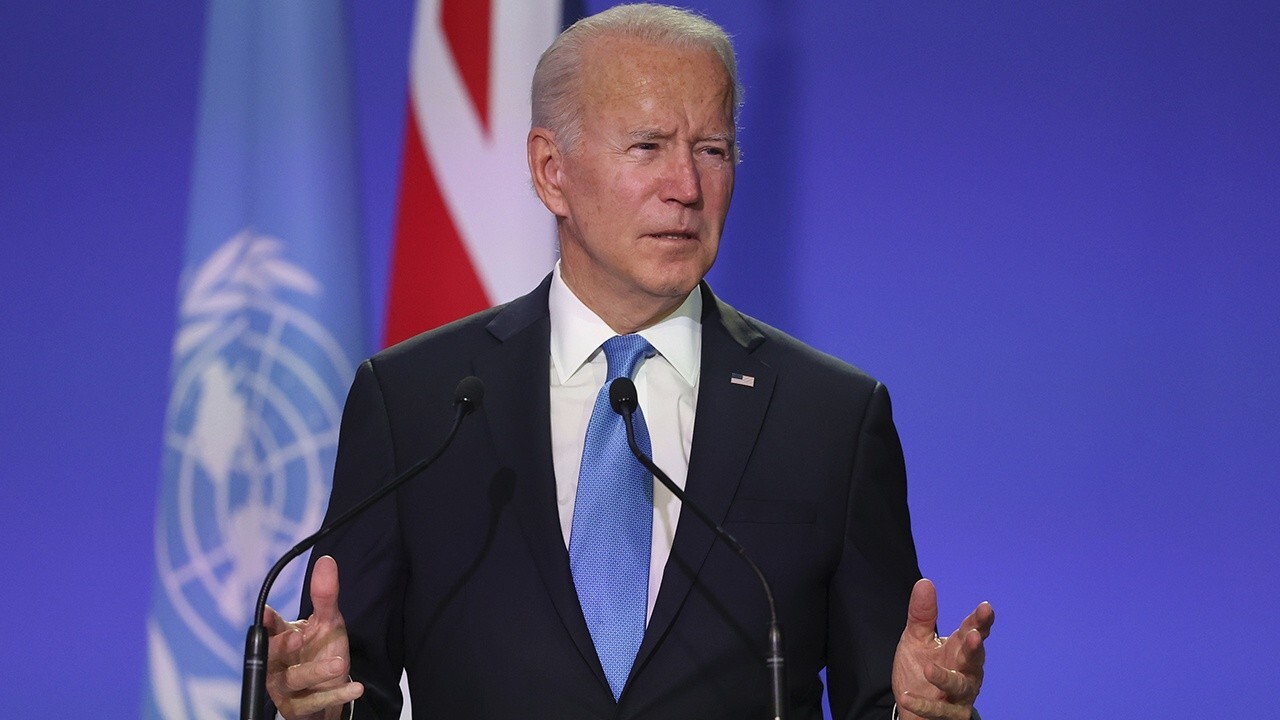

How Biden's policies ignited inflation

Inflation has soared from 2% to 6.2% in nine months

Rep. Malliotakis: Biden’s social spending bill is an ‘unsustainable fiscal disaster’

Rep. Nicole Malliotakis, R-N.Y., argues Biden’s social spending bill should not pass.

Inflation, as we all learned from our elementary economics text book, is too many dollars chasing too few goods.

Hold that thought and everything else falls into place.

SURGING INFLATION HURTS LOW-INCOME AMERICANS THE MOST, NEW STUDY SHOWS

Because this simple and inviolable law of economics and finance explains in one sentence why the Biden government spending bills have accelerated the rise in consumer prices to their highest rates in nearly 30 years.

Remember: there have been three massive spending bills flushed into the economy this year – already -- and mostly financed with debt: the $1.9 trillion blue state bailout bill back in the spring and the $1.2 trillion infrastructure/green energy bill.

Biden’s spending bill ‘doesn’t add up’: Stephen Moore

Economist Stephen Moore argues the Democrats’ spending bill will not fix inflation concerns.

Tack on to that the $1 trillion COVID relief bill that passed during President Trump's last weeks in office. These budget busters were mostly financed with more federal borrowing. And an unusually large share of the government bonds has been financed by the Federal Reserve Board buying them – that is with dollars that are printed and circulated into the economy.

BIDEN'S HOMETOWN BUSINESSES OWNERS SLAM SKYROCKETING INFLATION, SAY SUPPORT ISN'T 'RECIPROCATED'

As economist Larry Summers who served in both the Clinton and Obama administrations accurately predicted: these trillions of extra dollars sloshing around in the economy would raise inflation much more than President Biden or the Fed.

Right on the cue, inflation has soared from 2% to 6.2% in nine months.

Rep. French Hill slams Dems’ ‘crazy’ economic theories: We could lose our country

Rep. French Hill, R-Ark., argues Fed Chair Jay Powell has 'earned' reappointment by Biden.

Now Biden is trying to bulldoze through the Democratic Congress his third stimulus, a $3.5 trillion social welfare spending bill. That is supposed to be "free," according to the president’s sales pitch, because all the new spending will be "paid for with higher taxes on the rich."

On the Sunday talk shows last week the Biden White House spin was that this bill would ease inflationary pressures.

They think we are stupid. More government spending on social programs, increases consumer demand for goods and services, while reducing the supply. For example, the extended unemployment benefits and the free checks, rental assistance, and expanded food stamp payments pulled as many as 5 to 10 million Americans out of the workforce -- so they weren’t contributing to output production. But we were all taking our portions of the "free money" and partying like it was 1995.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Now add free child care, free rent, free college loans, $7,500 subsidies for buying a Tesla, more free health care, paid parental leave for four weeks, and you will see an explosion of consumer demand with all the free money.

Meanwhile, the taxes on successful small businesses, corporations, stock sales, combined with the reduction in oil, gas and coal production creates a double whammy on prices.

For example, under Biden’s war of fossil fuels, America is now producing roughly two million FEWER barrels of oil. What does that do to the world price at a time of rising demand? It raises the gas price at the pump by $1.30 a gallon nationally over just one year ago.

That’s inflation right in your face.

CLICK HERE TO READ MORE ON FOX BUSINESS

It’s hard not to laugh at the claim that massive new subsidies for child care will make child care expenditures more affordable. If that’s the case then why is it that the two industries with the most rapid increases in price over the last 25 years are health care and education -- and these are the most subsidized by government?

In sum: a national strategy of taxing workers, businesses and producers and then subsidizing non-work and consumption is a formula for economic demise -- and eventually runaway inflation.

Biden can hope to wish away inflation or pretend that it will go away on its own, as Jerry Ford did with his infamous "Whip inflation Now" buttons and Jimmy Carter’s advice to turn down the thermostat and wear cardigan sweaters to stay warm in the winter months. But if he passes another $3 trillion debt bill, he will discover as Ford and Carter did, that high inflation causes unemployment. Their own.

Stephen Moore is an economist with FreedomWorks and served as a senior economic adviser to Donald Trump. His latest book with economist Arthur Laffer is "Trumponomics."