2-year personal loan rates up slightly but remain near record lows, Fed reports

Short-term personal loans may be a good option for debt consolidation

Creditworthy borrowers may want to borrow a personal loan to consolidate debt or cover an unexpected expense while annual percentage rates are near record lows. (iStock)

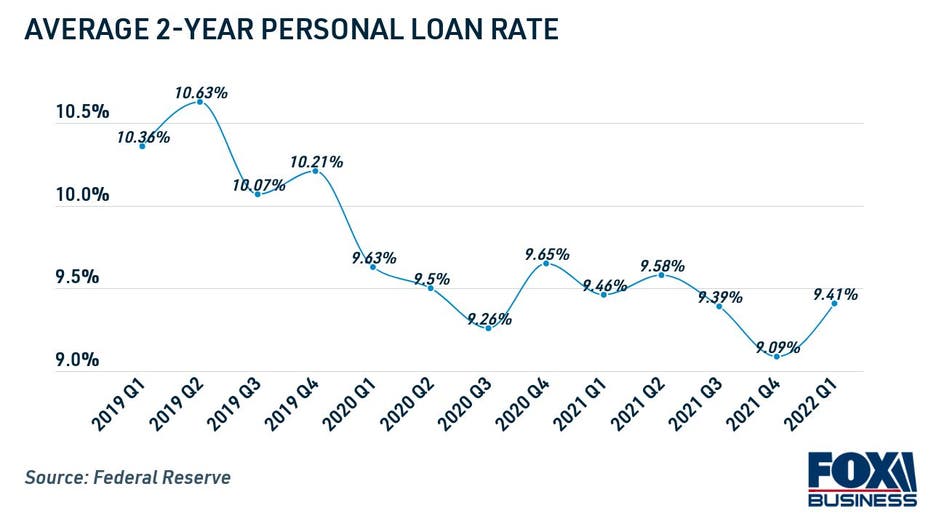

The average interest rate on two-year personal loans rose in the first quarter of 2022, according to the Federal Reserve. Still, rates remain historically low on this unsecured borrowing product.

Two-year personal loan rates are currently at 9.41%, up slightly from the record low of 9.09% set during the fourth quarter of 2021. Over the past three years, average personal loan interest rates have plummeted about one percentage point for the 24-month term.

PERSONAL LOANS ARE THE FASTEST-GROWING PRODUCT AT CREDIT UNIONS

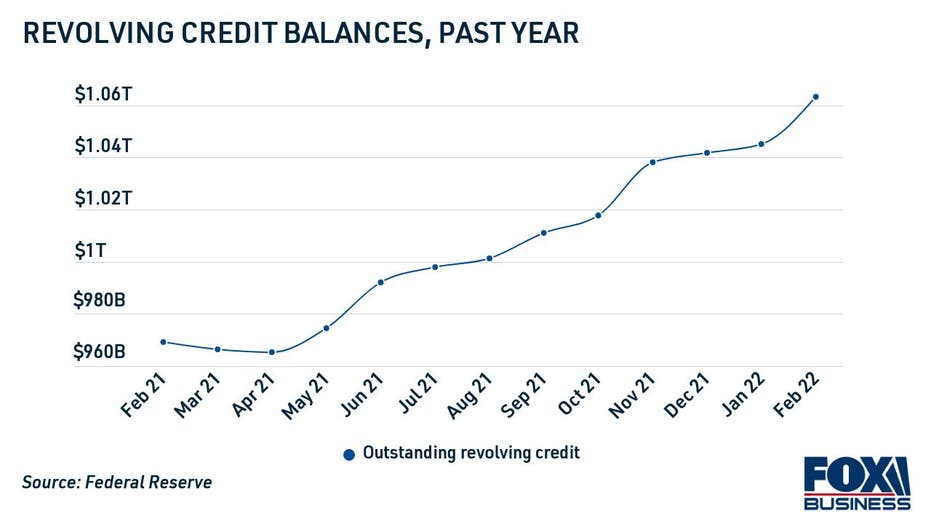

Personal loans are commonly used to consolidate high-interest credit card debt. The Fed data also showed that revolving credit balances ballooned nearly 10% in the past year, suggesting that Americans are becoming more reliant on credit card spending at a time when inflation is rising at a 40-year-high.

If you've been considering borrowing a personal loan for credit card consolidation, it's still a good time to do so with personal loan rates at historically low levels. You can visit Credible to compare personal loan interest rates for free without impacting your credit score.

PERSONAL LOAN ORIGINATION FEES: ARE THEY WORTH THE COST?

Credit card debt surges as personal loans offer a cheaper alternative

Compared with credit cards, personal loans typically offer lower, fixed interest rates. The average credit card rate for accounts assessed interest was 16.17% in the first quarter of this year, the Fed reported, compared with 9.41% for personal loans.

This may present an opportunity for consumers to save money while revolving credit balances in America have been surging. Over the past year, revolving credit debt grew from $969.2 billion to $1.06 trillion — this represents an increase of about 10% annually in February.

5 THINGS TO KNOW ABOUT PERSONAL LOAN FEES AND PREPAYMENT PENALTIES

Credit card consolidation can help some borrowers save money over time while shortening their repayment term. If a consumer is making the minimum monthly payments on their credit card — which is typically between 1% and 3% of the total outstanding balance, according to Experian — they could save thousands of dollars in interest charges and get out of debt years faster by paying off their credit cards with a two-year personal loan.

You can visit Credible to learn more about debt consolidation and estimate how much you can save by consolidating credit card debt.

SECURED PERSONAL LOANS: WHAT YOU NEED TO KNOW

How to get a low rate on a personal loan

Although personal loan rates are still near historic lows, that doesn't guarantee that all borrowers will qualify for a low interest rate. Here are a few steps you can take to get the best possible personal loan offer for your financial situation:

Work on building your credit score

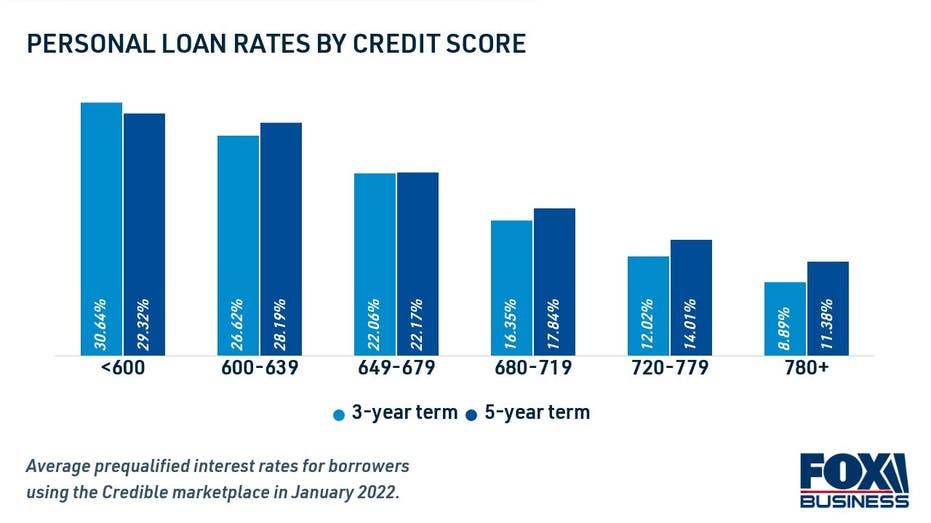

Personal loan lenders determine an applicant's interest rate and eligibility based in part on a borrower's credit history and debt-to-income ratio (DTI). Borrowers with very good credit will see the lowest rates available, while those with bad credit will likely see higher rates — if they meet the eligibility requirements at all.

If you're considering borrowing a personal loan soon, you might be able to lock in a lower rate by taking simple steps to improve your credit score, such as building your on-time payment history or lowering your credit usage. This is more important than ever, as lenders are anticipated to issue more personal loans to subprime borrowers this year.

If you want help boosting your credit score, you can visit Credible to enroll in free credit monitoring services.

PERSONAL LOAN APRS VS. INTEREST RATE: WHAT'S THE DIFFERENCE?

Choose a shorter loan term

Generally, shorter-term personal loans with smaller loan amounts come with lower interest rates than longer-term loans. And since short-term loans are repaid faster in higher monthly payments, they can save you even more money in interest charges over time.

If you can afford the higher monthly payments, it may be worthwhile to opt for a short-term personal loan. You can use Credible's personal loan calculator to estimate your monthly payments with different loan terms.

93% OF PAYDAY LOAN BORROWERS REGRET TAKING OUT THEIR LOANS

Shop around with multiple online lenders

Since personal loan lenders have their own unique set of eligibility criteria, you may be able to find a lower rate by shopping around for multiple offers. Most lenders let you prequalify to see your estimated interest rate with a soft credit inquiry, which won't affect your credit score.

You can browse current personal loan rates in the table below. Then, visit Credible to get prequalified through multiple online lenders at once without impacting your credit score.

UNSECURED LOANS: EVERYTHING TO KNOW

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.