Short-term personal loan rates plunge to new record low in March

Personal loans with short repayment periods typically offer more competitive rates

Personal loan interest rates fell to a record low in March for the three-year term length, according to data from Credible. (iStock)

Personal loans are a popular financing tool because they offer fast, lump-sum funding that you repay in predictable monthly installments at a fixed interest rate. Since this is an unsecured loan, lenders may deposit the funds directly into your bank account as soon as the next business day upon loan approval.

If you're thinking about borrowing a short-term personal loan to consolidate credit card debt, pay for an unexpected expense or finance home improvements, now is a good time to lock in favorable terms.

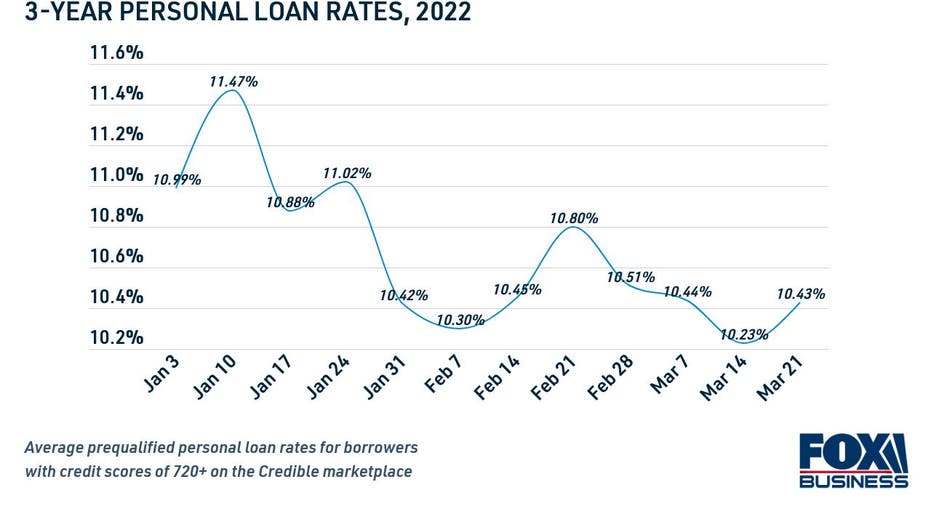

Interest rates on three-year personal loans plummeted to unforeseen levels this past month, according to data from Credible. While rates ticked up slightly over the past week, three-year personal loan rates set a record low of 10.23% during the week of March 14.

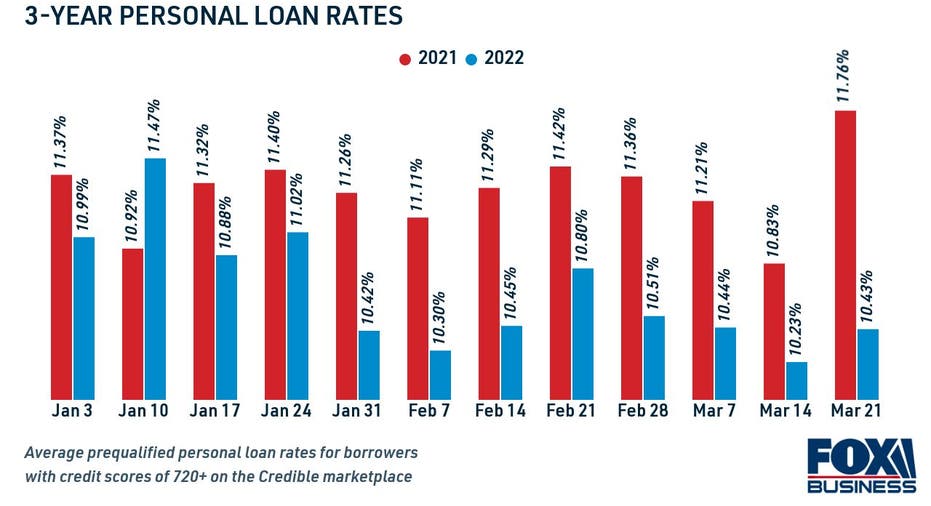

Historically, the current three-year personal loan rate of 10.43% is significantly lower than the average rate this time last year — 11.76%. And across all repayment terms, personal loan rates are much lower so far in 2022 when compared to the first few months of 2021.

Keep reading to learn more about personal loan interest rates, including how to find the best loan offer for your financial situation. You can visit Credible to compare rates across multiple personal loan lenders for free without impacting your credit score.

PERSONAL LOANS ARE THE FASTEST-GROWING PRODUCT AT CREDIT UNIONS

How to get a low personal loan rate

Although personal loan rates are currently low for short-term loans, that doesn't necessarily guarantee that all borrowers will qualify for a good rate. Below are a few steps you can take to lock in the lowest possible rate for your financial situation.

- Work toward building a better credit score

Since personal loans don't require collateral, lenders determine an applicant's eligibility and interest rate based on creditworthiness. Borrowers with an excellent credit score and low debt-to-income ratio (DTI) will qualify for the lowest rates available, while those with bad credit will likely see high interest rates — if they qualify at all.

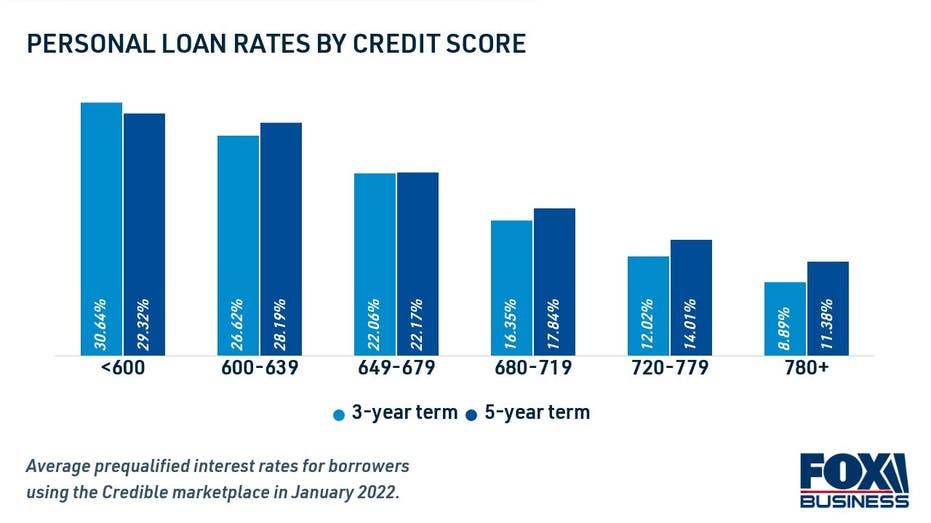

According to January data from Credible, personal loan applicants with a good credit score of 720 or higher saw much more competitive rate offers than fair-credit borrowers. This holds true for both shorter and longer loan terms.

If you have a credit score below 720, you might consider working on your credit history before applying for a personal loan. Improving your credit may be as simple as reducing your credit usage or disputing errors on your credit report. You can enroll in free Experian credit monitoring services on Credible to identify areas for improvement.

SECURED PERSONAL LOANS: WHAT YOU NEED TO KNOW

- Choose a short repayment period

Short-term personal loans typically come with more favorable interest rates than longer-term loans. If you can afford a higher monthly payment, then choosing a shorter loan term may grant you a lower interest rate and save you money in interest charges over time.

You can see how different loan lengths impact your estimated monthly payment and total interest charges using Credible's personal loan calculator.

SURVEY: 93% OF PAYDAY LOAN BORROWERS REGRET TAKING OUT THEIR LOANS

- Compare offers from multiple personal loan lenders

Most lenders let you get prequalified to see your estimated personal loan rate with a soft credit inquiry, which won't impact your credit score. This gives you the opportunity to shop around for the lowest interest rate possible for your financial situation before you fill out a formal personal loan application.

When comparing offers, you should read the loan agreement in full to get a better idea of the total cost of borrowing. The annual percentage rate (APR) includes the interest rate as well as any personal loan origination fees and prepayment penalties. Some lenders may grant you a rate discount for enrolling in automatic payments, while others don't offer autopay discounts.

You can prequalify through multiple online lenders at once on Credible's personal loan marketplace. That way, you can rest assured that you're getting a competitive interest rate when borrowing a loan.

WHAT ARE INSTALLMENT LOANS AND HOW DO THEY WORK?

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.