Fed eyes up to 3 interest rate hikes in 2022 to address high inflation

Time is running out for Americans to lock in record-low rates on mortgages and other financial products

Fed officials also plan to accelerate the central bank's tapering of bond purchases as they adjust their economic outlook on high inflation. (iStock)

The Federal Reserve will speed up tapering of its bond-buying program and is planning up to three rate hikes in 2022, Fed Chairman Jerome Powell said at a press conference on Wednesday following the latest Federal Open Market Committee (FOMC) meeting.

Federal Reserve rate hikes will cause interest rates to rise on a number of consumer loans, especially mortgage products. This means that the time to lock in record-low interest rates on mortgage purchase and refinance loans is running out.

If you're considering refinancing your mortgage or borrowing a home loan, act now to take advantage of low rates before the Fed's upcoming rate hikes. You can view your estimated mortgage rate on Credible for free without impacting your credit score.

MORTGAGE RATES DROP SLIGHTLY AMID OMICRON UNCERTAINTY

Fed speeds up tapering, predicts 7 interest rate hikes in coming years

During the coronavirus pandemic, the Federal Reserve increased its investment in government-backed debt like Treasury bonds and mortgage-backed securities to boost the labor market, spur economic growth and keep borrowing costs cheap for consumers. But amid concerns of persistent inflation, Fed officials now plan to taper bond purchases at an accelerated rate.

Inflation is rising at the highest pace in nearly 40 years, according to the Bureau of Labor Statistics. So despite signs of a "really strong economy," Powell said that "moving forward the end of our taper by a few months is really an appropriate thing to do" to address rising inflation.

However, the Fed has little control over the supply chain crisis, which has also been contributing to inflation over the past several months.

"I believe that inflation may be more persistent and that may be putting inflation expectations under pressure, and that the risk of higher inflation becoming entrenched has increased."

UNEMPLOYMENT RATE FALLS TO PANDEMIC-ERA LOW AS BENEFITS EXPIRE

The Fed has also kept interest rates near zero over the past few years to support economic activity amid COVID-19. But the time of a low-rate environment will soon come to an end. In addition to the Fed's three predicted rate hikes in 2022, it also expects two rates hike in both 2023 and 2024, for a total of up to seven rate hikes in the next several years.

"The actual rate decisions we make will depend on our evolving assessment of the forecast," Powell said.

When the Fed raises its benchmark rate, interest rates on consumer borrowing will also increase. This includes mortgage rates, which set record lows in early 2021 due in part to the Fed's monetary policy.

With multiple rate hikes on the horizon next year, time is running out to get a low mortgage rate. Visit Credible to begin the mortgage purchase or refinancing process, so you can lock in a historically low rate before the next Fed rate hike.

GDP REVISED UP FOR Q2 TO 6.6%: WHAT THAT MEANS FOR INTEREST RATES

Inflation concerns have already caused mortgage rates to rise

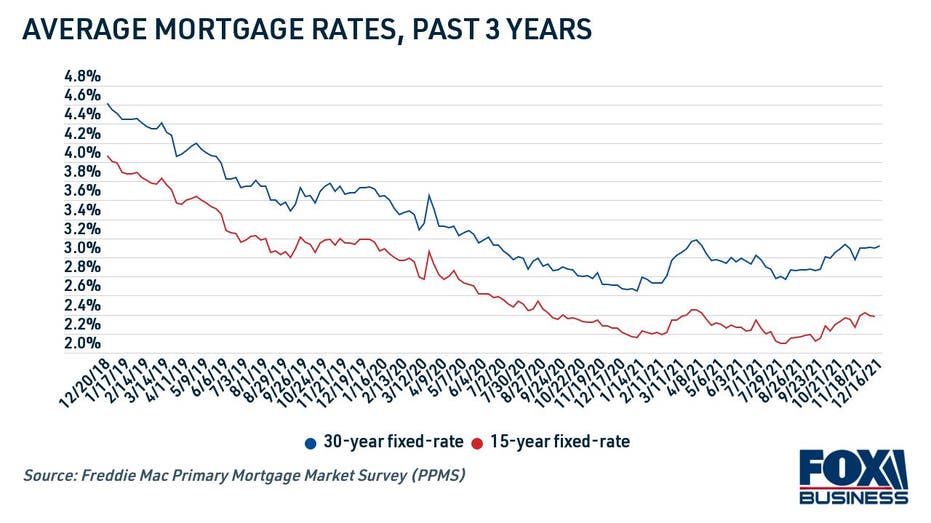

Mortgage interest rates have been trending up in recent months since reaching record lows in January 2021, according to Freddie Mac data. Although rates have increased during that time, they're still near historic lows when compared with the past 3 years.

CREDIT CARD BALANCES REACH PRE-PANDEMIC LEVELS AS CONSUMER SPENDING REBOUNDS

With the Fed's anticipated interest rate increases, it's not likely that mortgage rates will go down anytime soon. In fact, rates may trend up over the next few years, especially once the Federal Reserve implements these rate hikes.

The latest forecast from the Mortgage Bankers Association (MBA) predicts that average rates on 30-year mortgages will reach 4.0% in 2022 and 4.3% in 2023. The MBA also indicates that mortgage origination activity may fall 33% next year due to higher mortgage interest rates.

If you're considering buying a home or refinancing your current mortgage, it's important to act fast to lock in a mortgage rate before it inevitably rises. You can visit Credible to see your prequalified mortgage offers from multiple lenders to help you get the lowest possible rate for your financial situation.

SCHUMER CALLS ON BIDEN TO EXTEND STUDENT LOAN PAYMENT PAUSE

Have a finance-related question, but don't know who to ask? Email The Credible Money Expert at moneyexpert@credible.com and your question might be answered by Credible in our Money Expert column.