Why Wall Street’s spooked about debt default risk

The US avoided a default in 2011, but then came the ratings downgrade

Debt bubble is a ‘ticking time bomb’ for the US economy: Eddie Ghabour

Key Advisors Wealth Management co-founder and CEO Eddie Ghabour joined ‘Varney & Co.’ to discuss the state of the U.S. economy as investors’ concerns for another rate hike grow.

While the chances of the U.S. defaulting on its debt are shrinking, risks remain for the banking system and global financial markets.

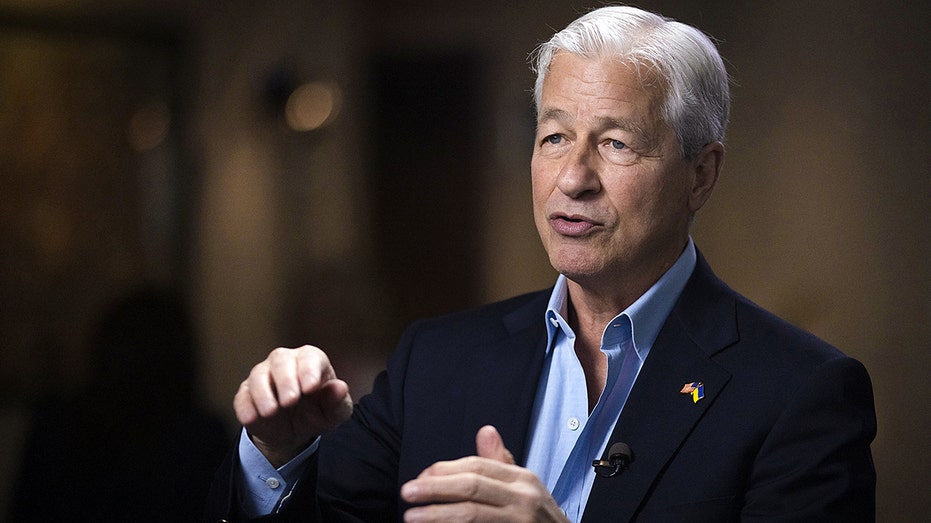

"An actual default would be a disaster," JPMorgan CEO Jamie Dimon told FOX Business’ Grady Trimble on Capitol Hill Wednesday.

While Dimon added a default is unlikely, others say the U.S. markets and the economy are still facing uncertainty.

"We are only days away from a default, and there isn’t a deal and that’s bad," Dennis Kelleher, Better Markets CEO, told FOX Business.

WHAT IS THE DEBT CEILING, AND WHAT DOES IT MEAN FOR YOU?

Jamie Dimon, chairman and CEO of JPMorgan Chase during a Bloomberg Television interview at the JPMorgan Global High Yield and Leveraged Finance Conference in Miami, Fla., March 6, 2023. (Marco Bello/Bloomberg via Getty Images / Getty Images)

"Basically, every financial instrument in the world is priced off of the risk-free rate of U.S. debt. The only reason U.S. debt is the cornerstone for the global financial economy and risk-free is because the U.S. has never defaulted."

Kelleher pointed to 2011 when a deal was reached, but chaos still followed.

"In 2011, there wasn't the default, but the political brinksmanship caused one of the rating agencies to downgrade U.S. debt," Kelleher added, noting the economy is also dealing with aggressive rate hikes from the Federal Reserve.

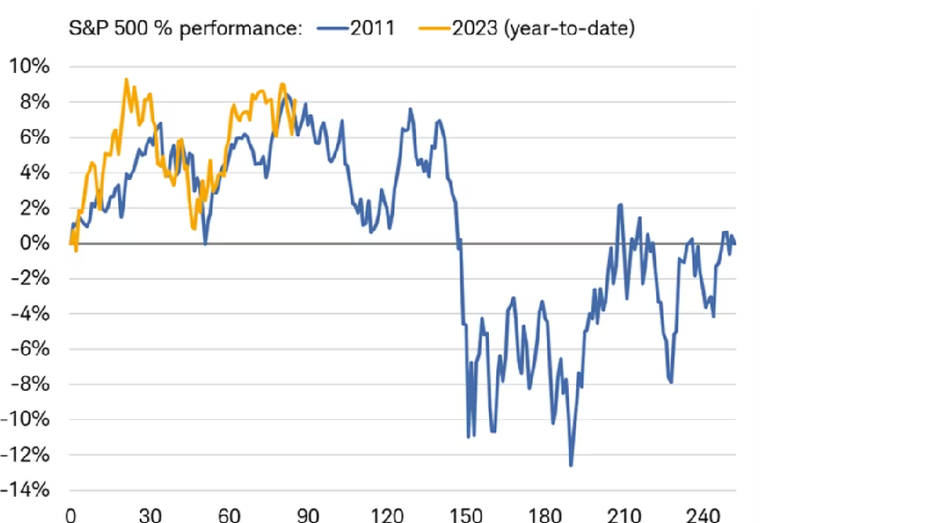

The events of 2011 were also raised in Schwab’s Market Perspective May 12 by strategists Liz Ann Sonders, Kathy Jones and Jeffrey Kleintop.

"A default would risk sending short-term yields higher, while riskier assets and the dollar would likely fall," the team wrote. "This is the scenario that played out in the 2011 debt ceiling fight, which resulted in the U.S. federal government credit rating being downgraded by several rating agencies, including Standard & Poor's, to below AAA for the first time ever."

S&P 500

.While the S&P 500’s 8% advance this year appears to show little anxiety over a default, there are similar trading patterns to 2011 based on a Charles Schwab-Bloomberg chart.

MORTGAGE DEMAND TANKS AS RATES HIT TWO-YEAR HIGHS

Schwab Market Perspective: Debt Ceiling Standoff (Charles Schwab, Bloomberg )

Earlier this week, Treasury Secretary Janet Yellen, in another letter, urged House Speaker Kevin McCarthy and lawmakers to act swiftly.

"We have learned from past debt limit impasses that waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers and negatively impact the credit rating of the United States," Yellen wrote.

"We have learned from past debt limit impasses that waiting until the last minute to suspend or increase the debt limit can cause serious harm to business and consumer confidence, raise short-term borrowing costs for taxpayers and negatively impact the credit rating of the United States."

Yellen also noted damage is already being done.

"We have already seen Treasury’s borrowing costs increase substantially for securities maturing in early June" she warned.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| KRE | STATE STREET® SPDR® S&P® REGIONAL BANKING ETF - USD DIS | 73.62 | +1.37 | +1.90% |

| JPM | JPMORGAN CHASE & CO. | 322.35 | +12.34 | +3.98% |

| WFC | WELLS FARGO & CO. | 93.93 | +2.37 | +2.59% |

| BAC | BANK OF AMERICA CORP. | 56.55 | +1.64 | +2.99% |

| C | CITIGROUP INC. | 122.66 | +6.98 | +6.03% |

Lawmakers appear to be closer together on avoiding a default. The SPDR S&P Regional Banking ETF (KRE) rose over 7% Wednesday, the biggest one-day percentage gain since January 2021.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

The government may not be able to pay all its obligations as early as June 1 if a deal is not reached.