Why Tesla stock is S&P 500 bound

Tesla could be the S&P's biggest addition since Buffett's Berkshire Hathaway

In what may be the world’s worst-kept investing secret, Tesla is inching closer to joining the S&P 500 at a value that would make it the biggest addition since Warren Buffett's Berkshire Hathaway in 2010.

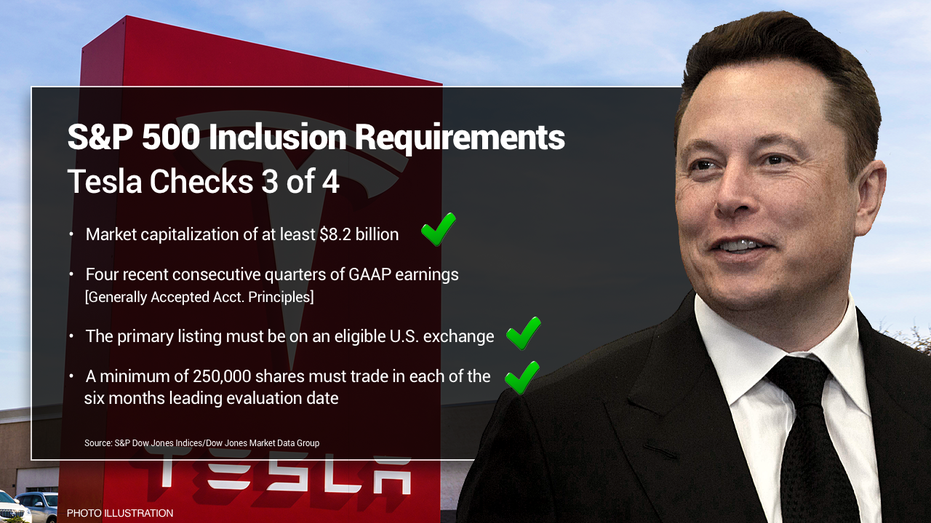

When Elon Musk’s electric vehicle company reports earnings later today it may mark the fourth straight quarter of profitability, one of four major criteria required for inclusion on the blue-chip index.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TSLA | TESLA INC. | 411.11 | +13.90 | +3.50% |

Getting added would force an entirely new crop of mutual funds, index funds and exchange-traded funds to load up on the stock, which has already advanced 275 percent this year.

TESLA NEEDS TO PROVE ITS WORTH AFTER ELECTRIFYING STOCK-PRICE SURGE

"Whether it's the best or worst company, funds [that mirror the S&P 500], have to buy and own a certain percentage" Howard Silverblatt, senior index analyst for S&P Dow Jones Indices, told FOX Business.

Those may include investment vehicles owned by mutual fund behemoths such as Vanguard, Fidelity and T. Rowe Price.

Tesla has already checked off the other three criteria to make the S&P 500: its market cap is at $290 billion, well above the $8.2 billion minimum, it’s listed on an “eligible U.S. exchange,” the Nasdaq; and its shares are among the most actively traded, also exceeding the required threshold.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| NDAQ | NASDAQ INC. | 84.83 | -0.68 | -0.80% |

While achieving the profitability milestone doesn’t guarantee inclusion, Tesla shares crossed the $1,500 level for the first time earlier this month, contributing to the Nasdaq's record run despite the dwindling overhang of short-sellers betting the stock would fall.

TESLA STOCK SKEPTICS BURN $18B WITH BAD BETS

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| I:COMP | NASDAQ COMPOSITE INDEX | 23031.213218 | +490.63 | +2.18% |

Wedbush managing director Dan Ives, who sees the stock hitting the $2,000 level, believes institutional investors are already building positions in the shares.

TESLA SECURES TAX BREAKS FOR CYBERTRUCK FACTORY IN TEXAS

"There is a strong retail component," he said, but "you are starting to see more institutional ownership of this just given the probability" and the growth in electric vehicles, which are becoming a trillion-dollar industry.

Analysts surveyed by Refinitiv have estimated Tesla's bottom line would be anywhere from a profit of $1.45 a share to a loss of $2.53 a share; the average is a loss of 11 cents. In recent quarters, however, the automaker has surprised to the upside.

While there is no schedule for a decision on S&P inclusion, the index committee evaluates candidates continuously, and once a decision is made, a company can be included with as little as 5-days notice.

CLICK HERE TO READ MORE ON FOX BUSINESS