Volatile markets sending investors running for refuge

The Federal Reserve meets this coming week and another big hike in interest rates is likely as the central bank battles inflation

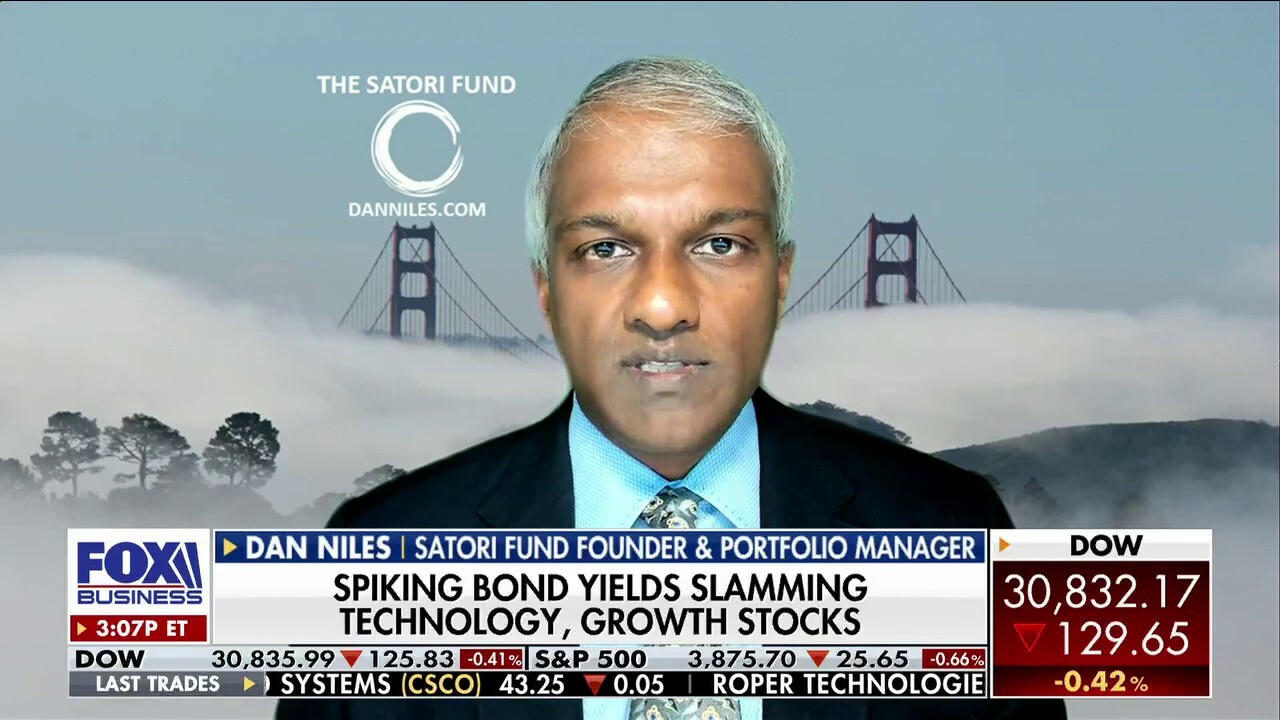

Dan Niles forecasts S&P 500 to 'bottom' middle of 2023

Satori Fun founder reacts to FedEx warning of a global recession, telling 'The Claman Countdown' our economic situation is due in part to the Fed initially ignoring the worst inflation in 40 years.

Its been a rough year for investors who have had to deal with wild market swings, skyrocketing inflation and a rising interest rate atmosphere.

Stocks just completed one of the worst weeks in months, with the Dow, S&P and Nasdaq marking a fourth losing week in the last five.

All three major U.S. stock indexes slid to levels not touched since mid-July, with the S&P 500 closing below 3,900, a closely watched support level.

The S&P 500 fell 4.8% in the past week and is down 18.7% this year.

THE S&P 500 FELL 4.8% IN THE PAST WEEK AND IS DOWN 18.7% THIS YEAR

A floor trader after a rough week on Wall Street. ((AP Photo/Richard Drew) / AP Newsroom)

The rally cry has become "Cash is King" as some investors seek refuge in cash, as they capitalize on higher interest rates and await chances to buy stocks and bonds at cheaper prices.

The Federal Reserve has shaken the markets as it implements huge rate hikes in an effort to moderate the steepest inflation in 40 years.

The higher rates are leading to better rates for money market funds.

That has made cash a better way to hide out from the volatility, although it may not buy as much due to inflation.

Investors have been looking to cash during volatile markets. (iStock / iStock)

Fund managers increased their average cash balances to 6.1% in September, the highest level in more than two decades, according to a survey from BofA Global Research.

BANK OF AMERICA WARNS OF NEW LOWS FOR S&P 500 AS 'INFLATION SHOCK AIN'T OVER'

Assets in money market funds came in at $4.44 trillion as of last month, not far from their peak of $4.67 trillion in May 2020, according to Refinitiv Lipper.

The Fed meets again this coming week and another big interest rate hike is on the table, following this week's consumer price index report that came in hotter than expected.

The Federal Reserve building in Washington. (AP Photo/Patrick Semansky, File / Associated Press)

Taxable money market funds had returned 0.4% so far this year as of the end of August, according to the Crane 100 Money Fund index.

The average yield in the Crane index is 2.08%, up from 0.02% at the start of the year and the highest level since July 2019.

CLICK HERE TO READ MORE ON FOX BUSINESS

There can however be drawbacks to sitting on cash, like possibly missing a sudden reversal that takes prices for stocks and bonds higher.

Reuters contributed to this report.