'Shark Tank' star reveals the stocks showing 'more cracks' in the market

Commercial real estate sector 'getting worse by the week,' Kevin O'Leary says

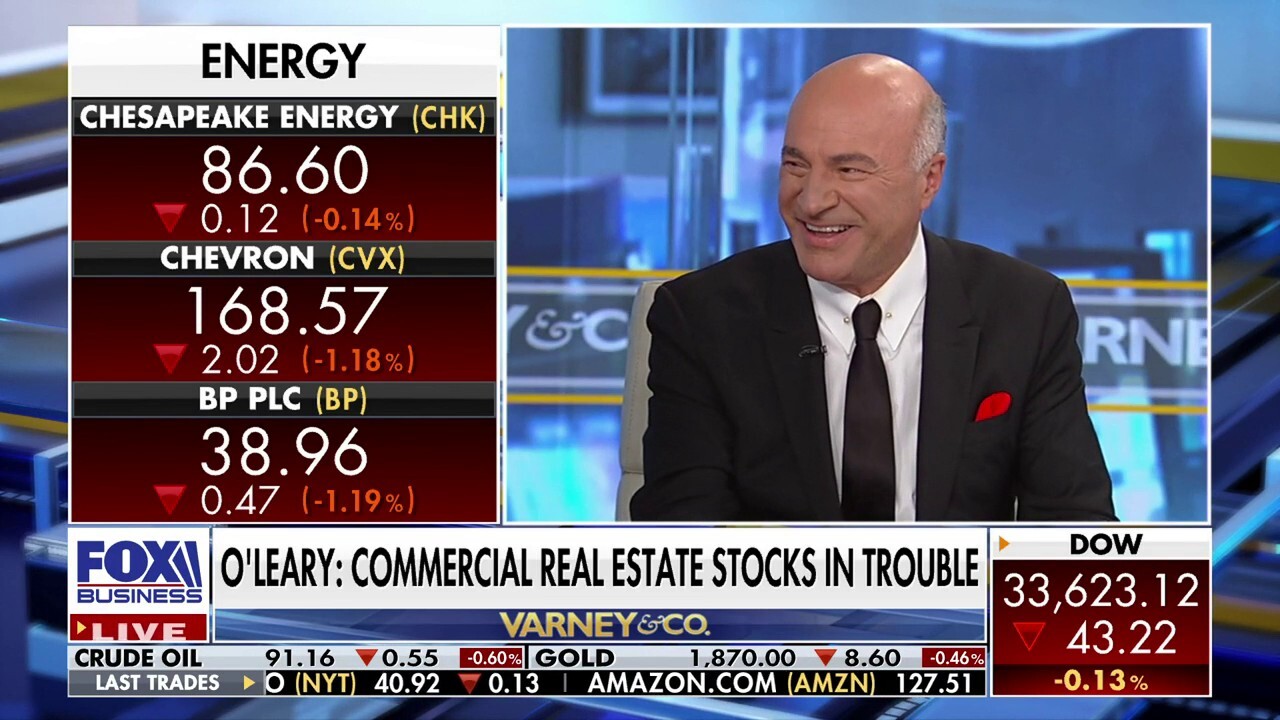

Kevin O'Leary: 'More cracks' being seen in commercial real estate

O'Leary Ventures Chairman and 'Shark Tank' investor Kevin O'Leary weighs in on a looming government shutdown, Gary Gensler's digital currency hearing and stocks in trouble.

Keeping a close eye on the market’s ups and downs, O’Leary Ventures Chairman and "Shark Tank" investor Kevin O’Leary sounded the alarm on a group of stocks that are in dire trouble.

"It's getting worse by the week," O’Leary said Friday of the commercial real estate sector on "Varney & Co." "And lots of private equity firms are admitting there's cracks in the system. It's based on debt."

"The debt was raised for these buildings back at 3, 4 and 5%, now they're dealing with 9 to 14% and refinancing them," he continued. "That makes these buildings uneconomic."

The threat of a commercial real estate market crash has been hanging over the already fragile U.S. economy as approximately $1.5 trillion in commercial mortgage debt is due by the end of 2025.

But steeper borrowing costs, coupled with tighter credit conditions and a decline in property values brought on by remote work, have increased the risk of default: Fitch Ratings already estimated that 35% — or $5.8 billion — of pooled securities commercial mortgages coming due between April and December 2023 will not be able to be refinanced.

Kevin O’Leary said commercial real estate has become "uneconomic" on Friday's "Varney & Co." (Fox News)

"Unfortunately, what we have is many of them are on the balance sheets of regional banks, up to 40% of their balance sheets. These are going to come through, rolling through refinancings over the next 18 to 30 months," O’Leary explained. "We're going to see more cracks on regional banks, and that's putting pressure on the loan books of those banks which are hitting small business."

Regional banks are the biggest source of credit to the $20 trillion commercial real estate market, holding about 80% of the sector's outstanding debt. Regional banks were just at the epicenter of the upheaval within the financial sector after Silicon Valley Bank’s collapse, and there are concerns that the turmoil could make lending standards drastically more restrictive.

Sharks share keys to success for entrepreneurs in tough economic times

‘Shark Tank’ stars Daymond John, Barbara Corcoran and Kevin O’Leary discuss a variety of topics on ‘The Claman Countdown,' including how to build a business in difficult economic times and the current retail demand.

"That was another issue that [Gary] Gensler was dealing with, because he hasn't given the rules for liquidity demands and liquidity on the balance sheets of regionals," O’Leary expanded. "And the regions are putting up their hand, talking to their congressmen and women saying, ‘What is it with this guy? Give us some direction.’"

"Make it clear, all the regulators including him," the "Shark" added. "We need rules so we can open our loan books again."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

There is pressure on the regional bank industry: Sen. Bill Hagerty

Sen. Bill Hagerty, R-Tenn., responds to the banking crisis following the fallout of Silicon Valley Bank on 'Kudlow.'

The millionaire investor voiced support for Senate Republicans’ proposition to guarantee a payroll account for regional banks that bears no interest up to $100 million for 24 months.

"So as these banks collapse or fail or merge or acquire, your payroll account is protected. I 100% endorse that idea," O’Leary said. "And everybody should, it should be a bipartisan issue because you don't want a regional bank failing because... many payroll accounts on Wednesday nights are way over $250,000. They have to pass that bill."

FOX Business’ Megan Henney contributed to this report.