Oil crash poised to siphon bank profits

'A sharp decline in oil prices will be a body blow to an industry already at high risk'

Oil prices are mired in an historic slump, and America’s biggest banks are not immune from the pain.

West Texas Intermediate crude oil has plunged nearly 50 percent from its Jan. 6 peak as a selloff that began amid demand destruction caused by the outbreak of the new coronavirus was exacerbated by the start of an oil-price war between Saudi Arabia and Russia.

“A sharp decline in oil prices will be a body blow to an industry already at high risk,” wrote Richard Bove, senior research analyst at Odeon Capital Group.

SAUDI ARABIA BOOSTS OUTPUT AMID OIL WAR WITH RUSSIA

The sharp selloff in oil puts further pressure on the big banks, including Bank of America, Citigroup and JPMorgan Chase, which have seen their share prices plunge by as much as 33 percent this year as aggressive interest-rate cuts by the Federal Reserve compressed their profit margins.

The banks have lent billions of dollars to U.S. shale companies that are now at risk because of the oil crash.

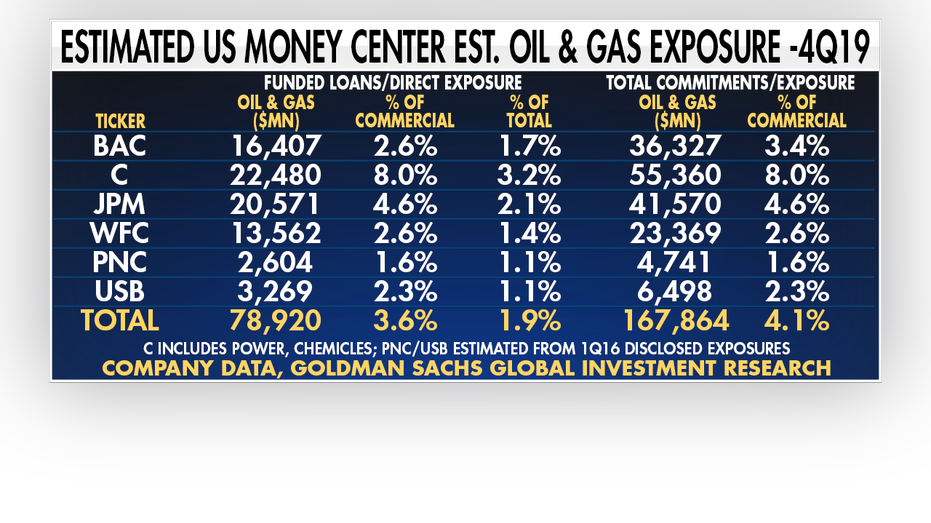

Analysts at Goldman Sachs say the oil crash’s short-term risk to bank earnings is 3 percent to 6 percent as the lenders raise reserves from 5 percent to 10 percent to cover potential loan-repayment problems. A further drop in crude prices or a prolonged slump would make the impact more pronounced.

The banking sector’s exposure to the oil and gas industry is relatively small, comprising only 2 percent of total loans, or 4 percent including unfunded commitments. Direct loans make up about 12 percent of Common Equity Tier 1, a capital measure used to gauge a bank's health.

“If you take a look at the oil industry, that is the biggest commodity industry in which the banks lend money,” Bove told Claman.

“If you go to Regions Financial along the Gulf Coast, there’s a lot of loans out there that are going to go bad," Bove said. "If you look at Comerica, which is lending money in Texas you’ve got a problem. If you take a look at Key Corp., which has loaned money into the fracking area, but you also have to look at JPMorgan and Citigroup and Bank of America, they are going to lose hundreds of millions on loans.”

Even before the oil crash, banks were feeling the pain of a drop in loan volumes and prices, which has put pressure on margins. Bove estimates their earnings could be down by as much as 30 percent this year.

Stocks In This Article:

The drop in earnings comes amid expectations that banks will soon increase their dividends due to the piles of cash they are sitting on. JPMorgan has $500 billion in cash-like assets and Bank of America has over $400 billion, according to Bove.

Still, he believes there’s no need to worry about a liquidity crisis like the one in 2008.

“It’s not going to freeze up in the banking industry because if you’ve got over 22 percent of the assets of this $13 trillion industry in cash or treasury securities there is no liquidity problem,” Bove said.

Additionally, loans to oil companies amount to only a fraction of those made for housing, which were hammered by the collapse of a real estate bubble in the mid-2000s.

CLICK HERE TO READ MORE ON FOX BUSINESS

While 2020 is “going to be a terrible year for banks,” Bove said, the signal to buy stock in them will occur when there is “an increase in loan volume in the commercial area, because that’s where they make the most money.”