Large-cap ETFs post biggest outflows in a year

Investors withdrew $34.6B from conventional funds and ETFs, according to the latest Refinitiv Lipper fund flow report

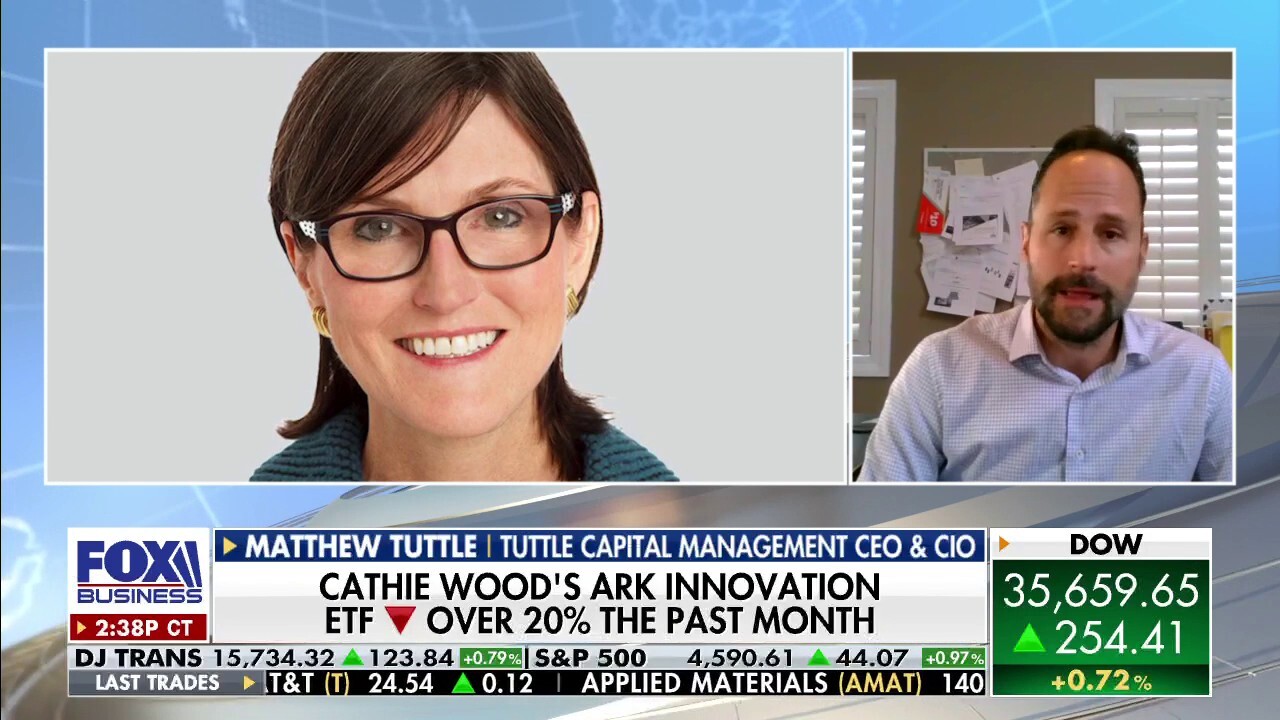

Tuttle Capital's SARK ETF bets against Cathie Wood's flagship strategy

Tuttle Capital Management CEO Matthew Tuttle discusses his anti-Cathie Wood ETF on 'The Claman Countdown.'

Large-cap ETFs have recorded outflows of $9.4 billion for the period ending Feb. 2, according to the latest fund flow report from Refinitiv Lipper. The figure marks the largest outflows since February of last year.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| SPY | STATE STREET® SPDR® S&P 500® ETF TRUST - USD DIS | 690.66 | +13.06 | +1.93% |

| IWM | ISHARES TRUST RUSSELL 2000 INDEX FUND | 265.02 | +9.17 | +3.58% |

The SPDR S&P 500 ETF and iShares Russell 2000 ETF led the week's outflows, with investors redeeming $15.8 billion and $1.1 billion, respectively.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| IJR | ISHARES CORE S&P SMALL-CAP ETF - USD DIS | 131.97 | +3.47 | +2.70% |

| XLK | TECHNOLOGY SELECT SECTOR SPDR ETF | 141.06 | +5.47 | +4.03% |

| IVV | ISHARES CORE S&P 500 ETF - USD DIS | 693.83 | +13.33 | +1.96% |

Meanwhile, small-cap ETFs, sector technology ETFs and value-aggressive ETFs posted outflows of $1.5 billion, $995 million, and $905 million, respectively.

Despite suffering a third straight week of outflows greater than $8 billion, large-cap ETFs saw a weekly gain of 4.87%, the largest since April 2020.

METAVERSE ETF ‘PUNK’ LAUNCHES, EXCLUDES INVESTMENTS IN MARK ZUCKERBERG'S META

Exchanged-traded equity funds recorded $10 billion in outflows for the week, despite a weekly gain of 4.33%, the largest since November 2020.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CAD | NO DATA AVAILABLE | - | - | - |

| QQQ | INVESCO QQQ TRUST - USD DIS | 609.65 | +12.62 | +2.11% |

Equity ETFs with the largest inflows for the week included the iShares: Core S&P 500 and Invesco QQQ Trust 1, which took in $2.8 billion and $2.6 billion, respectively.

CLICK HERE TO READ MORE ON FOX BUSINESS

Fixed-income ETFs suffered net outflows of $1.1 billion, led by the iShares TIPS Bond ETF and iShares: 7-10 Treasury Bond ETF's outflows of $1.6 billion and $1 billion, respectively.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| TIP | ISHARES TIPS BOND ETF - USD | 110.67 | +0.11 | +0.10% |

| IEF | ISHARES 7-10 YEAR TREASURY BOND ETF - USD | 96.07 | 0.00 | 0.00% |

| IUSB | ISHARES TRUST CORE TOTAL USD BD MKT | 46.67 | +0.03 | +0.06% |

| BIL | STATE STREET® SPDR® BLOOMBERG 1-3 MONTH T-BILL ETF - USD DIS | 91.44 | +0.03 | +0.03% |

The largest inflows came from the iShares: Core Total USD Bond Market ETF and SPDR Bloomberg 1- Month T-Bill ETF, which brought in $1.7 billion and $1.4 billion, respectively.

Overall, investors withdrew a net total of $34.6 billion from conventional funds and ETFs. The largest outflows came from money market funds, which lost $21.4 billion. Meanwhile, equity funds posted outflows of $5.2 billion, taxable bond funds saw outflows of $5.1 billion and tax-exempt bond funds suffered outflows of $2.9 billion.