Coronavirus spotlights risk at JPMorgan, Wells Fargo

Of the four largest banks, JPMorgan and Wells Fargo have the largest exposure to real estate

JPMorgan Chase & Co. and Wells Fargo are set to kick off first-quarter earnings season on Tuesday, but instead of focusing on the top and bottom-line results, investors should be paying closer attention to their commercial real estate exposure.

“Commercial real estate seems to be a faster domino effect than banks assessing consumer loan risk or credit card delinquencies,” Kenneth Leon, research director of industries and equities at the New York-based CFRA Research, told FOX Business. “I think that will take a little bit longer.”

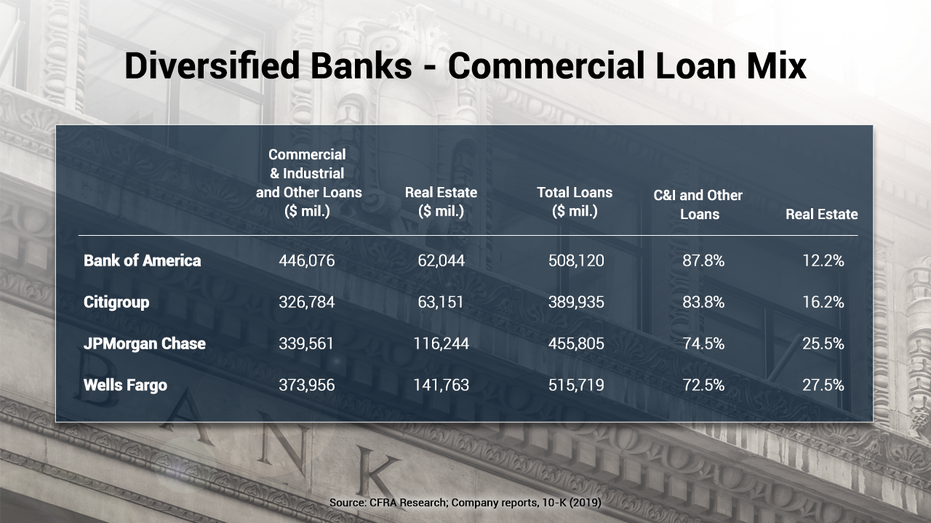

Of the four largest banks, JPMorgan and Wells Fargo have the largest exposure to real estate at 25.5 percent and 27.5 percent of their commercial loan exposure.

And JPMorgan's commercial real estate book has the bank's largest credit risk exposure, according to Leon. He says the credit rating agencies have only just started in some cases to lower their ratings from investment grade to junk.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| JPM | JPMORGAN CHASE & CO. | 322.40 | +12.24 | +3.95% |

| WFC | WELLS FARGO & CO. | 93.97 | +2.41 | +2.63% |

The diversified banks had $382 billion of credit loan exposure to commercial real estate last year. Their amount of nonperforming assets are expected to rise sharply as the COVID-19 pandemic has tipped the U.S. economy into its deepest recession since World War II.

STOCK MARKET'S CORONAVIRUS BOTTOM PROBABLY IN: GOLDMAN SACHS

That will lead to loan forbearance from tenants, particularly in large office buildings, meaning landlords and property owners won’t be receiving the same cash flows they are accustom to, impeding their ability to meet their mortgage requirements.

Leon also noted that while the Fed said it would purchase asset-backed securities, including commercial mortgage backed securities, it would only buy the AAA tranche. A lot of CMBS is not AAA-rated, meaning there is likely to be some liquidity problems in commercial real estate with mortgage loans.

He expects to see “an acceleration of charge offs of loans,” but says the good news is that banks “went into this crisis in a better position” than in 2008.

In his 2020 letter to shareholders, JPMorgan CEO Jamie Dimon noted that the bank would have to consider suspending its dividend if there was an “extremely adverse” downturn in the U.S. economy.

However, Leon says a dividend cut is unlikely to happen as they don’t “want to send that signal to the capital markets or to their investors,” many of which are yield-oriented.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| C | CITIGROUP INC. | 122.69 | +6.95 | +6.00% |

| BAC | BANK OF AMERICA CORP. | 56.53 | +1.59 | +2.89% |

Citigroup and Bank of America will report their first-quarter results on Wednesday.