Chevron CEO: $100 per barrel oil is possible

CEO Mike Wirth says it could happen in coming months

Chevron CEO talks oil industry recovery post-pandemic: ‘We’re generating strong cash’

Chevron CEO Mike Wirth discusses the statistics surrounding Chevron and the oil industry’s strong growth since the pandemic on ‘The Claman Countdown.’

Chevron CEO Mike Wirth says the prospect of oil hitting $100 per barrel is not out of the realm of possibility in the coming months, pointing to recent markets trends and global uncertainty.

Wirth appeared on FOX Business' "The Claman Countdown" on Friday, where host Liz Claman noted, "Oil hit $90 a barrel earlier this week, and you look at Wall Street's $100 a barrel forecast by this summer, that suddenly doesn't look so lofty."

International benchmark Brent crude hit $90 on Wednesday. On Thursday, The Wall Street Journal reported that Morgan Stanley analysts had lifted their summer forecast for Brent to $100, and so did Goldman Sachs. Bank of America predicted it will hit $120 by July.

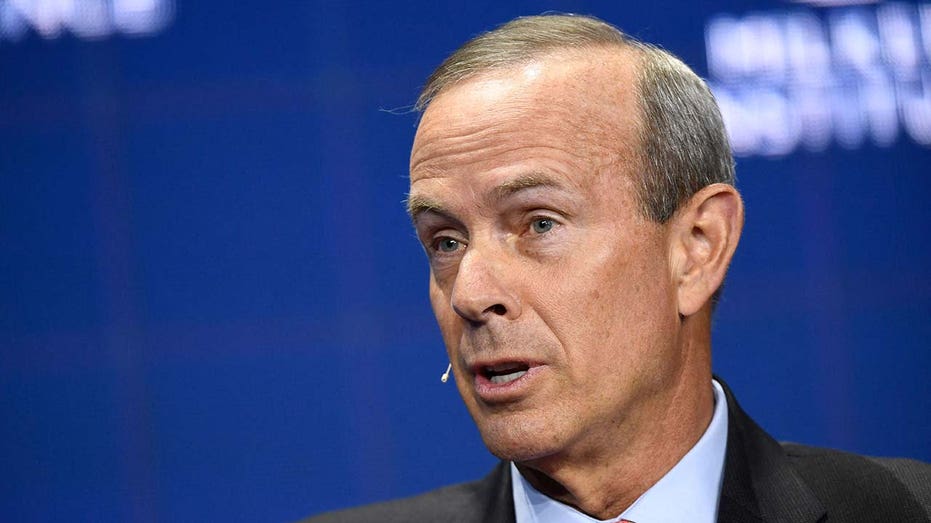

Michael Wirth, Chairman and CEO of the Chevron Corporation, during the Milken Institute Global Conference on Oct. 18, 2021, in Beverly Hills, California. (PATRICK T. FALLON/AFP via Getty Images / Getty Images)

Claman asked Wirth what his price outlook is for the spring, to which he replied, "Could we see $100 oil? I think we could – we're not far from it right now, and a lot of it depends on things that are very hard to predict that could happen around the world."

The chief executive highlighted one particular factor, pointing out that "geopolitical concerns such as those related to Russia and Ukraine are once again creating jitters in commodity markets."

Claman then asked Wirth if his company had been contacted by the Biden administration in its campaign asking liquid natural gas producers to help out in the instance that Moscow cuts off the critical energy supply to Europe amid conflict.

A Chevron gas station sign is seen in Del Mar, California, in this file photo. (REUTERS/Mike Blake/File Photo / Reuters Photos)

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| CVX | CHEVRON CORP. | 180.86 | +1.63 | +0.91% |

CONSUMERS ‘EXHAUSTED’ BY RISING GAS PRICES, INFLATION: BARUCH

The CEO declined to comment on whether Chevron had been in discussions with the White House, but said the company is "always planning for contingencies."

"In this strong market that we've seen, the incentives are for all producers to be producing as much as they can because the demand is clearly there," Wirth said.

The Biden administration has actively worked to hinder U.S. oil and gas production while blaming producers for the continued increases in gas prices Americans have been paying since President Biden took office. Wirth says the pricing situation is simply a supply and demand issue.

A pump jack is seen at sunrise near Bakersfield, California. (REUTERS/Lucy Nicholson/File Photo / Reuters Photos)

READ MORE ON FOX BUSINESS BY CLICKING HERE

"If we want to see lower prices what we really want to see is more supply," Wirth explained. "We need policies that encourage investment and supply, and this is a country that is an energy powerhouse."

He added, "We're the largest producer of oil and gas in the world, and can be for a long time to come if we're allowed to responsibly develop those resources."