STOCK MARKET NEWS: 2Q GDP contracts cementing recession, stocks sink, Hurricane Ian damages rise

Stocks sink as 2Q GDP remained negative confirming the start of a recession. Hurricane Ian continues to wreak havoc in Florida as damages pile up. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AAPL | $142.03 | -7.81 | -5.21 |

| WBA | $31.61 | -1.58 | -4.77 |

| BA | $125.62 | -7.82 | -5.86 |

| V | $179.93 | 0.75 | 0.42 |

| TRV | $154.46 | 1.53 | 1.00 |

U.S. stocks saw steep swings on Thursday with the Dow Jones Industrial Average wiping out most of Wednesday’s 548-point gain. Apple and Boeing led the drop, while Travelers and Visa managed to stay positive. In commodities, oil retreated by 1% to $81.23 per barrel.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| APRN | $5.56 | -0.65 | -10.47 |

Blue Apron Chief Financial Officer Randy Greben is leaving. The carbon-neutral meal-kit company said Greben has accepted a position at another company and plans to resign from his role, effective October 17.

Mitchell Cohen will serve as interim Chief Financial Officer, effective following Mr. Greben’s departure.

Greben joined Blue Apron in January 2021.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NKE | $95.22 | -3.48 | -3.53 |

Nike is falling in extended trading. Inventories rose 44 percent compared to the prior year period, driven by elevated in-transit inventories from ongoing supply chain volatility, partially offset by strong consumer demand during the quarter.

Selling and administrative expense increased 10 percent to $3.9 billion.

The Beaverton, Oregon-based company said it had net income of 93 cents per share. The results beat Wall Street expectations. The average estimate of 12 analysts surveyed by Zacks Investment Research was for earnings of 91 cents per share.

The athletic apparel maker posted revenue of $12.69 billion in the period, which also topped Street forecasts. Eleven analysts surveyed by Zacks expected $12.33 billion.

The Associated Press contributed to this report

The United States on Thursday imposed sanctions on companies it accused of involvement in Iran's petrochemical and petroleum trade, including some based in China and India, pressuring Tehran as it seeks to revive the 2015 Iran nuclear deal.

U.S. Secretary of State Antony Blinken said in a statement that Washington designated two China-based companies, Zhonggu Storage and Transportation Co Ltd and WS Shipping Co Ltd, as part of attempts to thwart sanctions evasion on the sale of Iranian petroleum and petrochemical products.

Blinken accused Zhonggu Storage and Transportation Co Ltd of operating a commercial crude oil storage facility for Iranian petroleum and WS Shipping Co Ltd of being a ship manager for a vessel that has transported Iranian petroleum products.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| RIDE | $1.84 | -0.18 | -9.13 |

Lordstown Motors is lower in Thursday trading. The electric truck maker began production of its Endurance pickup truck.

The company said its first two commercial vehicles have rolled off the production line at the Foxconn EV Ohio plant, with the third expected shortly.

Lordstown anticipates ending 2022 with approximately $110 million in cash and cash equivalents. The cash outlook is better than the previous outlook by approximately $75 million.

The truck maker continues to explore opportunities for capital raising alternatives, including in connection with the initial Foxconn JV program and strategic partnerships.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| BBBY | $6.46 | 0.08 | 1.25 |

Bed Bath & Beyond Inc. on Thursday reported a loss of $366.2 million in its fiscal second quarter.

The Union, New Jersey-based company said it had a loss of $4.59 per share. Losses, adjusted for asset impairment costs and restructuring costs, were $3.22 per share.

The results did not meet Wall Street expectations. The average estimate of nine analysts surveyed by Zacks Investment Research was for a loss of $1.59 per share.

The home goods retailer posted revenue of $1.44 billion in the period, which matched Street forecasts.

Bed Bath & Beyond shares have decreased 56% since the beginning of the year, while the S&P's 500 index has declined 22%. The stock has declined 72% in the last 12 months.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| NEE | $81.00 | -1.37 | -1.66 |

Millions of Florida residents are struggling to cope without power as utility crews work around the clock to restore power.

NextEra Energy subsidiary Florida Power and Light has restored power to more than half a million customers.

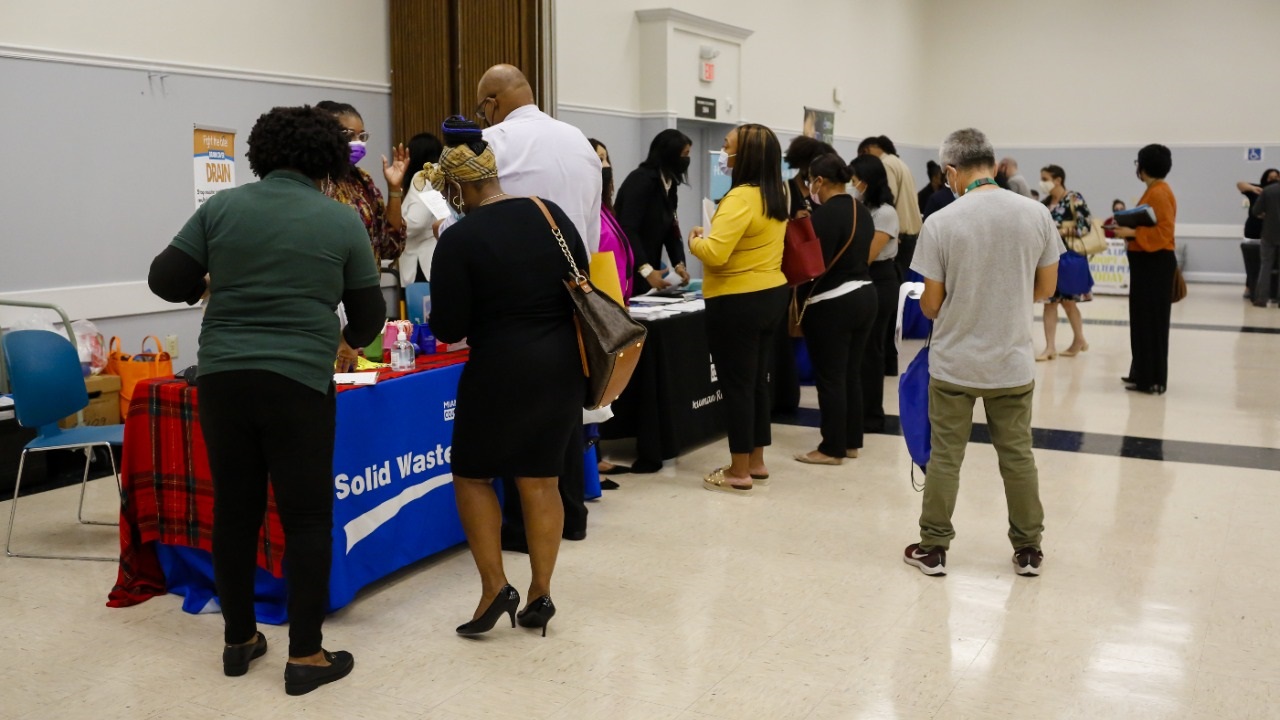

Initial jobless claims fell to 193,000, a decrease of 16,000 from the previous week’s revised level.

The largest increases in initial claims for the week ending September 17 were in Michigan (+6,102), Georgia (+1,837), New York (+1,709), New Jersey (+1,164), and California (+1,130), while the largest decreases were in Indiana (-1,103), Arkansas (-386), Kentucky (-295), Virginia (-288), and Oklahoma (-264).

The average rate on a 30-year fixed-rate mortgage averaged 6.7 percent as of September 29, up from 6.29 percent last week.

The 15-year rate averaged 5.96 percent, from 5.44 percent.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| RAD | $5.80 | -1.23 | -17.48 |

Rite Aid plunged as US trading opened Thursday. The drugstore chain reported fiscal second quarter profit that fell short of Wall Street estimates, but topped profit expectations.

Revenue for the three months ended August 27 fell to $5.9 billion from $6.1 billion a year earlier. Analysts expected $5.8 billion.

Same store sales for the second quarter increased 5.6 percent over the prior year period, consisting of an 8.0 percent increase in pharmacy sales, partially offset by a 0.3 percent decrease in front-end sales.

The net loss widened to $331.3 million from $100.3 million.

The adjusted net loss per share was 63 cents. Wall Street expected 56 cents.

“As we look to the second half of the year, we expect continued pressure on consumer spending and supply chain challenges,” said Heyward Donigan, president and CEO.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| KMX | $86.42 | 5.27 | 6.49 |

CarMax Inc. (KMX) on Thursday reported fiscal second-quarter profit of $125.9 million.

On a per-share basis, the Richmond, Virginia-based company said it had net income of 79 cents.

The results missed Wall Street expectations. The average estimate of seven analysts surveyed by Zacks Investment Research was for earnings of $1.40 per share.

The used car dealership chain posted revenue of $8.14 billion in the period, also missing Street forecasts. Six analysts surveyed by Zacks expected $8.75 billion.

U.S. stocks opened lower across the board after 2Q GDP contracted 0.6% for the second consecutive quarter cementing a recession. Bond yields resumed their climb. In commodities, oil was little changed hovering at the $82 per barrel level.

| Symbol | Price | Change | %Change |

|---|---|---|---|

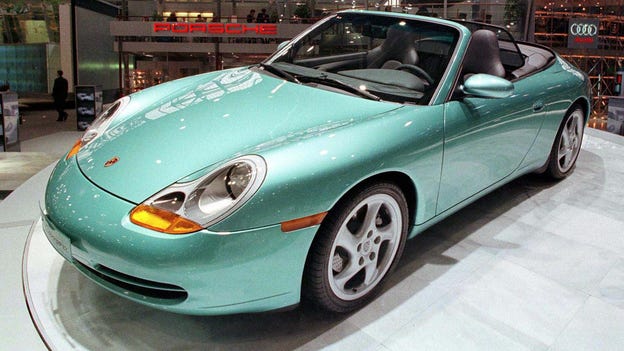

| POAHY | $6.78 | 0.24 | 3.67 |

| VWAPY | $13.65 | 0.58 | 4.44 |

Porsche AG shares made a strong start on Thursday after Volkswagen defied volatile markets to list the sports car brand at a valuation of 75 billion euros ($72 billion) in Germany's second-biggest market debut.

Volkswagen priced Porsche AG shares at the top end of the indicated range and raised 19.5 billion euros from the flotation to fund the group's electrification drive. By 1035 GMT Porsche AG stock was trading 3% up from the issue price of 82.50 euros.

That lifted Porsche AG's valuation to 77.4 billion euros, close to the market capitalization of Volkswagen as a whole, which is worth about 80.1 billion euros, and ahead of rivals such as Ferrari. It is Germany's biggest listing since Deutsche Telekom in 1996.Faced with costs in the tens of billions for software and a radical shift towards electric mobility, Volkswagen executives had long considered listing Porsche, a move executives hoped would raise much-needed funds and lift Volkswagen's own value.

The Porsche and Piech families, whose holding company Porsche SE controls Volkswagen, will in turn solidify their control over Porsche AG because they will own 25% plus one ordinary share - carrying voting rights - in the sports car brand.

Up to 113,875,000 Porsche AG preferred shares, carrying no voting rights, were sold in the initial public offering.

($1 = 1.0339 euros)

Hurricane Ian may become one of the costilest storms in U.S. history with damages rising to potentially $40 billion as tracked by the Insurance Information Institute.

The final revision for 2Q GDP was unchanged at 0.6% cementing the start of a U.S. recession after 1Q growth contracted 1.6%.

U.S. equity futures are trading lower as a global rally was short lived.

The major futures indexes suggest a decline of 0.9% when the opening bell rings on Wall Street.

Oil prices edged lower after jumping by more than $3 per barrel the previous day.

The strong dollar, demand worries and concerns over the faltering global economic outlook is impacting market sentiment.

U.S. crude futures traded around $80.00. Brent crude futures traded around $87.00.

The economic agenda includes the third and final reading on 2Q GDP and the latest weekly jobless claims numbers.

The yield on the 10-year U.S. Treasury, or the difference between its market price and the payout if held to maturity, was at 3.84% on Thursday, after exceeded 4% on Wednesday, its highest level in a decade.

Asian stock markets followed Wall Street higher Thursday after Britain's central bank, moved forcefully to stop a budding financial crisis.

The Nikkei 225 in Tokyo gained 0.7%, the Hang Seng in Hong Kong jumped 1.3% and China's Shanghai Composite Index rose 0.3%.

Wall Street's benchmark S&P 500 index surged 2% on Wednesday for its biggest gain in seven weeks, after the Bank of England said it would buy bonds over the next two weeks to stop a slide in prices.

The Dow Jones Industrial Average rallied 1.9% to 29,683.74. The Nasdaq composite climbed 2.1% to 11,051.64.

Did the U.S. economy actually slide into a recession in the first half of the year? New data that will be released by the government on Thursday morning could shed light on the pivotal question.

The Commerce Department is set to post the third and final estimate for second-quarter gross domestic product at 8:30 a.m., along with updated growth figures for the past five years — a process it performs annually.

GDP, the broadest measure of goods and services produced in the nation, officially shrank at a 1.6% annualized pace in the three-month period from January to March and declined a 0.6% pace between April and June, meeting the criteria for a so-called technical recession.

Economists surveyed by Refinitiv expect the updated data on Thursday to be unchanged and show that growth did, in fact, shrink at a 0.6% pace in the spring.

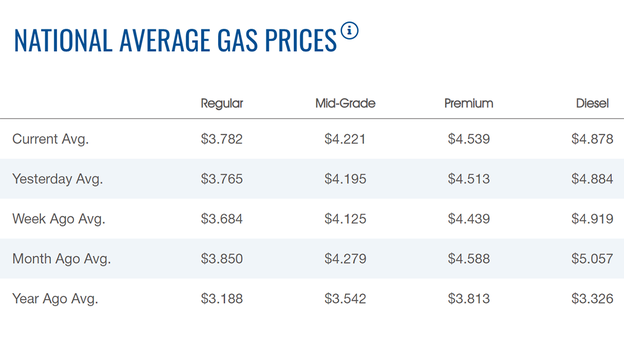

The average price for a gallon of regular gasoline in the U.S. continues to gain.

Thursday's price rose to $3.782, up from Wednesday's $3.765 a gallon, according to AAA.

The price started rising again a little over a week ago, after declining for nearly 100 days in a row during the summer driving season.

That makes it eight straight days of increases.

The average price a week a go was $3.685. Diesel is priced at $4.878 a gallon.

Shares in the Porsche IPO are gaining 2% at $81.15 in the debut in Frankfurt trading.

Germany’s Volkswagen AG said Wednesday it had priced the initial public offering of shares at the top end of the targeted range, putting the IPO on track to become one of Europe’s largest in more than a decade, according to the Wall Street Journal.

The offering of preferred stock values Porsche at about $73 billion.

The deal ranks Porsche among the top five biggest car markers measured by market value behind its parent company VW, but ahead of German rival Mercedes- Benz Group AG, which is valued at more than $56 billion.

Tesla's valuation of more than $886 billion leads the way followed by Japan’s Toyota Corp.

In a nod to the company's famous 911 sport car, VW created 911 million Porsche shares.

Oil prices traded lower on Thursday after gaining more than $3 in the prior session.

The strong dollar, demand worries and concerns over the faltering global economic outlook is impacting market sentiment.

U.S. crude futures traded around $80.00. Brent crude futures traded around $87.00.

Both benchmarks had rebounded in the prior two sessions, after reaching nine-month lows this week, after a temporary dive in the dollar index and a larger-than-expected drawdown of U.S. fuel inventory.

Bitcoin was trading around $19,000, after rising in three of the last four days. In the past week, Bitcoin has gained more than 4%.

For the month, the cryptocurrency was lower by more than 3%. Bitcoin is also down more than 57% year-to-date.

Ethereum was trading around $1,300, after a week in which it gained more than 6%.

Dogecoin was trading at 6 cents, after gaining more than 5% in the past week.

Live Coverage begins here