STOCK MARKET NEWS: Dow exits bear market as Fed’s Powell talks rate hikes, Sam Bankman-Fried chat

Investors digest mixed economic data on jobs and 3Q GDP but were pleased with Federal Reserve Chair Powell's speech. Apple's under the microscope for action in China as Elon Musk ups pressure over Twitter. FOX Business is providing real-time updates on the markets, commodities and all the most active stocks on the move.

Coverage for this event has ended.

Federal Reserve Chairman Jerome Powell delivered an early holiday gift to investors.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| VSCO | $46.02 | 0.49 | 1.08 |

Victoria's Secret & Co. on Wednesday reported fiscal third-quarter earnings of $24.4 million.

On a per-share basis, the Reynoldsburg, Ohio-based company said it had net income of 29 cents.

The results surpassed Wall Street expectations. The average estimate of six analysts surveyed by Zacks Investment Research was for earnings of 23 cents per share.

The retailer of lingerie, pajamas and beauty products posted revenue of $1.32 billion in the period, which met Street forecasts.

Victoria's Secret expects full-year earnings to be $4.50 to $4.95 per share.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AMZN | $95.71 | 3.29 | 3.55 |

Amazon CEO Andy Jassy says the online retailer is streaming costs ahead of economic conditions that will test “the long-term resolve of a lot of companies.”

Jassy elaborated Wednesday that while there are a lot of things Amazon is doing in the devices organization that he is "optimistic" about, there are other tings that they don't see as "really big needle movers."

FTX’s sister company Alameda Research owes money to Jimmy Buffett's Margaritaville Resort in the Bahamas and Amazon Web Services, according to bankruptcy filings.

The Margaritaville Beach Resort in Nassau, Bahamas, is the fourth-largest creditor owed money by Alameda, as bankruptcy filings indicate Alameda owed the resort a debt of $55,319.

Amazon Web Services is the largest creditor listed in the bankruptcy filing and is owed $4,664,996 by Alameda. AWS is a subsidiary of Amazon that provides cloud computing platforms and APIs to clients.

Treasury Secretary Janet Yellen on Wednesday said social media company Twitter should be held to certain standards for content, arguing that it is "not that different" from radio stations and broadcasters subject to such rules.

Speaking at the New York Times Dealbook Summit in New York, Yellen also said she believed that there were legitimate national security concerns related to TikTok, the Chinese-owned video sharing app.

Yellen declined to say whether the Treasury-led Committee on Foreign Investment in the United States (CFIUS) was conducting a review of Twitter after some calls for a probe of a Saudi Arabian stake in the company after billionaire Elon Musk's takeover of the platform.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CRM | $158.02 | 6.34 | 4.18 |

Salesforce Inc said on Wednesday that Bret Taylor would step down as co-chief executive officer in January and that co-founder Marc Benioff will become the CEO.

The news sent the company's shares down 5% in extended trading as investors shrugged off the annual profit raise.

"After a lot of reflection, I've decided to return to my entrepreneurial roots," said Taylor, who has previously served as chief operating officer and chief product officer of Salesforce.

The San Francisco-based company expects annual adjusted profit per share between $4.92 and $4.94, compared with $4.71 to $4.73 forecast earlier.

A diverse portfolio of products including its Customer 360 platform and the newly acquired workplace messaging app Slack have helped Salesforce attract customers at a time when digital transformation is becoming a priority, even as businesses are bracing for a broader economic downturn.

Revenue for the quarter ended Oct. 31 was $7.84 billion, compared with analysts' average expectation of $7.82 billion, according to Refinitiv IBES data.

The business software maker expects current-quarter revenue to be between $7.93 billion and $8.03 billion. On an adjusted basis, the company earned $1.40 per share during the third quarter, compared with estimates of $1.21.

U.S. stocks rose across the board after Federal Reserve Chairman Jerome Powell signaled smaller rate hikes may begin as soon as December. The Dow Jones Industrial Average gained over 700 points exiting the bear market that began in September. In commodities, oil rose 3% to $80.55 per barrel.

Federal Reserve Chair says the path ahead for inflation remains “highly uncertain.”

Powell said inflation forecasts of private-sector forecasters or of Federal Open Market Committee participants broadly show a significant decline over the next year. However, forecasts have been predicting just such a decline for more than a year, while inflation has moved stubbornly sideways.

Powell said the central bank anticipates ongoing interest rate increases will be appropriate.

“It seems to me likely that the ultimate level of rates will need to be somewhat higher than thought at the time of the September meeting and Summary of Economic Projections,” Powell said. “We have more ground to cover.”

Powell spoke on the outlook for the economy, inflation, and the changing labor market at the Hutchins Center on Fiscal & Monetary Policy at the Brookings Institution.

Following his prepared remarks, Powell was interviewed by Hutchins Center director David Wessel and took questions from the audience.

Powell on jobs

Powell said, “Wage increases will be an important part of the story going forward.”

The Fed chair said there’s an incentive for moderating employment demand. “Right now people’s wages are being eaten up by inflation,” Powell said, while noting wages at the lower end are rising faster than inflation.

He said the labor market will not come into balance until there is price stability, pointing out the latest jobs data shows there are 1.7 job openings for every unemployed worker. Powell opined the employment imbalance, in one sense, signals a great job situation, perhaps too great, he said.

“Without stable prices, we can’t have maximum employment,” Powell said.

The situation the Fed would love to have a very long economic expansion. “Those are very beneficial to society,” he said.

Powell said the labor market could come into balance through declining job openings.

The Fed chair added that wages have to go up with a level consistent with 2% inflation to keep inflation under control.

“We understand that real wages are not going up for most people,” Powell said. “This labor shortage doesn’t look like it’s going away any time soon.” As a result, Powell expects investment in labor replacement technology.

JOB OPENINGS EASED IN OCTOBER IN EARLY SIGN OF A SLOWDOWN

Powell on inflation

The Fed chair says the natural assumption is to assume inflation will recede, but that hasn’t happened.

Powell said the central bank will continue to make forecasts but will be humble. He noted there is a tendency to overtighten monetary policy.

“It’s a very difficult situation to forecast inflation,” Powell said.

The Fed chair said policymakers will look at economic factors including forecasts, actual data, macroeconomic conditions, asset prices, private borrowing rates in an effort to identify policy that is sufficiently restrictive to bring inflation down.

“It will have to be judgement,” Powell said.

Powell on monetary policy

The Fed chair says the central bank doesn’t want to overtighten monetary policy. “That’s why we’re slowing down,” Powell explained.

“At a certain point we’re just going to call it,” he opined, noting the Fed wants to stop at a place “where it’s safe.”

Powell continues to believe there’s a path to a soft economic landing, saying it is “very plausible” and “still achievable.”

The Fed chair says the central bank monitors global developments, noting the best thing the Fed can do to help the global economy is to get inflation under control. Powell said the global costs of inflation will only rise with delay.

“I feel like we’re now in a place where we can slow down,” he said. “I don’t regret getting to where we are.”

| Symbol | Price | Change | %Change |

|---|---|---|---|

| WBD | $11.05 | -0.09 | -0.78 |

Warner Bros Discovery-owned CNN's top boss Chris Licht informed employees in an all-staff memo on Wednesday that layoffs are under way, according to an email seen by Reuters.

Licht said CNN would notify a limited number of individuals, largely some of its paid contributors on Wednesday and the impacted employees on Thursday, according to the memo.

He would follow up with more details on the changes on Thursday afternoon.

The job cuts have been anticipated and come at a time when companies are looking to rein in costs and trim their headcount to brace for an economic slowdown.

In October, Licht had warned CNN would be undergoing changes, citing "widespread concern over the global economic outlook." The changes would affect "people, budgets and projects," Licht had said.

Cable channels operator AMC Networks on Tuesday said it would cut 20% of its U.S. staff as it faces industry pressures and a challenging economy.

Cryptocurrency exchange Kraken is reducing its global workforce by approximately 1,100 people, or 30%, in order to adapt to current market conditions, the company said in a blog post.

Kraken said macroeconomic and geopolitical factors have weighed on financial markets since the start of the year, resulting in significantly lower trading volumes and fewer client sign-ups.

“We responded by slowing hiring efforts and avoiding large marketing commitments. Unfortunately, negative influences on the financial markets have continued and we have exhausted preferable options for bringing costs in line with demand,” said co-founder and CEO Jesse Powell.

“I remain extremely bullish on crypto and Kraken,” he opined.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| AMZN | $92.14 | -0.28 | -0.30 |

Amazon.com Inc said on Wednesday it recorded its biggest ever Thanksgiving weekend this year as shoppers, undeterred by inflation, scooped up everything from New Balance sneakers to Nintendo Switch gaming consoles.

Fire TV Sticks, AirPods and Champion clothing were among the top-selling items, Amazon said.

The National Retail Federation said on Tuesday a record number of 196.7 million people shopped during the five-day period from Thanksgiving through Cyber Monday, while Adobe Analytics said Cyber Monday sales rose to $11.3 billion, making it the biggest U.S. online shopping day in history.

Amazon in October hosted a second Prime Day-like event offering steep holiday discounts, while rivals ranging from Walmart Inc to Best Buy Co Inc also launched their own sales events to lure shoppers.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| CRWD | $112.84 | -25.16 | -18.23 |

| PANW | $167.73 | -2.78 | -1.63 |

| S | $13.52 | -1.93 | -12.49 |

| ZS | $125.86 | -8.99 | -6.67 |

A warning from Crowdstrike Holdings Inc that clients were cutting back on spending and delaying purchases due to an economic slowdown slammed cybersecurity stocks on Wednesday, inflicting fresh pain on the battered sector.

"Increased macroeconomic headwinds elongated sales cycles with smaller customers and caused some larger customers to pursue multi-phase subscription start dates," Crowdstrike Chief Executive Officer George Kurtz said.

The results are the latest in a series of dour reports from cybersecurity firms, whose business boomed during the pandemic but is now seeing a slowdown, making them a hot target for private equity buyouts.

Still, some analysts see long-term benefits from the rising demand for cybersecurity as more businesses take to the web and high-profile hacks force companies to be more cautious.

That, as well as year-to-date share drops of up to 69%, have made these companies buyout targets. In October, Vista Equity Partners agreed to take KnowBe4 Inc private in a $4.6 billion deal, while earlier this year Thoma Bravo said it would buy Ping Identity for $2.4 billion.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| DASH | $56.02 | 2.67 | 5.00 |

DoorDash Inc said it was cutting about 1,250 jobs, or 6% of its total workforce, as the food-delivery company looks to keep a lid on costs to cope with a slowdown in demand.

“This is the most difficult change to DoorDash that I’ve had to announce in our almost 10-year history,” CEO Tony Xu said in a memo to employees that was posted on the company's website.

Earlier this month, DoorDash reported a bigger-than-expected quarterly net loss of $295 million, raising questions about the growth prospects of delivery firms as economies reopen.

The chief executive said the company had actually been “undersized” prior to the COVID-19 pandemic but then sped up hiring to catch up with demand for delivery services and started many new businesses.

"Most of our investments are paying off, and while we’ve always been disciplined in how we have managed our business and operational metrics, we were not as rigorous as we should have been in managing our team growth. That’s on me. As a result, operating expenses grew quickly,” Xu said.

Reuters contributed to this report.

| Symbol | Price | Change | %Change |

|---|---|---|---|

| HNNMY | $2.18 | 0.04 | 1.87 |

Swedish fashion giant H&M on Wednesday became the first big European retailer to start laying off staff in response to the cost of living crisis despite a still tight labor market, as it tries to save 2 billion Swedish crowns ($190 million) a year.

“Keeping the lights and heating on in vast stores is becoming increasingly unaffordable with energy prices so volatile. With shoppers also becoming impressively price sensitive as cost-of-living headwinds continue to whip up, retailers are finding it more difficult to pass on increase in input costs,” said Susannah Streeter, Senior Investment and Markets Analyst, Hargreaves Lansdown.

The move by the world's No.2 fashion retailer to reduce mainly back-office staff, comes amid surging inflation and soaring costs related to the Ukraine war which have pressured companies across Europe and the United States to save cash.

“Shoppers are showing signs of trading down and hunting out bargains, so the pressure is on H&M to compete with chains seen as offering greater value,” Streeter continued.

The cuts by H&M, which employs roughly 155,000 people, are part of a plan laid out in September to save 2 billion Swedish crowns per year.

Reuters contributed to this report.

The number of job openings shifted down in October. Here's what it means for the economy.

U.S. stocks notched modest gains as investors balanced a weaker than expected ADP jobs report against a stronger read on 3Q GDP and awaited remarks from Federal Reserve Chairman Jerome Powell later today. In commodities, oil jumped 3% crossing back above the $80 per barrel level.

ADP: 127,000 vs. 239,000 [Nov]

3Q GDP: +2.9% vs. 2.6% [prior read]

The ADP payrolls report, the first of three jobs data points this week, disappointed.

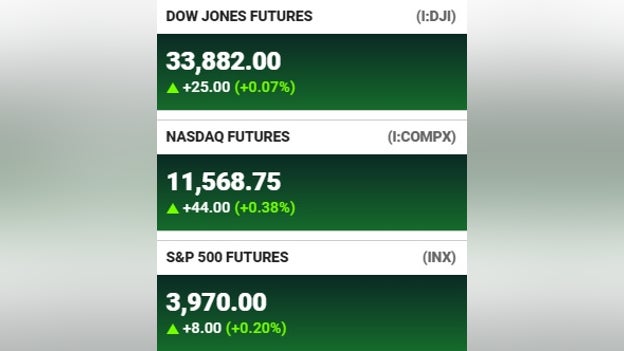

U.S. stock futures are higher on Wednesday ahead of a speech by Federal Reserve Chairman Jerome Powell.

The Dow Jones Industrial Average is up 23 points, or 0.07%, while the S&P 500 and Nasdaq Composite are up 0.20% and 0.38%, respectively.

Powell will speak at the Brookings Institution about the outlook for the U.S. economy and the labor market. Traders will pay close attention to what he says as it could give clues about what the next move in interest rates could look like.

Meanwhile, oil prices are up by more than 2%. West Texas Intermediate crude is trading at about $80 a barrel and Brent crude is trading at $85 per barrel.

U.S. equity futures were trading higher on Wednesday ahead of an anticipated speech by the Federal Reserve chief that may give clues about future interest rate hikes.

The major futures indexes suggest a gain of 0.2% when the opening bell rings on Wall Street.

Oil prices traded higher on Wednesday as U.S. crude inventories were seen falling, but concerns that OPEC+ would leave output policy unchanged at its upcoming meeting limited gains.

U.S. West Texas Intermediate crude futures traded around $79.00 per barrel.

Brent crude futures traded around $83.00 per barrel.

Fed Chairman Jerome Powell speaks at the Brookings Institution about the outlook for the U.S. economy and the labor market.

Traders will pay close attention to what Powell says as it could give clues about what the next move in interest rates could look like.

Several economic data points that could play into the Fed's decision making will be released including: the second estimate of 3Q GDP, the ADP private payrolls report, job openings and labor turnover survey, pending home sales and the Fed’s Beige Book.

In Asia, Japan's benchmark Nikkei 225 lost 0.2%, Hong Kong's Hang Seng added 2.2% and China's Shanghai Composite edged up less than 0.1%.

Due to a more reflective approach to the recent zero-COVID measures, Chinese stocks have taken substantial leaps and bounds this week.

On Tuesday, the S&P 500 slipped 0.2% to 3,957.63, its third straight drop. The tech-heavy Nasdaq composite fell 0.6% to 10,983.78, while the Dow Jones Industrial Average added fractionally to 33,852.53.

The Chairman of the Federal Reserve is set to speak Wednesday at the Brookings Institution.

It is the last major scheduled speech for Fed officials before the next monetary policy meetings on Dec. 13-14.

Traders will pay close attention to what Powell says as it could give clues about what the next move in interest rates could look like.

Investors have been hoping that the Fed could ease up on its rate increases and are closely watching the latest data.

The Fed’s benchmark rate currently stands at 3.75% to 4%, up from close to zero in March.

Congress is under the gun to pass legislation ending the threat of a nationwide rail strike. Time is running out. A walkout could happen as early as next week, with damaging disruptions to the supply chain set to begin in days.

As lawmakers ready their arguments for or against intervening in the stalled labor negotiations between the major freight railroads and four hold-out unions, one thing that is not up for debate is whether the economy would be crippled if the trains stop running.

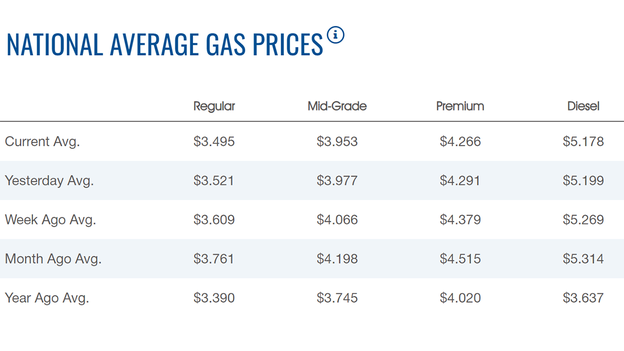

The nationwide price for a gallon of gasoline slipped Wednesday to $3.495, according to AAA.

The average price of a gallon of gasoline on Tuesday was $3.521.

One week ago, a gallon of gasoline cost $3.609. A month ago, that same gallon of gasoline cost $3.761.

Gas hit an all-time high of $5.016 on June 14.

Diesel declined to $5.178.

Oil prices traded higher on Wednesday as U.S. crude inventories were seen falling, but concerns that OPEC+ would leave output policy unchanged at its upcoming meeting limited gains.

U.S. West Texas Intermediate crude futures traded around $79.00 per barrel.

Brent crude futures traded around $83.00 per barrel.

U.S. crude oil stocks were expected to have dropped by about 7.9 million barrels in the week ended Nov. 25, according to market sources citing American Petroleum Institute figures on Tuesday.

Official figures are due by the U.S Energy Information Administration on Wednesday, according to Reuters.

Bitcoin was trading near $17,000, after gaining in three of the last four days.

For the week, Bitcoin has gained 1.7%. For the month, the cryptocurrency has lost 19% and is down more than 64% year-to-date.

Ethereum was trading around $1,200, after gaining 7% in the past week.

Dogecoin was trading at 10 cents, after gaining 30% in the past week.

Live Coverage begins here