Report: CFTC Exploring Bitcoin Regulation

The Commodities Futures Trading Commission is reportedly ‘seriously’ exploring whether volatile cyber currency Bitcoin may fall under the U.S. regulator’s purview.

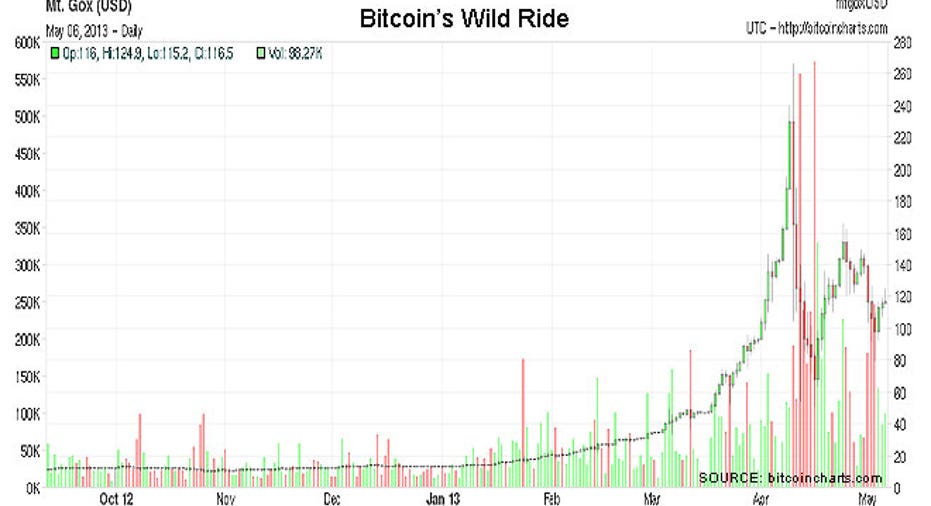

The potential regulatory oversight from the CFTC poses a serious threat to Bitcoin, which has enjoyed a surge of new attention and an explosion in value in recent months amid concerns about traditional bank deposits and currencies.

Bitcoin “is for sure something we need to explore,” Bart Chilton, one of the five commissioners at the CFTC, told the Financial Times. A source told the paper that the regulator, which gained new powers thanks to the Dodd-Frank legislation, is “seriously” examining the issue.

“It’s not monopoly money we’re talking about here -- real people can have real risk in these instruments, and we need to ensure that we protect markets and consumers, even in what at first blush appear to be ‘out there’ transactions,” Chilton told the FT.

A spokesman from the CFTC declined to comment on the report.

Regulation is among the biggest hurdles facing Bitcoin, which was founded in 2009 as a decentralized, digital currency and in recent months benefited from the controversial "bail in" of depositors in Cyprus.

The comments indicate the U.S. may be moving to regulate Bitcoin faster than some had anticipated.

Last week Peter Dugas, director of government affairs at the law firm Clark Hill, said regulators are so busy implementing Dodd-Frank and with other activities that “there would need to be a serious security problem or a need to protect consumers” before they step in.

So far the U.S. has said little about Bitcoin. In March an arm of the Treasury Department said companies that exchange or transfer virtual currency like Bitcoin will be considered money-service businesses, meaning they must track transactions and look out for money-laundering activities.

Potential new regulation is likely to attempt to force Bitcoin to become more transparent and avoid some of the extreme volatility of recent months. It’s also possible regulators could move to ban the virtual currency.

“Regulators do have the facility to make life difficult for Bitcoin if they so choose,” Nicholas Colas, chief market strategist at ConvergEx, wrote in a recent note to clients.

One source told the FT that Bitcoin would not become subject to CFTC jurisdiction unless it becomes the basis for a derivatives contract. Leveraged Bitcoin transactions settled in more than two days, known as “rolling spot” transactions, would similarly fall under the CFTC’s oversight, the FT reported.