ExxonMobil CEO: U.S. Jobs Story Could Get Worse

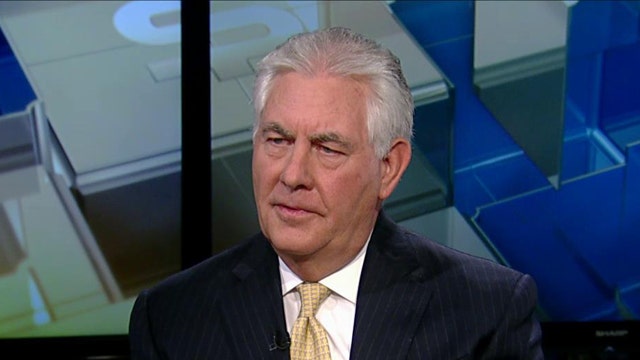

If you’re looking to the energy sector for a positive economic indicator, you might be hard-pressed to find any good news. During an interview with the FOX Business Network’s Maria Bartiromo, ExxonMobil (NYSE:XOM) CEO Rex Tillerson painted a very bleak picture on the economy and jobs.

“If you look at energy for kind of a proxy for how the economy is going, it’s pretty sluggish and there’s not a lot that we can see on the horizon through next year that’s going to change that,” he said.

Tillerson said the U.S. economy has been “sluggish” since the downturn of 2009.

“We’ve never really found our legs. We [have] just been kind of sliding along at a very, very modest economic rate.”

Tillerson attributes job growth in the U.S. to the shale revolution.

“If you look at job growth in the U.S. since about 2010 and 2009 when the shale revolution really began and activity levels really picked up to these very high levels most of the job growth in the United States, if you strip out our industry… there was no job growth in the U.S… As we’ve had the downturn we are seeing significant job losses there and I think that’s why you see it translating into a flattening into some of the job gains.

Despite seeing solid free cash flow in his business, he warned that the jobs picture could get worse in the U.S.

“As companies move into next year, depending on their cash available, they will have to adjust their activities further in order to manage the cash that’s available to them.”

He also said things aren’t much better in China and Europe.

"Europe is pretty much sliding sideways… and in China, we are seeing the rate of growth continue to bend over… The global economy is not hitting on all its cylinders,” he said.