Car-buying tip: Use this 'hidden fee' to get a better deal

“Hidden fees” may catch car shoppers by surprise, instantly hiking the actual cost of buying a new or used vehicle. Documentation fees are no exception.

But consumers can use “doc fees” to their advantage. With new data from Edmunds, buyers can haggle for a lower sale price when a dealer charges more than usual for handling the paperwork.

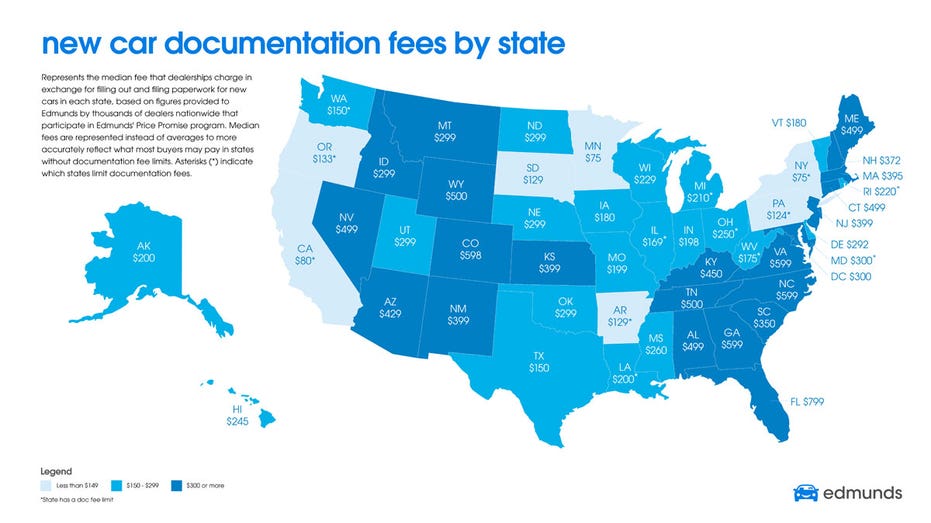

Some states limit documentation fees by law. In California, the median charge is $80. Ohio dealers include a documentation fee of roughly $250. Doc fees in other states are unregulated. The median fees in Georgia, Virginia and Colorado are nearly $600.

Documentation fees are a standard charge included in a car buyer’s contract. However, buyers should make sure they don’t pay more than necessary, Edmunds says. If a dealer charges significantly more than the state’s median doc fee, consumers can negotiate a steeper discount off the sticker price to compensate for it.

“The doc fee is in your contract, so you can’t really negotiate it. But if the fee is $300, and you’re only comfortable paying $150, you can negotiate a better sale price,” said Matt Jones, senior consumer advice editor at Edmunds.

Jones added that car buyers sometimes focus on the sticker price of the car and forget to account for taxes and fees.

“It’s really good to know these fees up front,” he said.

Documentation fees are just one extra charge included in the actual sale price of a new or used vehicle. Most buyers are familiar with registration fees and sales taxes. For used cars, buyers typically pay a dealer preparation fee. Dealers pay a fee for pre-delivery inspections, but those charges shouldn’t get passed on to consumers.