Oil whipsawed by world of wildcards

U.S. and global oil prices have cratered and forecasting future prices remains a toss-up. The bears want to say that prices are falling due to a slowdown in world demand. While the bulls want to say that American fracking and the record production in the U.S. of 11.6 million barrels a day is the reason. Trump supporters, naturally, want to give the President credit.

The truth could be all of the above with a caveat that explains the recent volatility and a swing from $50 to $76 per barrel and a retreat back to the $51 level.

While the oil supply balance is scheduled to tip in the favor of supply in the next couple of years, bearish for long term oil prices, short term wildcards are mounting. This means oil price swings may become more of the norm over the short term.

Global Hot Spots

There is still a problem in many oil producing hot spots around the globe. Case in point, Venezuela. The battered socialist country continues its economic woes as government corruption and ineptness escalates. As a result, production has dropped to the tune of over one million barrels per day. Other oil producing countries such as Angola, Libya and Nigeria are also seeing a reduction or temporary shortages of oil production.

Iranian Sanctions?

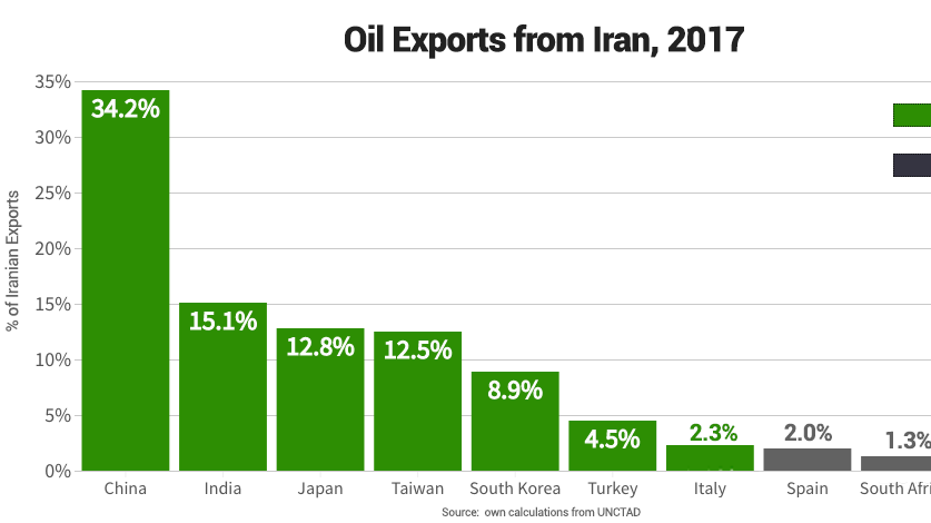

The biggest issue with global supply was going to be the 1.5 million barrels a day of oil coming off the market in Iran due to the sanctions which began earlier this month. Yet, the real surprise came when the list of exemptions for Iranian oil was released. Eight countries have exemptions —Italy, Turkey, Greece, Taiwan, China, India, South Korea, and Japan. The top three-India, China and South Korea-alone accounted for 860,000 barrels per day of exemptions. So, very little Iranian oil has come off the market, creating a glut of supply.

Iraq’s Role

In addition, the Trump Administration has also pressured Iraq to open the oil pipeline in Kirkuk, which the Iraqis did, adding 50,000-100,000 barrels per day to the world markets via a pipeline to the Turkish Mediterranean port of Ceyhan. This could rise to 300,000 barrels per day further expanding the supply.

Saudi Arabia’s Crisis

Then we have Saudi Arabia. After journalist Jamal Khashoggi, a Saudi critic, was first was reported missing, and later allegedly brutally murdered, the Saudis wanting to avoid the world response of sanctions, ceded to President Trump’s request of opening the spigot. This extra capacity that the Saudis keep in case oil spikes started the fall of oil prices. Khashoggi was killed on October 2 and oil prices started their decline the day after. The increase in Saudi production, along with the oil resurgence in Kirkuk, has been in anticipation of 1.5 million barrels coming off of the market, the Iranian oil not coming off the market has been the biggest cause of the huge drop in oil prices of late.

Bulls vs. Bears

The question is what happens now? The oil market is not trading, solely, on market fundamentals but rather how politics affect supply. Sanctions are planned to get to 100 percent of Iranian oil. If this happens oil prices should spike, however that looks unlikely.

The bullish and bearish outcomes could both have a positive effect on oil prices. If the bears are right and there is a global slowdown coming, then the President may never take the waivers off the Iranians. That likely means the oil doesn’t come off the market and prices stay low. If the bulls are right, then extra oil capacity coming online will more than offset the lost Iranian oil.

The bullish case is based on (mainly) the growth of West Texas shale, however, a pipeline congestion issue causes short term concerns that will be a year-long process to correct. If the sanctions still exist a year from now when the pipeline issue is fixed, then the supply side never becomes a factor as shale oil will flood the market. In West Texas, production is set to increase by 3 million BDP by 2023, as much as the entire country of Kuwait. Currently, West Texas produces over 3 million BDP, with only 3 million BDP of pipeline capacity, this changes over the next decade with over 3.5 million BDP of pipeline capacity being built or proposed.

| Ticker | Security | Last | Change | Change % |

|---|---|---|---|---|

| XOM | EXXON MOBIL CORP. | 149.05 | +2.97 | +2.03% |

| CVX | CHEVRON CORP. | 180.86 | +1.63 | +0.91% |

| BP | BP PLC | 39.01 | +0.84 | +2.20% |

| RDS | NO DATA AVAILABLE | - | - | - |

I don’t like to bet on what I can’t control but I am long several oil majors; Exxon Mobil, Chevron, British Petroleum and Royal Dutch Shell, because of their generous dividend yields, even if volatility remains in place over the next 6-12 months in oil prices.

John Layfield is FOX Business contributor and is the longest reigning WWE Champ in Smackdown TV history. Follow him @JCLayfield.