Key Social Security report delay leads top Republican to press Treasury for answers

The report is scheduled for delivery by April 1 each year

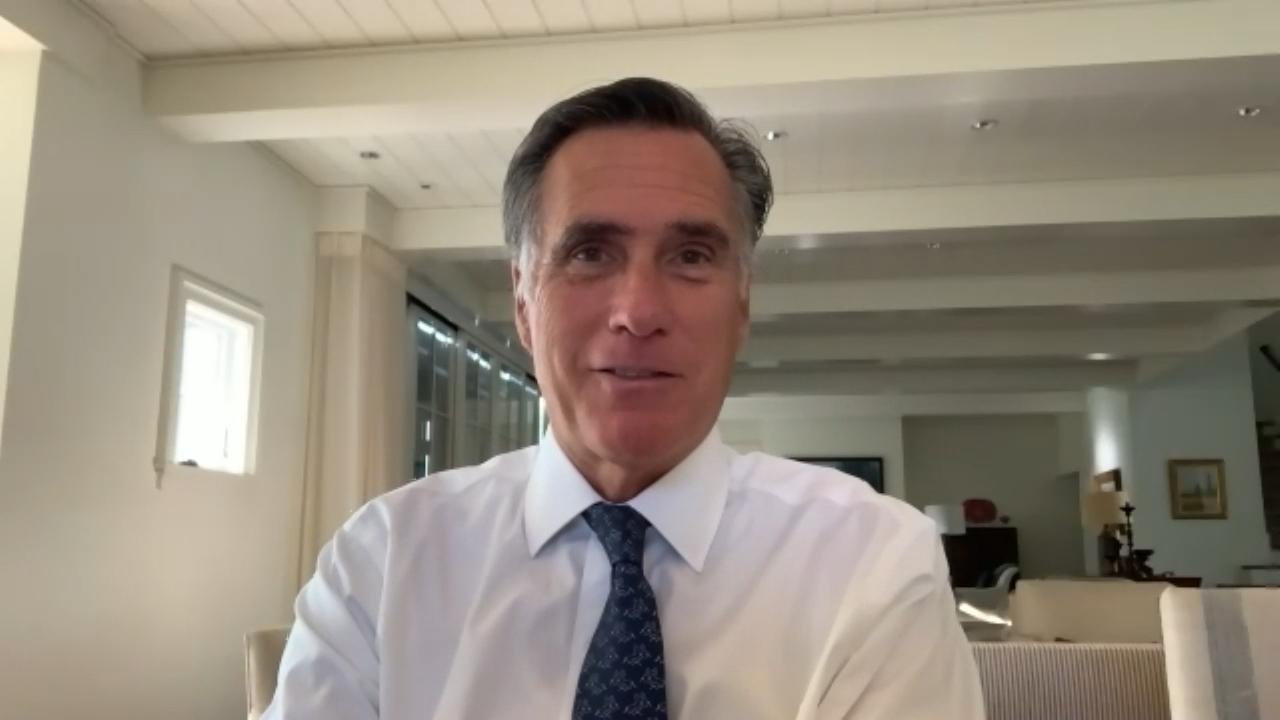

Mitt Romney's Big Idea to keep Social Security and Medicare from going bankrupt

Mitt Romney shares his Big Idea speaking about the TRUST Act

Sen. Mike Crapo, R-Idaho, sent a letter to the Treasury Department on Friday inquiring as to why an important report detailing the financial health of two popular programs, Social Security and Medicare, has yet to be released.

Crapo noted that the report is scheduled for delivery by April 1 each year, and the 2020 report was issued 21 days past that deadline. The 2021 report, however, is already 126 days overdue.

Initially, the letter noted stated that Congress was informed the reports would be delayed sometime within an eight-week timeframe. However, Crapo said he later inquired as to whether the delay would extend beyond that estimate and has not yet received information regarding expected release dates.

IRS TAX GAP BILL IN PROGRESS BY GOP AS ESTIMATES ARE IN DOUBT

"Assessing the true nature of the trust funds’ current financial status is time sensitive," Crapo said in the letter. "Either through reconciliation or regular order, there is every expectation that Congress will consider additional legislation impacting mandatory programs during the remainder of this year. Before Congress debates any further legislation, it is imperative that policymakers have accurate information explaining the status of the two trust funds."

Crapo asked for details regarding the report’s release and also for an updated policy for delivering updates when the reports are expected to miss deadline.

CLICK HERE TO READ MORE ON FOX BUSINESS

A spokesperson for the Treasury Department did not return FOX Business’ request for comment. The letter was sent to Treasury Secretary Janet Yellen, who functions as Managing Trustee of the Boards of Trustees of the Social Security and Medicare trust funds.

According to last year’s annual trustees report, Social Security’s reserve funds were expected to be depleted in 2035, at which time the program would no longer be able to pay out benefits in full. Continuing tax income was expected to be sufficient to cover 79 percent of scheduled benefits.

The report hadn’t, however, taken into account a number of effects of the COVID-19 pandemic.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Since many businesses around the country have been forced to close, for example – and millions of Americans lost their jobs – payroll tax revenue declined. Unemployment benefits are not subject to the payroll tax.

Payroll taxes fund Social Security and Medicare. Employers and employees each pay 6.2 percent for Social Security and 1.45 percent for Medicare, and an additional 0.9 percent is levied on the highest earners.

The pending report is expected to account for those elements.