Mortgage rates surge to highest since 2018

But costlier home loans have yet to dent demand in a big way.

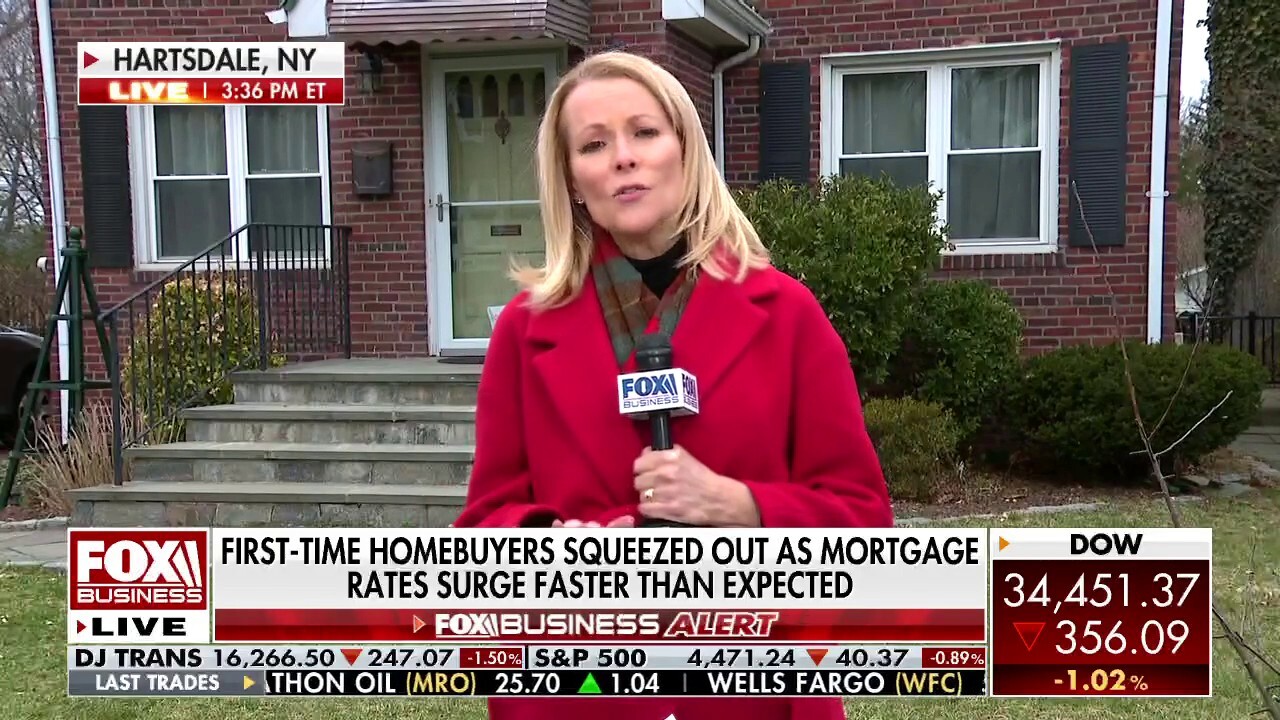

First-time homebuyers discouraged from buying as mortgage rates surge

Fox Business’ Gerri Willis discusses how the increase in home prices and decrease in inventory have deterred many homebuyers from purchasing on ‘The Claman Countdown.’

The average rate for a 30-year fixed-rate loan jumped to 4.67%, mortgage-finance giant Freddie Mac said Thursday, marking the weekly figure’s highest reading since December 2018.

FILE - Newly finished development of homes for sale, built by home builder KB Homes, are pictured in Carlsbad, California. (REUTERS/Mike Blake) (REUTERS/Mike Blake / Reuters Photos)

The 30-year fixed rate rose from 4.42% a week ago, continuing a steady rise that has pushed home-loan rates within sight of 5% for the first time in four years. This year’s surge in mortgage rates was hardly unforeseen, given the record lows reached in the pandemic period and concerns about high U.S. inflation readings, but it has unfolded faster than expected. At the beginning of the year, the average rate on America’s most popular home loan was 3.22%.

HOME PRICES UNEXPECTEDLY RISE 19.2% IN JANUARY: CASE-SHILLER

Higher mortgage rates typically slow home buying activity, but the number of applications submitted by hopeful home buyers has risen for three of the past four weeks, according to the Mortgage Bankers Association, showing the U.S. home boom is far from over.

(AP Photo/Michael Conroy, File) (AP Photo/Michael Conroy / AP Newsroom)

"It’s going to take a pretty healthy increase in rates to moderate the demand," said Phil Shoemaker, president of originations at Homepoint Financial Corp., a Michigan-based mortgage lender.

HOUSING MARKET ‘STARING INTO FACE OF PERFECT STORM,’ EXPERT WARNS

Expectations that the Federal Reserve will raise interest rates several more times this year to control inflation are driving up mortgage rates. Before the central bank raised rates for the first time since 2018, the Fed’s decision to unwind its purchases of mortgage-backed securities had started forcing rates upward.

A man walks past open house signs in front of condominiums for sale in Santa Monica, California. REUTERS/Lucy Nicholson (REUTERS/Lucy Nicholson / Reuters Photos)

Home prices continue to push homeownership out of the question for many Americans. The median sales price of an existing home rose 15% in February from a year earlier.

GET FOX BUSINESS ON THE GO BY CLICKING HERE

Rising rates are reducing refinances, which powered much of the mortgage market’s boom in 2020 and 2021. About four million Americans could lower their monthly mortgage payments through a refinancing in February, down from close to 16 million a year ago, according to mortgage-data firm Black Knight Inc. Refinancings are expected to make up 33% of mortgage originations this year, down from 59% in 2021, according to the Mortgage Bankers Association.