Home loan amounts for purchases rising as mortgage applications fall

Low inventory and rising interest rates are taking their toll.

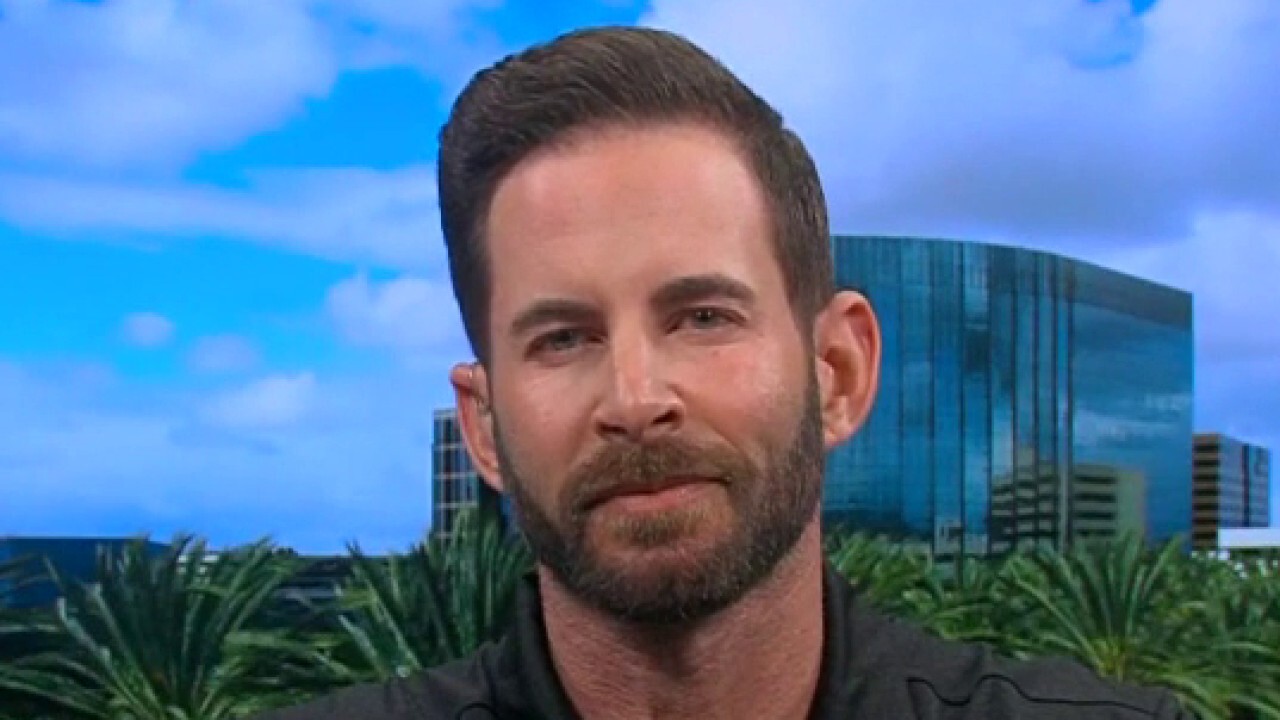

Tarek El Moussa on dramatic pickup in luxury home sales

Tarek El Moussa, star of HGTV's 'Flip or Flop,' says the increase in luxury home sales is due to 'a huge transfer of equity.'

The average loan amount for buying a home in the U.S. continued to climb this week while loan applications across the board continued to drop, as low inventory in the market pushes the cost of purchasing to greater heights.

"Swift home-price growth across much of the country, driven by insufficient housing supply, is weighing on the purchase market and is pushing average loan amounts higher," Joel Kan, the Mortgage Brokers Association Associate vice president of Economic and Industry Forecasting, said in the MBS' latest report on its weekly mortgage survey.

The average loan amount for a purchase hit $405,300 this week, up from $405,000 last week as the numbers continue to climb.

MORTGAGE APPLICATIONS SKID TO LOWEST IN OVER A YEAR

The latest data show that mortgage application numbers continued to decline, after dropping the week prior to their lowest point since more than a year ago. However, interest rates for both conforming ($548,250 or less) and jumbo loan amounts (higher than $548,250) also declined in the most recent report – although they remained above 3%.

"Mortgage application activity fell for the second week in a row, reaching the lowest level since the beginning of 2020," Kan said. "Even as mortgage rates declined, with the 30-year fixed rate dropping 5 basis points to 3.15 percent, both purchase and refinance applications decreased."

GET FOX BUSINESS ON THE GO BY CLICKING HERE

"Treasury yields have been volatile despite mostly positive economic news, including last week’s June jobs report, which showed ongoing improvements in the labor market. However, rates continued to move lower – especially late in the week," he continued. "The 30-year fixed rate was 11 basis points lower than the same week a year ago, but many borrowers previously refinanced at even lower rates. Refinance applications have trended lower than 2020 levels for the past four months."

Not only have refinance applications continued to drop lower, but refinance loan amounts also took a dip over the last week, going from an average of $297,700 down to $291,900.