It's not the economy right now for voters: Here's why

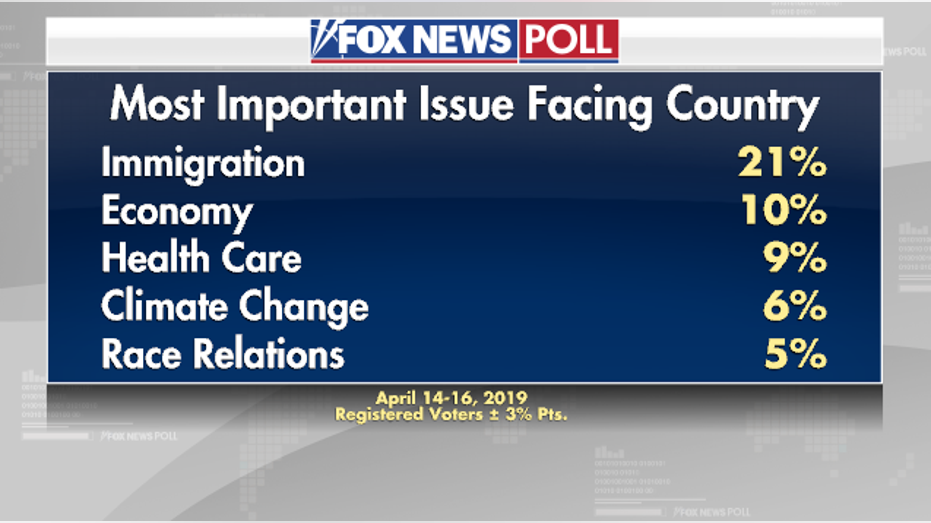

The latest Fox News Poll put immigration atop the list of issues in the eyes of voters. And the economy came in second.

We scratched our heads when we saw this; being data geeks, we decided to look for answers in the numbers.

Economy checkup

Last week, retail sales came in much better than expected. While many believed that that “sugar high” from tax reform had all but evaporated, tax refunds helped consumers head to the stores or their mobile device to start shopping. A closer look at the numbers shows that sales of bigger ticket items like autos and home furnishings were up as well.

At the same time weekly jobless claims just hit the lowest level in 50 years. Employers are holding onto staff as the labor market continues to tighten. And let’s not forget that inflation remains low, even though we are a decade into the nation’s economic expansion.

One week of data does not an economy make, but that said wage growth, stable prices and a confident consumer does all bode well for the U.S. economy.

But how are businesses doing?

While still in the early days of first-quarter earnings season, estimates are quickly moving higher. While a decline in profits of 2.3 percent is still expected, that is an improvement from the earlier expectations of -3 percent. So far, 77 percent of companies have beat the low expectations.

We expect to see flat to positive growth in profitability from S&P 500 companies when all is said and done for Q1. 2019 estimates are already starting to move higher with the consensus now expecting growth to exceed 2 percent.

This week, 31 percent of the index is reporting results. In addition to the earnings outlook, guidance for capex will be important to keep an eye on. In the fourth quarter, S&P 500 companies spent $177 billion on capex, setting a record high for the index. Thus far, of the companies that reported Q1, capex is 16.5 percent higher year-over-year.

Additionally, the March reading for the Conference Board’s leading economic indicators index (LEI) reached a new all-time high. This is an index that combines 10 economic indicators that typically lead the trend in economic growth, like the stock market and jobless claims. Recessions usually don’t set in until about 13 months after a peak is reached on this index. Ideally the index keeps moving higher from here.

What is the sum?

When you add it all up -- wage growth above 3 percent for six months in a row, capital expenditures by business hitting new all-time highs, the consumer spending again -- the economy feels like it’s on very solid footing. And the expansion appears poised to continue beyond the 120-month mark, making this the longest period of sustained economic growth in U.S. history.

Despite all of the negative hype that growth was going to slow sharply in the first quarter of 2019, all of the positive economic data has caused the Atlanta Fed to hike their GDPNow forecast to 2.8 percent.

So why is the economy NOT the top issue in the eyes of voters?

It is possible that voters (responding to polls) react to the topics that get the most airtime in various forms of news media.

CLICK HERE TO GET THE FOX BUSINESS APP

Or it could be because voters feel fundamentally confident in the condition of economy. As the data suggest, the economy appears to be on solid footing.

Lindsey Bell is an investment strategist at CFRA Research. She brings a broad perspective given her background working in investment banking, equity research and on the buy-side for a charitable trust. Lindsey is a frequent commentator on FBN and FNC.