Chamber of Commerce has "serious concerns" and questions about Trump's payroll tax deferment

Trump says he will forgive deferred payroll taxes if he wins reelection

The U.S. Chamber of Commerce is asking the Trump administration to clear up the concerns and questions many businesses have in the wake of the President' Tump's executive action to defer payroll taxes.

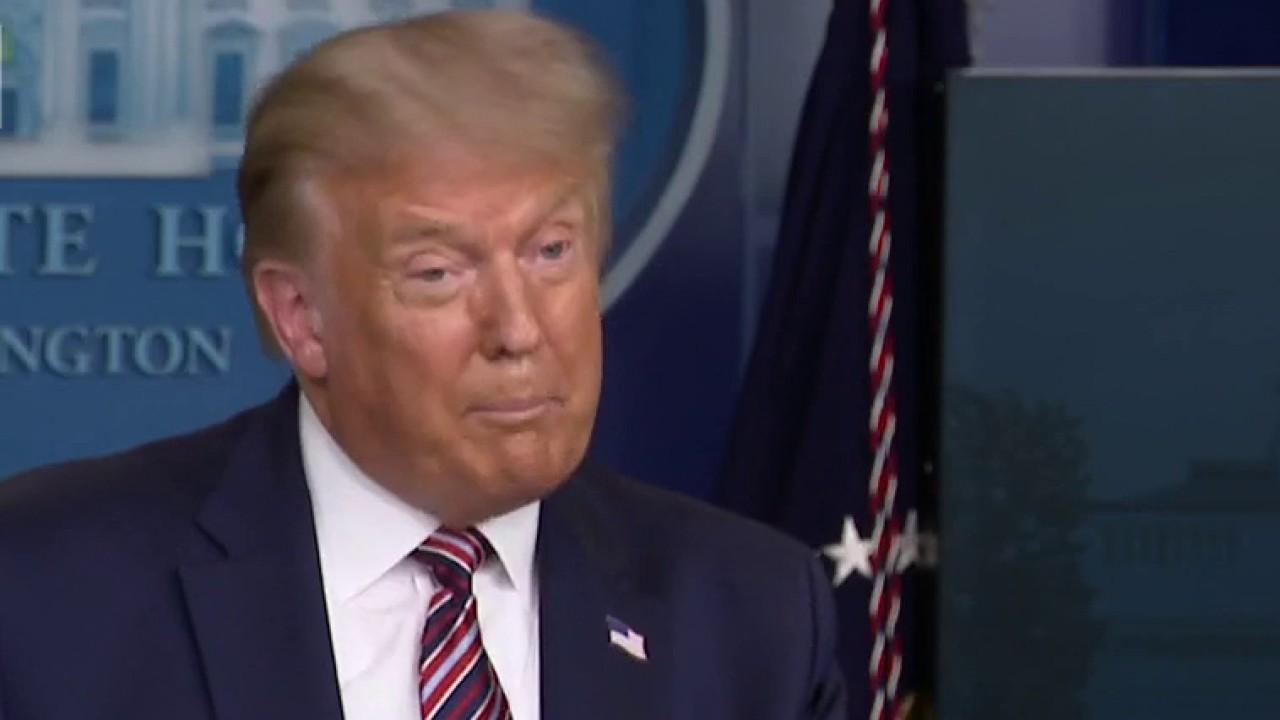

On Wednesday at a White House briefing, Trump said, “At the end of the year, on the assumption that I win, I’m going to terminate the payroll tax.” Noting some concerns that payroll tax funds Social Security Trump added “We’ll be paying into Social Security through the general fund.”

President Trump ordered the Treasury Department Saturday to pause collecting the 6.2% workers’ share of the payroll tax that funds Social Security.

But the U.S. Chamber of Commerce sent a letter to Treasury Secretary Steven Mnuchin late Wednesday about the “serious concerns” that businesses have about how to implement the payroll tax deferral.

TRUMP PLANS TO TERMINATE PAYROLL TAX BUT WILL PROTECT SOCIAL SECURITY

“The Chamber appreciates recent reports that this (executive order) will be optional but needs additional clarification about who elects this application,” the business group wrote to Mnuchin.

The chamber, which boasts some 300,000 members, also expressed "uncertainty as to who is ultimately liable for the repayment of the deferred taxes, and when the repayment will be due and what mechanism will be used to collect that repayment.”

The administration does have the authority to act under a law that lets the Treasury Secretary postpone tax deadlines after a presidentially declared disaster -- such as what the administration did at the outset of the pandemic when the tax filing deadline was delayed from April 15 until mid-July.

But it is only Congress that has the power of the purse, as laid out in Article 1, Section 8 of the U.S. Constitution for permanent changes in tax law.

The president has voiced his support for a permanent payroll tax cut, and said Wednesday that if he wins reelection later this year, then he will forgive the deferred taxes.

CORONAVIRUS PUTS FULL SOCIAL SECURITY BENEFITS AT RISK YEARS EARLIER THAN EXPECTED

“When I win the election, I'm going to completely and totally forgive all deferred payroll taxes without in any way, shape or form hurting Social Security,” Trump said Wednesday. “That money is going to come from the general fund. We're not going to touch Social Security.” But using money from the general revenue pool would also take an act of Congress

The issue of how Social Security would be funded has held back some Republicans from fully embracing the payroll tax cut.

“I would not entertain that question unless ... it would go in with the reform of Social Security,” Senate Finance Committee Chairman Chuck Grassley, R-Iowa, told The Hill on Tuesday. “We’ve got to make sure that we keep our promises to senior citizens.”

GET FOX BUSINESS ON THE GO BY CLICKING HERE

It’s not only the deferment and eventual collection of the payroll taxes that is an issue though, as the Chamber of Commerce also wants more guidance on how it will apply to different types of workers.

“As taxpayers delve further into this EO, questions arise about how to apply this in other situations, such as where employees have fluctuating salaries or receive bonuses; where employees are employed for a short term, such as with seasonal holiday workers; and where employees leave employment prior to the end of the deferral period,” the chamber wrote.

The plan for the payroll tax deferment is to begin in September -- a little over two weeks -- and will only apply to workers who make up to $104,000.

CLICK HERE TO READ MORE ON FOX BUSINESS