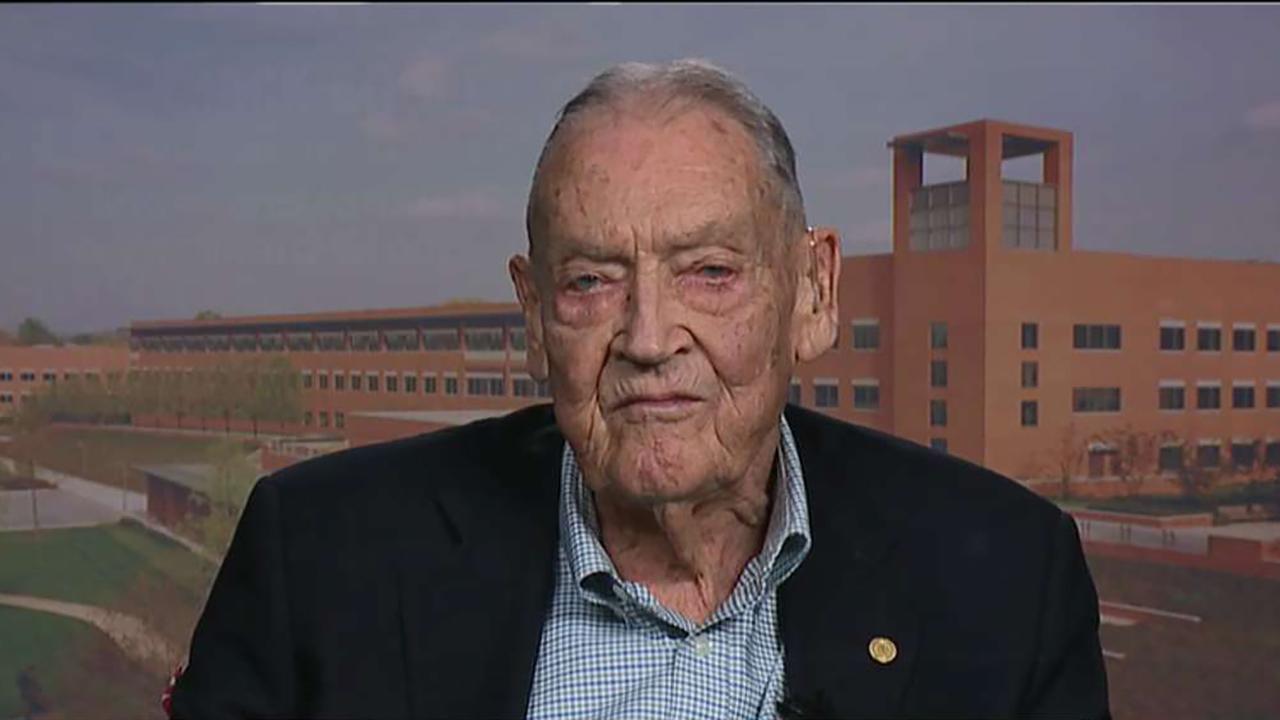

Vanguard founder John Bogle dead at 89

John Bogle, founder of Vanguard Group, one of the world's largest investment funds, has passed away at the age of 89.

The legendary investor and icon in the financial industry pioneered low-fee investing and created the index-fund concept.

“Jack Bogle made an impact on not only the entire investment industry, but more importantly, on the lives of countless individuals saving for their futures or their children’s futures,” said Vanguard CEO Tim Buckley in a statement provided by the firm. “He was a tremendously intelligent, driven, and talented visionary whose ideas completely changed the way we invest. We are honored to continue his legacy of giving every investor ‘a fair shake.’”

Bogle, who recently authored the new book "Stay The Course", which chronicles the history of his firm, provided an excerpt to FOX Business in early January of 2019 following the worst December since 1931 for the S&P 500 and the Dow Jones Industrial Average. "We know that index funds that are focused on broad diversification in the major market sectors, bought and held for the long term, have proved to be the optimal strategy for investment success" he wrote.

Vanguard created the world’s first index mutual fund in 1975 – First Index Investment Trust (since 1981, Vanguard 500 Index Fund) – now 44 years later, the industry has attracted trillions in assets for millions of investors.

“He showed that small investors, people who don’t have mega billions or millions, can do just as well or better than those in the market through indexing,” Forbes Media Chairman Steve Forbes said on the FOX Business Network Wednesday.

Condolences and praise poured in from business leaders including noted economist Mohamed El-Erian, the team at Barron's and Philly.com, Bogle's local paper.

CLICK HERE TO GET THE FOX BUSINESS APP

The firm, in honoring his legacy, noted that "Mr. Bogle, a resident of Bryn Mawr, PA, began his career in 1951 after graduating magna cum laude in economics from Princeton University. His senior thesis on mutual funds had caught the eye of fellow Princeton alumnus Walter L. Morgan, who had founded Wellington Fund, the nation’s oldest balanced fund, in 1929 and was one of the deans of the mutual fund industry. Mr. Morgan hired the ambitious 22-year-old for his Philadelphia-based investment management firm, Wellington Management Company. Mr. Bogle worked in several departments before becoming assistant to the president in 1955, the first in a series of executive positions he would hold at Wellington: 1962, administrative vice president; 1965, executive vice president; and 1967, president. Mr. Bogle became the driving force behind Wellington’s growth into a mutual fund family after he persuaded Mr. Morgan, in the late 1950s, to start an equity fund that would complement Wellington Fund. Windsor Fund, a value-oriented equity fund, debuted in 1958.

In 1967, Mr. Bogle led the merger of Wellington Management Company with the Boston investment firm Thorndike, Doran, Paine & Lewis (TDPL). Seven years later, a management dispute with the principals of TDPL led Mr. Bogle to form Vanguard in September 1974 to handle the administrative functions of Wellington’s funds, while TDPL/Wellington Management would retain the investment management and distribution duties. The Vanguard Group of Investment Companies commenced operations on May 1, 1975" the firm noted.

Bogle founded the world’s largest mutual fund company in 1975 and served as its chairman and CEO until 1996. Vanguard currently manages $5.1 trillion in assets from more than 20 million investors in about 170 countries.